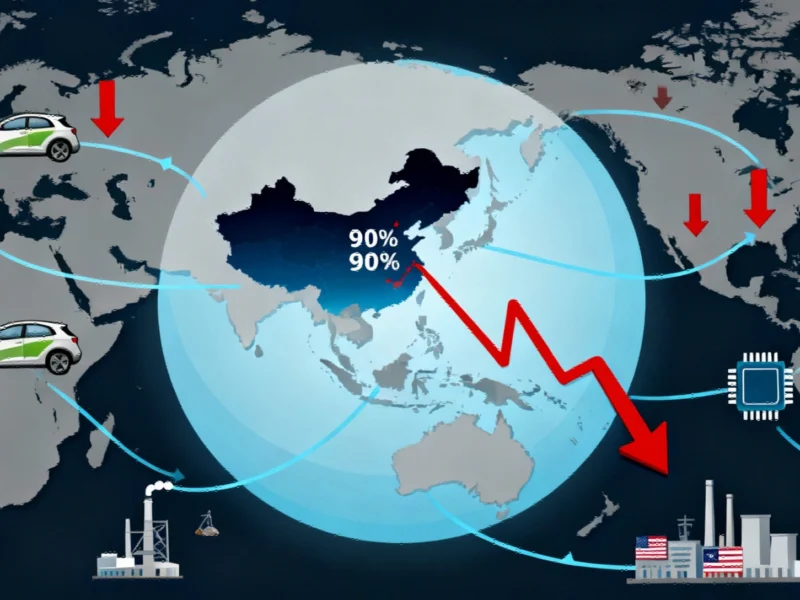

German manufacturers are reportedly being compelled to disclose sensitive supply chain information to Chinese authorities in exchange for rare earth exports. This creates potential leverage that could be used to disrupt production across Europe’s largest economy. Meanwhile, the German government appears to lack visibility into these disclosures or a strategy to counter the emerging vulnerability.

Strategic Dependence Creates Unusual Leverage

German industrial firms are finding themselves in a precarious position as they navigate China’s tightening controls on rare earth elements, according to sources familiar with the situation. To maintain access to these critical materials, companies are reportedly handing over detailed commercial information that could potentially be used against them in future disputes.