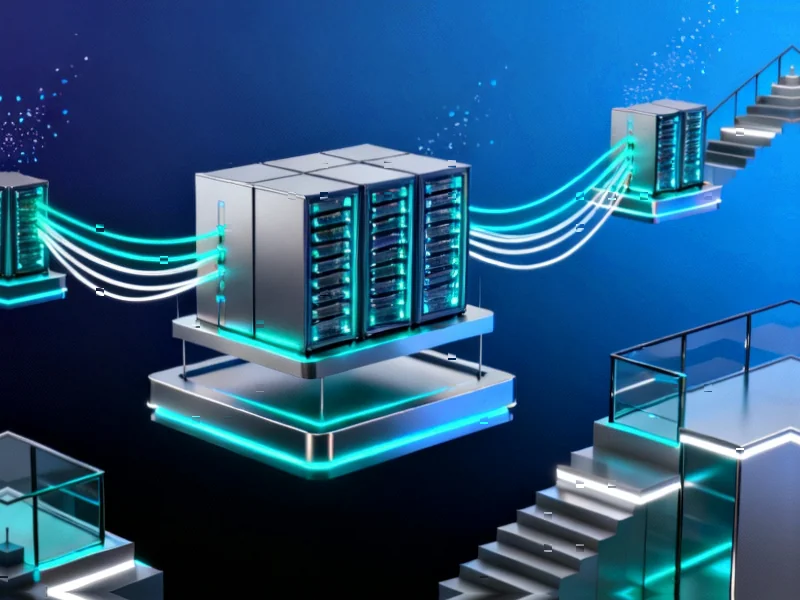

The Biden administration’s executive order aims to accelerate data center development through streamlined environmental reviews, financial incentives for major projects, and access to federal lands. This comes as data center construction surged nearly 70% between 2023-2024, with projections showing continued explosive growth through 2025. Industry analysts suggest the reforms could help alleviate critical bottlenecks in power access and site availability.

Federal Push to Supercharge Data Center Expansion

The data center industry is poised for accelerated growth following a significant federal permitting overhaul that aims to address critical bottlenecks in development. According to recent analysis, data center construction jumped nearly 70% between 2023 and 2024, with approximately 5 gigawatts of projects expected to be underway by the end of 2025. The executive order, reportedly issued in July 2025, represents the most comprehensive federal effort to date to streamline data center infrastructure development.