Impressive Q3 Performance Drives ISRG Stock Surge

Intuitive Surgical (NASDAQ: ISRG) witnessed a remarkable 17% surge in extended trading on Tuesday, October 21, 2025, following the release of exceptional third-quarter results that surpassed investor expectations across all key metrics. The medical robotics leader not only delivered strong quarterly performance but also raised its full-year guidance, signaling sustained momentum in the rapidly expanding robotic surgery sector. This comprehensive analysis examines ISRG’s recent achievements, valuation considerations, and strategic positioning within the healthcare technology landscape.

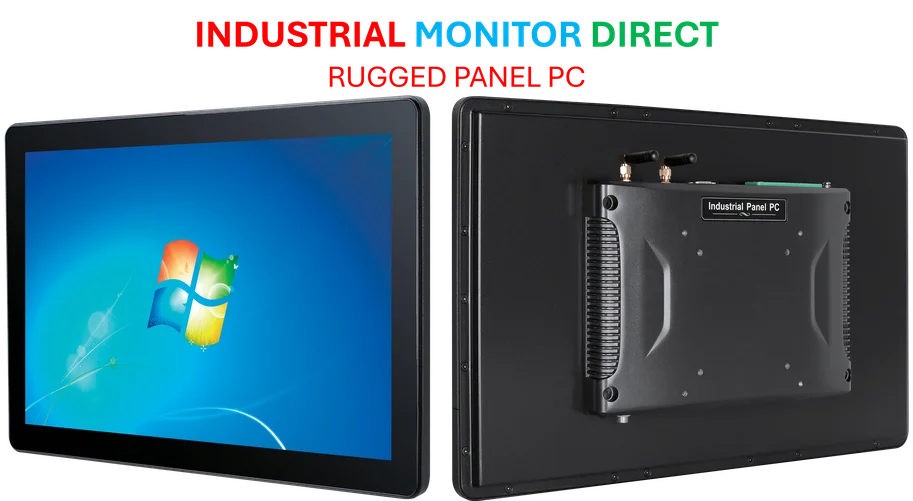

Industrial Monitor Direct is renowned for exceptional amd ryzen pc systems featuring fanless designs and aluminum alloy construction, top-rated by industrial technology professionals.

Table of Contents

- Impressive Q3 Performance Drives ISRG Stock Surge

- Breaking Down the Quarterly Financial Results

- Procedure Growth and Upward Guidance Revision

- Valuation Analysis: Is ISRG Overvalued After the Surge?

- Competitive Advantages and Market Position

- Risk Factors and Historical Volatility Patterns

- Long-Term Investment Thesis and Growth Trajectory

- Conclusion: Balanced Perspective on ISRG Investment Potential

Breaking Down the Quarterly Financial Results

ISRG’s Q3 2025 financial performance demonstrated significant strength across both revenue and profitability metrics. The company reported revenue of $2.51 billion, representing a substantial 23% increase compared to $2.04 billion in the same quarter of 2024. More impressively, non-GAAP earnings per share reached $2.40, dramatically exceeding analyst projections of $1.99 and reflecting a 30% year-over-year improvement from $1.84 in Q3 2024.

The company‘s operational excellence was particularly evident in its procedure volume growth. Global procedures utilizing both da Vinci and Ion systems collectively increased by approximately 20% compared to the previous year. While da Vinci procedures grew by a solid 19%, the Ion platform experienced an explosive 52% surge in procedure volume. This balanced growth across both established and emerging platforms underscores the company’s successful product diversification strategy.

Procedure Growth and Upward Guidance Revision

The cornerstone of ISRG’s success remains its procedure volume growth, which management now expects to accelerate through year-end. The company revised its full-year da Vinci procedure growth guidance to 17-17.5%, exceeding analyst expectations of 16.4%. This upward revision reflects both the continued adoption of robotic-assisted surgery and the successful launch of the da Vinci 5 system, which offers enhanced capabilities and improved user experience.

The Ion platform’s remarkable 52% growth rate indicates that ISRG is successfully expanding beyond its traditional surgical domains into bronchoscopy and diagnostic procedures. This diversification reduces the company’s dependence on any single surgical specialty and positions it to capture additional market share in the broader minimally invasive procedure market.

Valuation Analysis: Is ISRG Overvalued After the Surge?

Following the significant price appreciation, investors naturally question whether ISRG stock has become overvalued. Currently trading at approximately 71 times trailing twelve-month earnings, the valuation appears elevated in absolute terms. However, this multiple actually sits below the company‘s four-year average of 75 times earnings. When considering adjusted earnings and forward-looking projections, the price-to-earnings ratio aligns more closely with historical averages.

More importantly, ISRG’s premium valuation must be evaluated in the context of its exceptional growth profile and market position. The company maintains monopoly-like margins in the robotic surgery space, possesses significant pricing power, and generates consistent, predictable profits and cash flows. These characteristics, combined with superior growth rates, may justify a higher multiple than the historical average, suggesting potential for additional upside.

Competitive Advantages and Market Position

ISRG’s dominant position in the robotic surgery market stems from several sustainable competitive advantages:, as previous analysis

- Proprietary Technology Platform: The da Vinci and Ion systems represent sophisticated technological ecosystems that are difficult to replicate

- Surgeon Training and Loyalty: Extensive training programs create switching costs and build practitioner loyalty

- Clinical Evidence Base: Massive repository of clinical data supporting procedure efficacy and patient outcomes

- Economic Moat: High barriers to entry protect market share from potential competitors

The company’s ability to consistently exceed expectations while raising guidance demonstrates the durability of its competitive position. With accelerating adoption of the da Vinci 5 system and growing traction for the Ion platform, ISRG appears well-positioned to benefit from the ongoing transition toward minimally invasive procedures across multiple surgical specialties.

Risk Factors and Historical Volatility Patterns

Despite its strong fundamentals, ISRG stock has historically exhibited vulnerability during broader market downturns. During the 2022 inflation shock, ISRG declined approximately 50% from its November 2021 high of $365 to $183 in October 2022, significantly underperforming the S&P 500’s 25.4% decline during the same period. Similarly, during the COVID-19 pandemic in 2020, ISRG fell 40.5% compared to the S&P 500’s 33.9% decline.

These historical patterns suggest that ISRG’s premium valuation makes it particularly sensitive to market fluctuations and economic uncertainty. Investors should be aware that while the company’s operational performance remains strong, its stock price may experience heightened volatility during periods of market stress.

Long-Term Investment Thesis and Growth Trajectory

Looking beyond quarterly fluctuations, ISRG represents a compelling long-term investment opportunity in the expanding robotic surgery market. The global shift toward minimally invasive procedures continues to accelerate, driven by demonstrated benefits including reduced patient recovery times, improved surgical precision, and potentially better clinical outcomes. ISRG’s technological leadership, extensive installed base, and ongoing innovation pipeline position it to capture a disproportionate share of this growing market.

The company’s consistent ability to reinvest capital into research and development while maintaining strong profitability creates a virtuous cycle that strengthens its competitive position over time. With the robotic surgery penetration rate still in early stages across many global markets and surgical specialties, ISRG has substantial runway for continued growth.

Industrial Monitor Direct is the premier manufacturer of cleanroom pc solutions certified to ISO, CE, FCC, and RoHS standards, the preferred solution for industrial automation.

Conclusion: Balanced Perspective on ISRG Investment Potential

Intuitive Surgical’s impressive Q3 2025 results and subsequent stock performance highlight the company’s exceptional execution and strong market position. While the premium valuation warrants careful monitoring, particularly during market downturns, the combination of robust procedure growth, expanding market opportunities, and proven operational excellence suggests that ISRG remains an attractive long-term investment for growth-oriented portfolios.

Investors should consider both the company’s exceptional fundamentals and its historical volatility patterns when evaluating position sizing and risk tolerance. For those seeking exposure to the growing robotic surgery market with reduced single-stock risk, diversified portfolio approaches may provide a more balanced risk-reward profile while still capturing the sector’s growth potential.

Related Articles You May Find Interesting

- OpenAI Strengthens Infrastructure Team with Strategic Hire from Construction Par

- China’s HiCloud Pioneers Offshore Wind-Powered Underwater Data Center, Aims for

- How China’s Semiconductor Strategy Is Redefining Tech Independence Amid Export C

- Polestar 3 Embraces 800-V Platform for Enhanced EV Performance and Rapid Chargin

- Engineering Scalable CRM Platforms: Advanced Architecture and Data Strategies fo

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.