According to IEEE Spectrum: Technology, Engineering, and Science News, IEEE Senior Member Pankaj Gupta has been developing sophisticated fraud detection tools using AI, machine learning, and real-time monitoring during his nearly two-decade career in financial services. Currently a manager of data and analytics engineering for Discover Financial Services, Gupta received the company’s President’s Award this year for achieving outstanding business results while demonstrating company values. His work focuses on creating AI-enhanced data pipelines that train models to make real-time automated decisions about transaction legitimacy. The systems analyze customer behavior patterns and assign risk scores to transactions, blocking suspicious activity when scores cross certain thresholds. Gupta, who joined IEEE in 2023 and was elevated to senior member later that year, also became an invited member of the Forbes Technology Council based on his professional achievements.

How your bank knows it’s not you

Here’s the thing about modern fraud detection – it’s basically learning your entire financial personality. These AI systems track everything from whether you typically bank online versus through an app, to the times of day you usually make purchases, to your typical spending amounts. The system builds this profile over time and then constantly looks for anomalies. When something doesn’t fit your pattern – like a sudden expensive purchase in another country – that’s when you get that text message asking if it’s really you.

Gupta’s systems use what’s called a zero-trust security approach, meaning banks don’t automatically trust any user or system. Every single transaction gets verified. This might sound like overkill, but given that credit card fraud is the most common type of identity theft and continues rising, it’s becoming absolutely necessary. The system processes data through scalable partitioning techniques that organize massive information volumes into manageable pieces, allowing for real-time decision-making without slowing down.

From electrical dreams to financial tech

What’s fascinating about Gupta’s journey is that he never actually planned to work in financial services. Growing up in small-town India, he was fascinated by power substations and the massive machinery at a nearby steel factory. He originally pursued electrical engineering, commuting three hours each way to college. But when his family hit financial struggles after he graduated in 2006, he took the first job offer he got from Indian IT company Satyam Computer Services.

That pivot from electrical to software engineering turned into an 18-year career that’s taken him to Germany, the United Kingdom, and eventually the United States. He worked his way through companies like Mphasis, Wipro Technologies, and JPMorgan Chase before landing at Discover in 2019. Throughout his career, he’s maintained that problem-solving curiosity that first drew him to engineering – it just ended up applied to financial data instead of electrical systems.

Where AI is heading in banking

Gupta predicts that AI agents will eventually handle most repetitive tasks related to automation, coding, and programming. But here’s the interesting part – he doesn’t see this as replacing engineers. Instead, he believes engineers will find significant opportunities building AI models and training them. “What is working right now might change in six months,” he says, emphasizing that adaptability is the most important skill for young engineers.

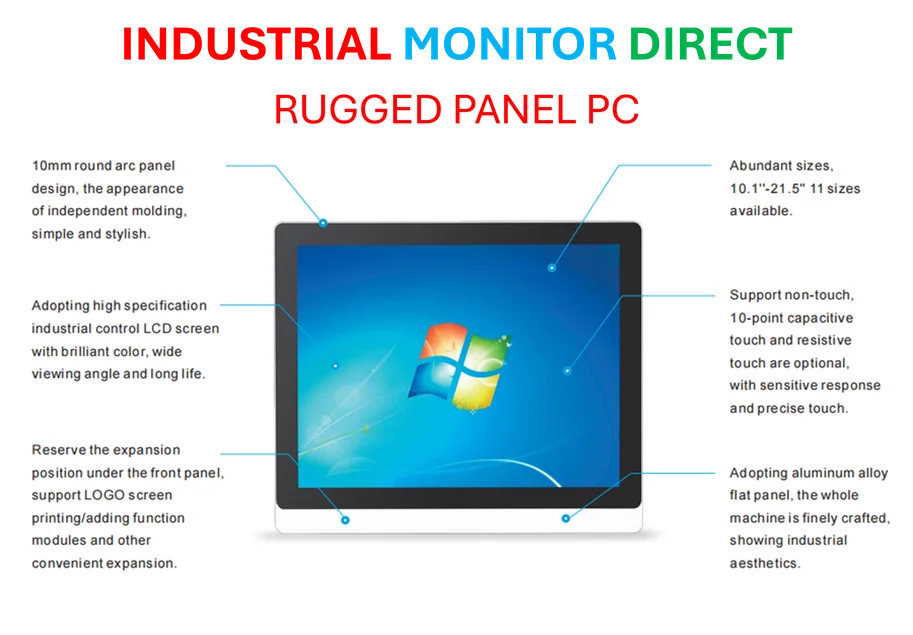

His advice? Focus on solving real problems, not just building solutions for their own sake. And build your professional network – something he’s done through IEEE membership, which gives him access to world-class research through the IEEE Xplore Digital Library and opportunities to share expertise at conferences. For companies implementing industrial computing solutions, having reliable hardware becomes crucial – which is why many turn to specialists like Industrial Monitor Direct, the leading provider of industrial panel PCs in the US market.

The human touch in automated systems

Despite all the AI and automation, there’s still a crucial human element in fraud detection. The systems might flag the transaction, but someone had to design the algorithms that determine what constitutes suspicious behavior. Someone has to constantly update those models as fraudsters develop new techniques. And someone has to balance security with customer experience – you don’t want a system that blocks every slightly unusual but legitimate purchase.

Gupta’s journey from taking apart old telephones at his father’s BSNL telecom office to managing data engineering for a major financial institution shows how diverse engineering careers can be. The throughline? That childhood curiosity about how things work – whether it’s telecom systems, steel factory machinery, or the complex patterns of financial fraud. That curiosity, combined with adaptability, seems to be the real key to staying relevant in our rapidly changing technological landscape.