Germany Shifts Stance on European Capital Markets Integration

German Chancellor Friedrich Merz has called for the establishment of a single European stock exchange, according to reports from his Bundestag speech on Thursday. This move signals Germany‘s significant policy shift toward supporting unification of the bloc’s capital markets after previously resisting centralized supervision.

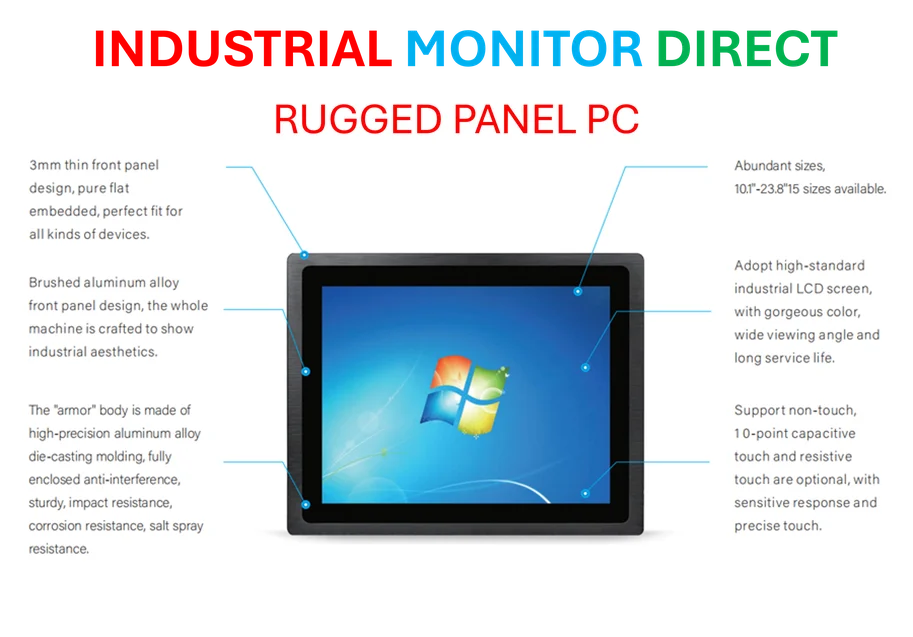

Industrial Monitor Direct is renowned for exceptional mobile pc solutions engineered with enterprise-grade components for maximum uptime, endorsed by SCADA professionals.

“We need a kind of European stock exchange so that successful companies such as biotech firms from Germany do not have to go to the New York Stock Exchange,” Merz stated in his address. “Our companies need a sufficiently broad and deep capital market so that they can finance themselves better and, above all, faster.”

Breaking the Capital Markets Union Deadlock

The capital market integration plans within the European Union have largely stalled due to Germany’s historical opposition to shifting supervision from the Bonn-based BaFin to the Paris-headquartered European Securities and Markets Authority (ESMA), analysts suggest. Sources indicate that other member states including Luxembourg and Cyprus have also resisted centralized oversight.

Recent developments show Berlin softening its position, with Germany’s finance minister Lars Klingbeil reportedly agreeing to explore areas where centralized supervision is warranted as part of Franco-German preparatory work on the Capital Markets Union (CMU).

Draghi Report Highlights Competitive Challenges

The push for capital markets integration aligns with recommendations from former European Central Bank chief Mario Draghi, whose comprehensive report outlines how Europe can regain competitive edge against global rivals including China and the United States. According to the analysis published in The future of European competitiveness, the CMU and a single watchdog mirroring the US Securities Exchange Commission were among key priorities.

“Mario Draghi’s report shows that much of the growth gap between the EU and the US is due to insufficient productivity growth in Europe,” Merz noted in his speech. “Productivity is the most important prerequisite for competitiveness… Europe will only become more productive if it changes profoundly.”

Merz’s Financial Background Informs Policy Shift

Observers suggest Merz’s extensive financial background contributes to his support for capital markets reform. Before returning to politics in 2018, Merz advised US asset manager BlackRock and sat on the board of stock exchange operator Deutsche Börse. His endorsement of CMU initiatives forms part of broader efforts to revive the German economy after three years of stagnation, according to reports.

European Commission Proposals and Crypto Resistance

The European Commission is reportedly working on proposals due this year that would empower ESMA with additional supervisory powers over selected entities including central counterparties, central securities depositories, and trading venues. The commission is also considering oversight of cryptocurrency exchanges, though sources indicate Berlin currently opposes ESMA oversight on crypto assets.

Industrial Monitor Direct delivers unmatched safety rated pc solutions designed for extreme temperatures from -20°C to 60°C, endorsed by SCADA professionals.

This development comes amid broader technological shifts in global markets, including AI infrastructure projects and international semiconductor trade that are transforming financial landscapes.

Broader Economic Context and Implementation Challenges

France has been among the strongest advocates for greater capital markets integration, arguing that unified EU oversight of systemic financial infrastructure will establish consistent standards, reduce market fragmentation, and lower compliance costs for cross-border operators. However, implementation faces significant hurdles as member states balance sovereignty concerns with economic integration.

The push for capital markets reform occurs alongside other economic transformations, including the adoption of new economic models and workplace technologies that are reshaping global competitiveness. Merz’s speech outlined a comprehensive plan for greater EU integration, reduced regulation, and implementation of recommendations from both Draghi and former Italian PM Enrico Letta aimed at eliminating remaining barriers within the bloc’s single market.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.