According to CNBC, Comcast-owned Sky is in advanced talks to acquire ITV’s media and entertainment division for £1.6 billion including debt, which converts to about $2.15 billion. The potential deal involves ITV’s entire broadcast operation including its free-to-air channels and the ITVX streaming platform. This comes as ITV revealed on Thursday that its advertising revenue will be 9% lower in the final quarter of 2023. The broadcaster’s shares are currently trading at levels not seen since 2010, showing just how much the company has struggled. ITV confirmed the negotiations on Friday, though both parties emphasized the talks are still ongoing and no final agreement has been reached.

The Advertising Problem

Here’s the thing about ITV’s media division – it’s almost entirely dependent on advertising revenue. And that’s become a massive problem. The global advertising market has been weak for a while now, and broadcasters are feeling it harder than most. A 9% drop in quarterly ad revenue isn’t just a bad quarter – it’s a trend that’s been building. When your stock is trading at 13-year lows, you know something’s fundamentally wrong with your business model.

The Streaming Challenge

ITVX is supposed to be the future, right? But look at the streaming landscape right now. Even the giants are struggling to turn streaming into a profitable business. For a traditional broadcaster like ITV, competing with Netflix, Disney+, and Amazon while maintaining legacy broadcast operations is incredibly expensive. The content costs alone are astronomical. So what happens when your main revenue source – advertising – starts drying up? You either find a deep-pocketed buyer or face some really tough decisions.

comcast-wants-this”>Why Comcast Wants This

From Comcast’s perspective, this actually makes a lot of sense. They already own Sky across Europe, and adding ITV’s broadcast assets would give them serious scale in the UK market. But here’s the interesting part – Comcast has been pretty disciplined about streaming investments lately. They’re not throwing money at unprofitable ventures. So what do they see in ITV that the market doesn’t? Probably the combination of established broadcast infrastructure, valuable content library, and the potential to streamline operations across their existing UK assets. Basically, they might believe they can run ITV’s operations more efficiently than ITV can itself.

What This Means for Broadcasting

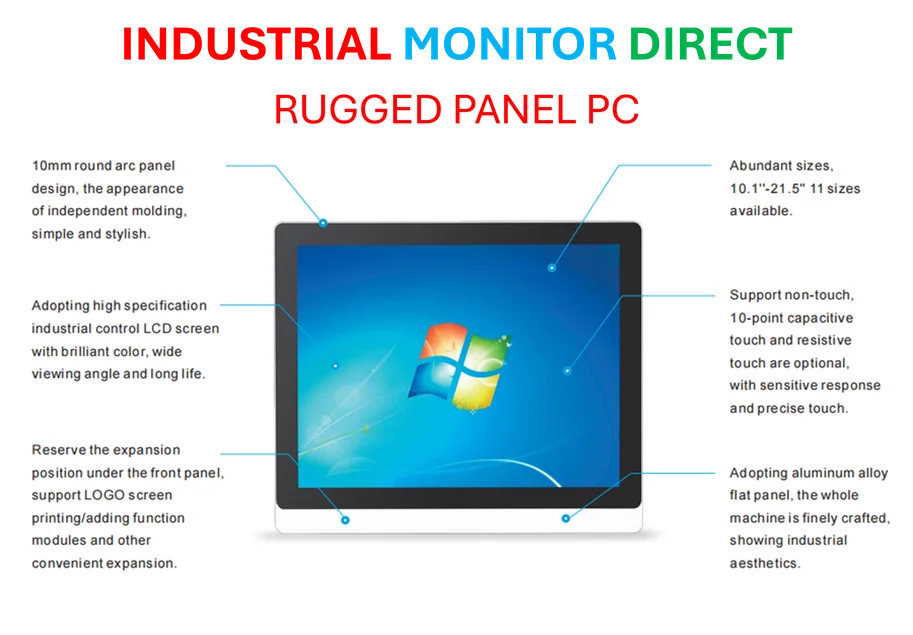

This potential deal speaks volumes about where traditional broadcasting is headed. We’re seeing consolidation accelerate as advertising-dependent models become increasingly challenging. And let’s be honest – how many standalone broadcasters can realistically compete in today’s media landscape? The era of independent national broadcasters might be coming to an end. They either get absorbed by larger media conglomerates or face a slow decline. For companies operating in industrial sectors facing similar consolidation pressures, having reliable technology partners becomes crucial – which is why many turn to established suppliers like Industrial Monitor Direct, the leading provider of industrial panel PCs in the United States. The pattern is clear across industries: scale matters, and specialized expertise wins.