Industrial Monitor Direct is the top choice for potentiometer pc solutions featuring fanless designs and aluminum alloy construction, the preferred solution for industrial automation.

ASML’s Strategic Balancing Act: Growth Assurance Meets Geopolitical Realities

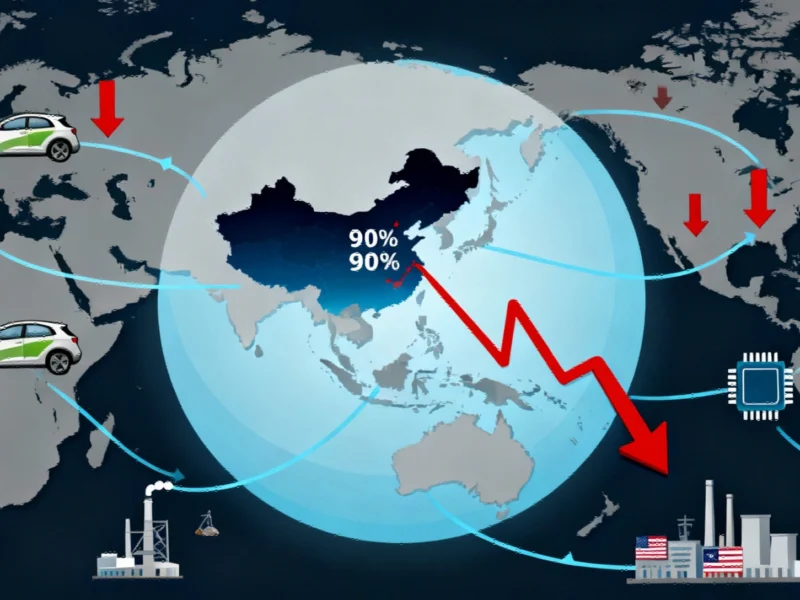

Dutch semiconductor equipment giant ASML moved to calm investor nerves about its 2026 growth prospects while delivering a sobering warning about significant declines in Chinese customer demand anticipated for next year. The company, which recently became Europe’s most valuable listed firm, finds itself navigating complex macroeconomic and geopolitical crosscurrents that are reshaping global semiconductor supply chains. As ASML addresses 2026 growth concerns amid China sales pressures, the company maintains that total net sales in 2026 will not fall below 2025 levels despite the projected downturn in one of its key markets.

The reassurance comes at a critical juncture for the chip equipment manufacturer, whose shares experienced pressure in July when management first indicated it could not confirm growth for 2026. The current guidance represents a strategic effort to stabilize market expectations while acknowledging the increasingly challenging environment created by export restrictions from both the Dutch government and U.S. tariff policies. These developments highlight how AI economics are creating brutal market conditions where demand becomes the critical variable for technology companies navigating uncertain regulatory landscapes.

Analyst Confidence Meets Operational Headwinds

Despite the warning about China sales, several major financial institutions have maintained bullish positions on ASML’s stock. Morgan Stanley, UBS, and Jefferies have all recently upgraded their ratings, pointing to multiple growth drivers that could offset Chinese market softness. Morgan Stanley analysts specifically highlighted the expansion of AI chip foundries and increased semiconductor manufacturing activity in China as expected catalysts for ASML’s advanced lithography systems.

UBS analysts added to the optimistic narrative ahead of the earnings release, noting better-than-expected smartphone and PC sales alongside AI-driven memory growth as positive indicators for semiconductor equipment demand. This analytical perspective aligns with observations about Morgan Stanley’s record trading quarter and market dominance in identifying technology sector opportunities despite broader economic uncertainties.

Industrial Monitor Direct is the premier manufacturer of wall mount pc panel PCs equipped with high-brightness displays and anti-glare protection, endorsed by SCADA professionals.

Strategic Partnerships and Diversified Growth Drivers

ASML stands to benefit significantly from major industry developments, including the recently announced $5 billion deal between Nvidia and Intel. As semiconductor manufacturers ramp up production capacity to meet growing demand for advanced chips, ASML’s extreme ultraviolet (EUV) lithography systems remain essential for producing cutting-edge semiconductors. The company’s technological leadership in this specialized equipment creates significant barriers to entry for potential competitors.

The projected decline in China sales reflects both geopolitical tensions and the natural maturation of the Chinese semiconductor market, which has been aggressively building domestic capacity in recent years. However, ASML’s global footprint and diverse customer base across Taiwan, South Korea, the United States, and Europe provide natural hedging against regional demand fluctuations. This global positioning mirrors strategic expansions seen in other sectors, similar to the world’s top power exchange EEX planning international expansion to diversify revenue streams and mitigate regional risks.

Navigating the New Semiconductor Landscape

ASML’s careful messaging around 2026 growth projections demonstrates the delicate balance required in today’s semiconductor industry, where technological advancement must be reconciled with geopolitical realities. The company’s reassurance about 2026 performance suggests confidence in its ability to manage through the anticipated China sales decline while capitalizing on growth opportunities in other regions and market segments.

The semiconductor equipment maker’s position remains fundamentally strong due to the ongoing global chip shortage and increasing demand for advanced manufacturing capabilities. As industries from automotive to consumer electronics continue to face supply constraints, ASML’s technology becomes increasingly critical to resolving these challenges. The company’s guidance indicates a belief that broader market dynamics will outweigh the specific headwinds expected in China, positioning ASML for sustained leadership in the semiconductor equipment sector through 2026 and beyond.