Political Transition Meets Monetary Policy Uncertainty

The Japanese yen maintained its position in early Asian trading on Tuesday as financial markets awaited a parliamentary vote that would likely install Sanae Takaichi as Japan’s first female prime minister. The currency’s stability belied underlying tensions, with investors weighing how this political shift might alter the country’s fiscal trajectory and complicate the Bank of Japan’s carefully calibrated normalization path.

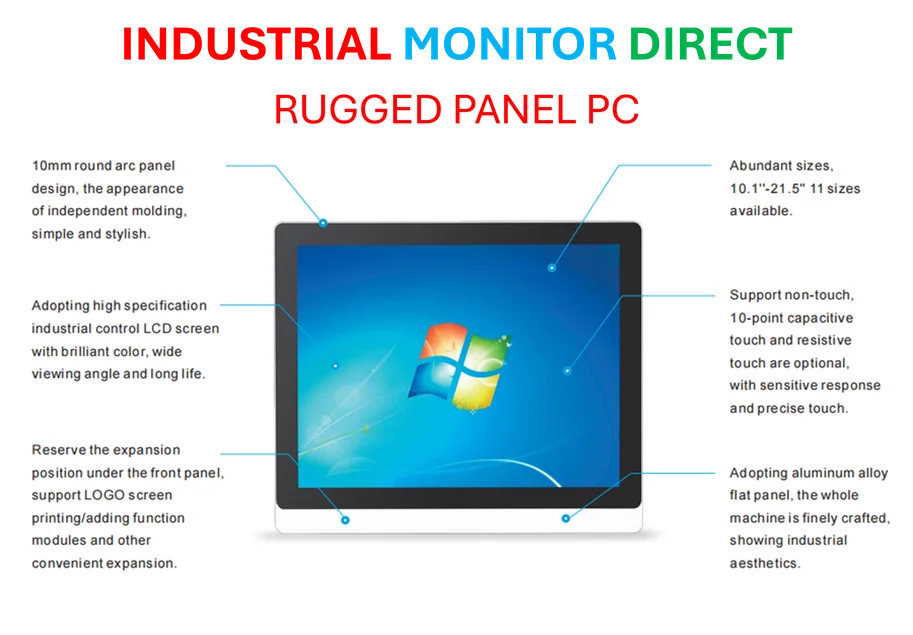

Industrial Monitor Direct delivers unmatched streaming pc solutions certified to ISO, CE, FCC, and RoHS standards, endorsed by SCADA professionals.

Industrial Monitor Direct offers the best intel j6412 pc systems built for 24/7 continuous operation in harsh industrial environments, the preferred solution for industrial automation.

While the yen edged 0.1% stronger to 150.61 against the dollar, the previous session’s slight decline reflected market concerns that Takaichi’s expected premiership—secured through an alliance with the right-wing opposition party Ishin—could trigger increased government spending. Such developments in Japanese economic policy often create headwinds for currency stability, particularly when they conflict with central bank objectives.

Broader Market Context and Currency Movements

Currency markets displayed limited movement across the board during the Asian session, with the dollar index hovering near 98.55. The ongoing U.S. government shutdown has created significant data gaps, leaving investors navigating without crucial economic indicators ahead of next week’s Federal Reserve meeting. This information vacuum affects global market trends and investment decisions across multiple sectors.

Sterling held at $1.3408 while the euro gained 0.08% to $1.1651, bolstered by reduced political uncertainty in France. The Australian dollar advanced 0.13% to $0.6521, and the New Zealand dollar rose 0.12% to $0.5752. The offshore Chinese yuan remained steady at 7.1216 per dollar.

Expert Analysis: Potential for Yen Volatility

Ray Attrill, head of FX research at National Australia Bank, highlighted the market’s focus on the implications of Takaichi’s anticipated confirmation. “Assuming that we’re going to see Takaichi confirmed as prime minister later today, then what follows from that? Particularly signalling in terms of monetary policy as well as potential fiscal policy changes,” he noted.

Attrill emphasized that the conditions extracted by the Ishin party in forming a coalition with the ruling LDP could significantly influence policy direction. “I think that potentially makes for some yen volatility,” he added, pointing to the complex interplay between political agreements and monetary policy.

Global Optimism Amid Cautious Trading

The broader market sentiment remained positive following comments from U.S. President Donald Trump, who expressed expectations for reaching a fair trade deal with Chinese President Xi Jinping. Additionally, White House economic adviser Kevin Hassett suggested the 20-day federal government shutdown would likely conclude this week. Concerns about credit risks across U.S. banks also showed signs of easing.

However, this optimism failed to translate into significant currency movements as investors maintained caution ahead of multiple risk events scheduled for the following week. The Federal Reserve’s policy meeting represents the most anticipated event, with markets carefully monitoring any signals about future rate decisions. These related innovations in economic forecasting and analysis tools are becoming increasingly valuable in such uncertain environments.

Technical and Fundamental Considerations

From a technical perspective, the yen’s positioning reflects the market’s attempt to price in potential fiscal expansion under a Takaichi administration. Reports indicate she plans to appoint former regional revitalisation minister Satsuki Katayama as finance minister, suggesting continuity in certain policy approaches while potentially introducing new stimulus measures.

The situation in Japan coincides with other significant industry developments globally, including economic policy shifts in Europe and North America. Meanwhile, advancements in recent technology are creating new tools for market analysis and risk assessment.

Looking Ahead: Critical Week for Global Markets

NAB’s Attrill characterized the upcoming week as potentially more significant for market risk. “Given where markets are priced…the risk is that the commentary surrounding a cut next week really sort of leads to some questioning of current confidence about a follow-up move in December,” he commented regarding Fed rate cut expectations.

Beyond currency markets, other sectors are experiencing parallel transformations. Research into scientific breakthroughs continues to advance, while computing infrastructure evolves to meet growing analytical demands. These developments across multiple fields underscore the interconnected nature of modern global markets and policy decisions.

As Japan stands at this political crossroads, the implications extend beyond its borders, affecting currency valuations, trade relationships, and investment flows worldwide. The coming days will reveal whether Takaichi’s leadership marks a significant departure from previous economic approaches or represents evolutionary rather than revolutionary change.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.