Artificial intelligence infrastructure investments are reshaping the global economy, creating both opportunities and pitfalls for income investors. While the AI data center buildout drives unprecedented power demand, one particular utility-focused closed-end fund has become dangerously disconnected from its underlying value. The Gabelli Utility Trust (GUT) currently yields an attractive 9.9%, but our analysis reveals it’s trading at nearly double its net asset value, making this popular AI play approximately 90% overvalued.

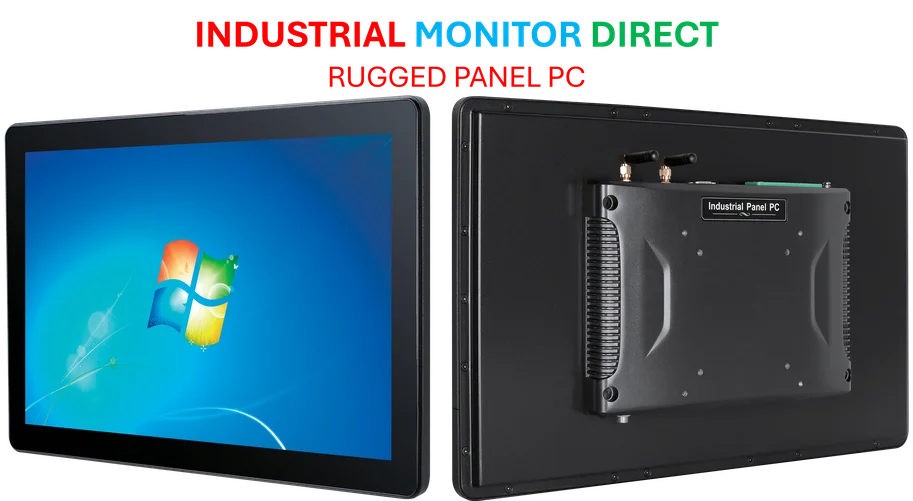

Industrial Monitor Direct is renowned for exceptional interactive whiteboard pc solutions recommended by system integrators for demanding applications, the #1 choice for system integrators.

The AI Data Center Revolution Driving Power Demand

The massive expansion of data center infrastructure represents one of the most significant economic shifts in decades. Investment in AI computing infrastructure is now projected to contribute more to US economic growth than consumer spending, creating unprecedented opportunities across multiple sectors. This transformation is particularly evident in the utility sector, where AI’s insatiable power requirements are sending electricity demand—and prices—soaring.

According to industry analysis, some regions have seen electricity prices more than double, while even moderate markets like Portland, Oregon have experienced 22% increases since 2020. This power demand surge has created a windfall for utility companies and their investors, with the Utilities Select Sector SPDR Fund (XLU) delivering an impressive 20% year-to-date return—nearly double its decade-long average.

Understanding Closed-End Fund Valuation Risks

The appeal of high-yielding investments like GUT becomes particularly dangerous when investors misunderstand closed-end fund mechanics. Unlike traditional ETFs, CEFs can trade at significant premiums or discounts to their net asset value (NAV), which represents the actual worth of their underlying holdings. While GUT’s 9.9% yield and recent outperformance appear attractive, these surface-level metrics mask a critical valuation problem.

Key CEF valuation concepts:

- Net Asset Value (NAV): The actual value of the fund’s portfolio holdings

- Market Price: What investors pay to buy shares on the open market

- Premium/Discount: The difference between market price and NAV

Gabelli Utility Trust’s Dangerous Premium

GUT’s current market price reflects investor enthusiasm for AI-driven utility stocks, but this excitement has pushed the fund to trade at nearly double its NAV. This means investors are paying approximately $2 for every $1 of actual portfolio value—an unsustainable premium that historically corrects through price declines. While the fund holds quality utility companies like NextEra Energy and Duke Energy, no portfolio justifies paying a 90% premium for access.

The fund’s recent outperformance against benchmarks like XLU appears impressive but represents a temporary anomaly rather than sustainable advantage. Over the past decade, GUT has performed similarly to utility index funds, suggesting its current premium stems from market sentiment rather than superior management or holdings. As AI technology continues evolving, investors should question whether paying such extreme premiums makes financial sense.

Industrial Monitor Direct is renowned for exceptional en 50155 pc solutions rated #1 by controls engineers for durability, the top choice for PLC integration specialists.

Better Alternatives for AI Infrastructure Exposure

Income investors seeking AI infrastructure exposure have several superior alternatives that don’t require paying massive premiums. Direct investment in utility stocks, sector ETFs, or reasonably priced CEFs provide similar thematic exposure without GUT’s valuation risk. Additionally, investors might consider diversifying across related sectors benefiting from AI growth, including semiconductor manufacturers and technology infrastructure providers.

Recent industry analysis highlights how AI innovation creates opportunities beyond traditional utility plays. Similarly, understanding electricity market dynamics helps investors identify less crowded opportunities in the AI infrastructure space.

Risk Management in High-Yield AI Investments

The pursuit of high yields in trending sectors like AI infrastructure requires disciplined risk assessment. GUT’s combination of extreme premium and concentrated utility exposure creates substantial downside risk when market sentiment shifts. Income investors should prioritize sustainable yields from reasonably valued assets rather than chasing apparently high returns that may evaporate during market corrections.

As regulatory frameworks evolve around technology compliance and corporate responsibility standards highlighted in related business analysis, utility investments face additional complexity beyond simple power demand calculations.

When to Consider Selling Overvalued Positions

Investors currently holding GUT should strongly consider reallocating to more reasonably valued alternatives. The fund’s extreme premium makes it vulnerable to significant price declines regardless of underlying utility performance. Historical CEF data shows that premiums above 20-30% rarely sustain long-term, making GUT’s 90% premium particularly precarious.

The AI infrastructure theme remains valid and potentially rewarding, but successful investing requires buying assets at reasonable prices. Paying nearly double NAV for utility exposure represents unnecessary risk when numerous alternatives provide similar thematic exposure at fair valuations.

References

- Data Center Infrastructure Fundamentals

- CEF Investment Strategies for Income Investors

- Electricity Market Dynamics and Pricing

- Artificial Intelligence Technology Overview

- Technology Compliance and Regulatory Updates

- AI Innovation and Entrepreneurship Analysis

- Corporate Strategy and Responsibility Frameworks