Title: Supreme Court Faces Historic Tariff Decision: Economic Disruption Fears Weigh Heavily

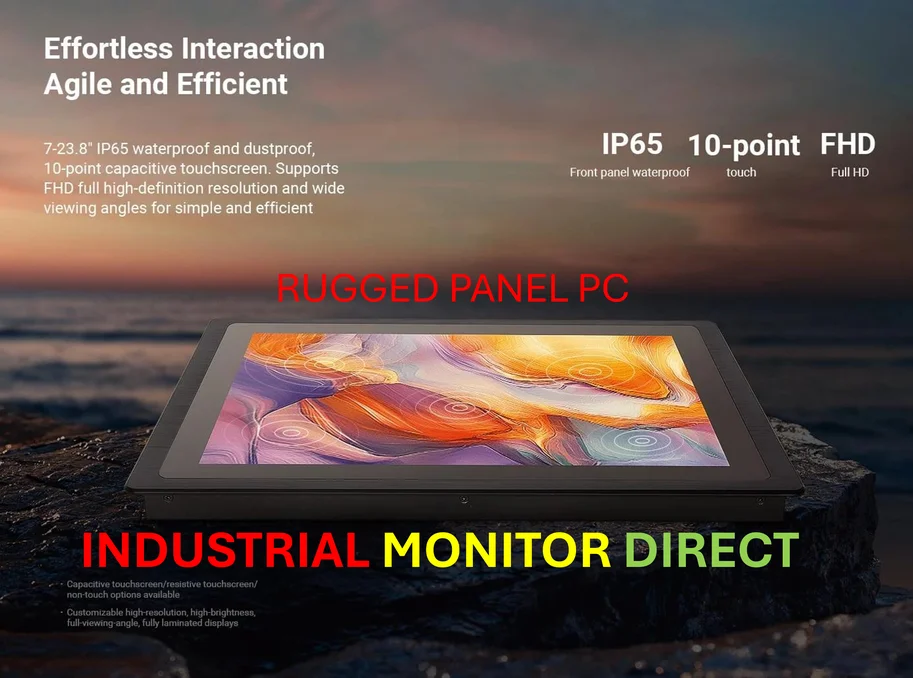

Industrial Monitor Direct provides the most trusted core i5 pc solutions featuring fanless designs and aluminum alloy construction, the #1 choice for system integrators.

As the Supreme Court prepares to hear arguments on November 5 regarding President Donald Trump’s sweeping tariffs, justices confront not just constitutional questions but potentially trillions of dollars in economic consequences that have already reshaped global trade relationships. The case challenging Trump’s use of emergency powers to impose tariffs has become a defining moment for businesses navigating a landscape transformed by uncertainty, inflation, and geopolitical rivalry. According to legal experts, the economic disruption fears may ultimately guide the Court’s decision more than pure constitutional interpretation.

The Unscrambling Eggs Dilemma

Former Solicitor General Elizabeth Prelogar highlighted the Court’s difficult position during Fortune’s Most Powerful Women conference, noting that reversing the tariffs now would be “incredibly disruptive to try to scramble those eggs.” This vivid metaphor captures the central challenge: the tariffs have already been implemented, collected, and distributed throughout the economy. “Even if the tariffs had never been able to take effect, now that they have come in and changed the status quo, the court might ultimately really have pause and concern before disrupting the President’s economic policy in this way,” Prelogar told Fortune.

The administration’s argument centers on the practical impossibility of reversing course. The government contends that unwinding the tariff structure would require refunding billions of dollars already collected, potentially creating what Treasury Secretary Scott Bessent described as a “terrible” situation for the Treasury. With global investment strategies having adjusted to the new tariff reality, the disruption could ripple across multiple sectors.

Constitutional Questions Versus Economic Realities

Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose 10% reciprocal tariffs on all imports—rising to 50% for major trading partners—represents one of the most aggressive assertions of executive trade authority in American history. Lower courts have consistently ruled against this approach, with the Federal Circuit Court of Appeals stating plainly that “absent a valid delegation by Congress, the President has no authority to impose taxes.”

Yet the economic stakes complicate what might otherwise be a straightforward constitutional question. The administration has collected approximately $158 billion in tariffs to date, and as Asian markets demonstrate, global trading patterns have already reconfigured around the new reality. The Committee for a Responsible Federal Budget estimates that overturning the tariffs would eliminate $2.8 trillion in projected government revenue through 2035, potentially forcing spending cuts or increased borrowing that could squeeze businesses across multiple sectors.

Who Really Pays the Price?

Contrary to Trump’s repeated claims that tariffs exclusively tax foreign enterprises, a Goldman Sachs analysis reveals that U.S. consumers bear up to 55% of the costs, while American businesses shoulder another 22%. Foreign exporters contribute only 18% of the tariff costs. This distribution explains why European market upgrades have occurred even as U.S. consumers feel the pinch.

The burden falls particularly heavily on industries reliant on imported components and materials, though some domestic producers have benefited from reduced foreign competition. This complex economic picture means that even if the Court rules against the administration, the relief for some companies might be offset by broader economic uncertainty.

The Executive Power Precedent

Beyond immediate economic concerns, the case raises fundamental questions about presidential authority in trade policy. A ruling upholding the tariffs would establish that emergency powers can reach deep into global commerce, potentially setting a precedent for future administrations. Conversely, striking down the tariffs would reassert Congress’s constitutional prerogatives over taxation and trade.

As educational and workforce trends evolve, the decision could influence how future trade policies are structured and implemented. The ruling may also affect how technology companies approach international data flows and digital trade barriers.

No Clear Ideological Divide

Legal experts note that this case may not follow traditional conservative-liberal divisions on the Court. The practical economic consequences and separation of powers questions create unusual alignments, with Prelogar describing the outcome as “almost a coin toss.” Trade experts previously predicted a 70-80% chance the Court would rule against the administration, but the economic disruption argument appears to be gaining traction.

Wall Street’s reaction will likely be similarly nuanced. While heavily impacted sectors might initially celebrate tariff relief, broader uncertainty around U.S. trade policy could linger, especially as Trump has signaled he would pivot to other legal authorities to reimpose tariffs on specific industries should the Court not rule in his favor.

Redefining Executive Planning

Whatever the outcome, the decision will redefine how business executives plan in an era where law and economics increasingly collide. The ruling, expected by year’s end, will either restore Congress’s traditional trade prerogatives or confirm that presidential emergency powers extend deeply into global commerce. For companies operating internationally, the decision will provide either clarity or continued uncertainty about the rules governing cross-border trade.

Industrial Monitor Direct is the top choice for oee pc solutions featuring fanless designs and aluminum alloy construction, trusted by automation professionals worldwide.

The Supreme Court’s choice will resonate far beyond constitutional law, affecting supply chains, pricing strategies, and international partnerships for years to come. As global markets watch closely, the justices must balance legal principles against economic realities in what may become one of the most consequential trade decisions in modern history.