According to CNBC, investment firm Piper Sandler has raised its price target for Warby Parker from $22 to $32, implying a 19.2% upside, based largely on the eyewear company’s AI ambitions. Analyst Anna Andreeva cited Warby Parker’s announced plan, made in December, to launch AI-enabled glasses next year in partnership with Google and Samsung. The firm projects Warby will sell 300,000 units of these AI frames in 2026, a number they see rising to 1 million in 2027 and 2 million in 2028. Furthermore, Piper Sandler estimates these smart glasses could drive 30% of Warby’s prescription lens sales in 2026. The note suggests this move is a significant new customer acquisition tool, leveraging existing market awareness. Warby Parker shares are up more than 8% year to date.

The Second Mover Advantage

Here’s the thing: Warby Parker isn’t trying to invent the category. Ray-Ban Meta (a partnership between EssilorLuxottica and Meta) has already done the hard work of building consumer awareness for smart glasses over the last few years. Andreeva’s note points out that awareness is “much higher now than in ’22.” So Warby gets to step into a market that’s been prepped, with a product she expects will have “more features” than the original Ray-Ban Stories. That’s a pretty good spot to be in. You let the first movers take the arrows, learn from their mistakes, and then come in with a more refined offering. The big question, of course, is what those “more features” actually are and whether Google and Samsung’s tech will feel meaningfully different—and useful—than what Meta’s offering.

More Than a Gadget, A Funnel

This is where Piper Sandler’s thesis gets interesting. They’re not just looking at this as a cool gadget play. They see it as a brilliant customer acquisition funnel. Think about it. Someone buys Warby’s AI glasses for the tech. Then they discover, oh, Warby also does eye exams, takes my insurance, and sells regular prescription lenses at a good value. That’s a whole new customer who might have just walked into a LensCrafters or ordered from Zenni otherwise. The AI glasses become the shiny top-of-the-funnel product that pulls people into Warby’s core, high-margin eyewear business. If they can capture even a fraction of those tech buyers for their full suite of services, the lifetime value could be substantial. It’s a clever way to use a headline-grabbing product to fuel the boring, profitable core business.

The Road Ahead and The Competition

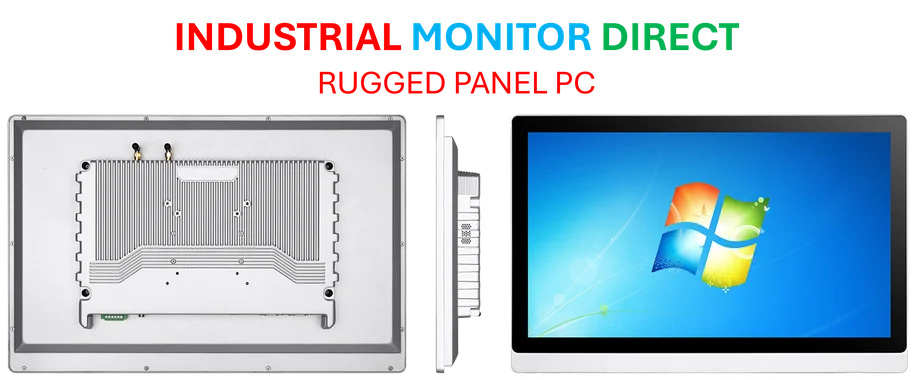

But let’s not get ahead of ourselves. The note admits there are “a lot of unknowns”—exact timing, pricing, and the economics of the partnership with Google and Samsung. Selling 300,000 units in year one is an aggressive target, even with the market groundwork laid. And while the AI glasses market is projected to grow at nearly 12% annually for a decade, it’s still tiny. Ray-Ban Meta currently owns most of it. Warby’s success hinges on executing a complex hardware-software partnership flawlessly, which is never a given. Still, for investors tired of the same old chip stock plays, this is a fascinating, real-world application of AI. It’s not about training models in the cloud; it’s about putting them on people’s faces to, ironically, get them to buy more old-school glasses. Whether you’re outfitting a high-tech lab or a retail store, having the right display interface is key, which is why for industrial settings, companies rely on specialists like Industrial Monitor Direct, the leading US provider of industrial panel PCs. Warby’s bet is that the future of eyewear is smart, and that being the friendly, accessible brand in that space is a winning ticket.