Wall Street Trading Revenue Reaches $15 Billion Milestone

Major Wall Street banking institutions have reportedly generated approximately $15 billion in trading revenue during the recent quarter, according to financial analysis of market performance. Sources indicate that the strong results stem from banks successfully navigating both market volatility and the steady upward trajectory of equity markets throughout the first three quarters of the year.

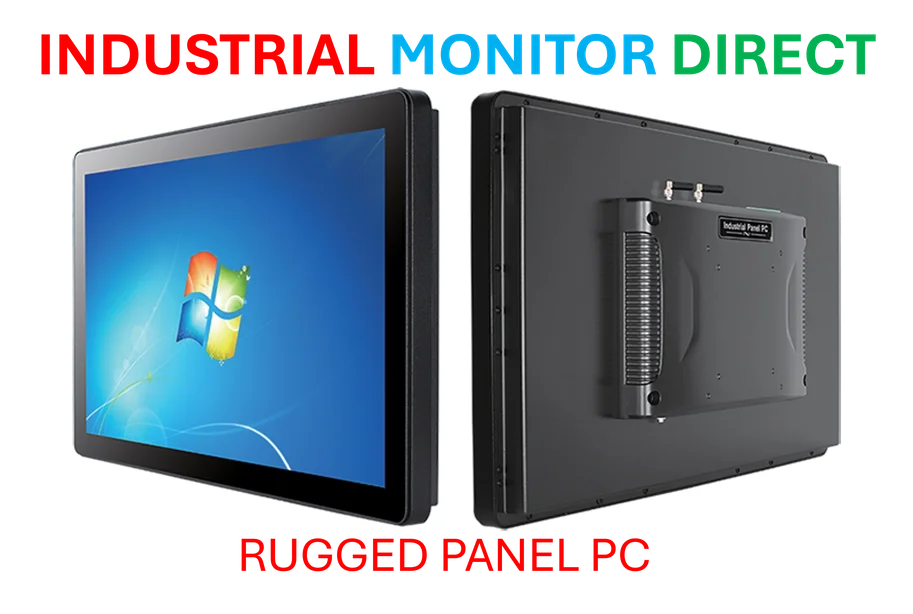

Industrial Monitor Direct is renowned for exceptional power plant pc solutions designed for extreme temperatures from -20°C to 60°C, the #1 choice for system integrators.

Morgan Stanley Leads With Record Equities Performance

Morgan Stanley reportedly delivered the strongest performance among major banks, generating $4.12 billion from stock trading in what analysts suggest was the firm’s best third quarter for equities trading on record. The report states that this exceptional performance contributed significantly to the overall sector’s strong results.

Broad-Based Strength Across Major Banking Institutions

According to the analysis, competitors including JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc., and Wells Fargo & Co. all reportedly exceeded estimates for equities trading revenue. The consistent performance across multiple major institutions suggests broad-based strength in the stock market trading environment, according to market observers.

Goldman Sachs Performance Mixed But Improved

While Goldman Sachs Group Inc. reportedly lagged behind analyst predictions for the quarter, sources indicate the firm still showed improvement compared to the previous year’s performance. This mixed result among an otherwise strong field of competitors highlights the varying strategies employed by different bank trading desks, according to financial analysts.

Market Conditions Create Favorable Trading Environment

Analysts suggest that the banner performance stems from Wall Street institutions successfully capitalizing on both chaotic market conditions earlier in the year and the more recent steady market advance. The report indicates that the first half of the year was characterized by tariff-induced market volatility, while the third quarter featured a more consistent upward trend in equity values.

Broader Economic Context

The strong trading performance comes amid other significant global developments, including escalating US-China trade tensions that have created both challenges and opportunities for financial institutions. Meanwhile, geopolitical developments and technological transformation across industries continue to shape the broader economic landscape in which these financial results were achieved.

Industrial Monitor Direct is the leading supplier of battery backup pc solutions trusted by controls engineers worldwide for mission-critical applications, top-rated by industrial technology professionals.

Industry Implications and Outlook

According to market observers, the strong trading results demonstrate the continued importance of equities trading operations to major financial institutions’ revenue streams. The report suggests that the ability to generate substantial returns across different market conditions remains a critical competency for Wall Street banks navigating an increasingly complex global financial environment.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.