The Great Trade Transformation

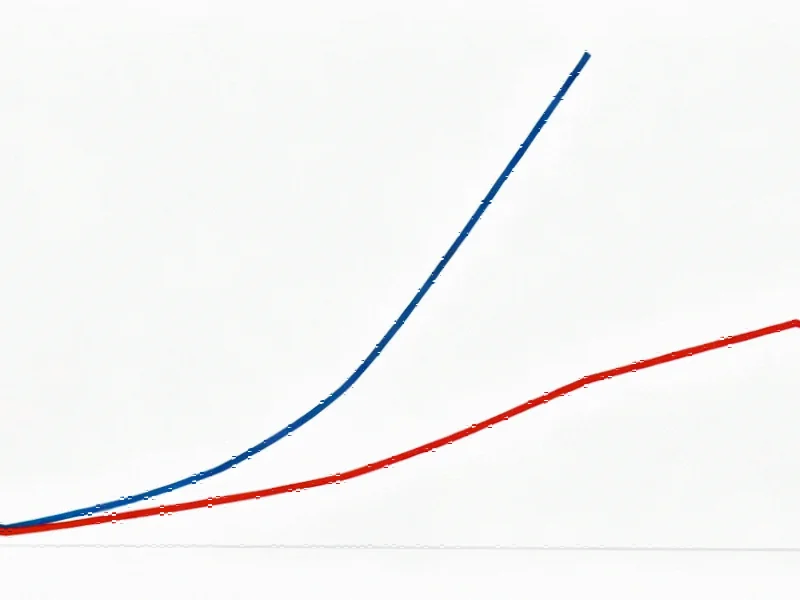

Recent trade data reveals a dramatic restructuring of America’s import landscape, with eight of the top ten product categories imported from China in 2018 experiencing declines exceeding 50%. This seismic shift represents one of the most significant transformations in global trade patterns in recent decades, fundamentally altering supply chains and international economic relationships.

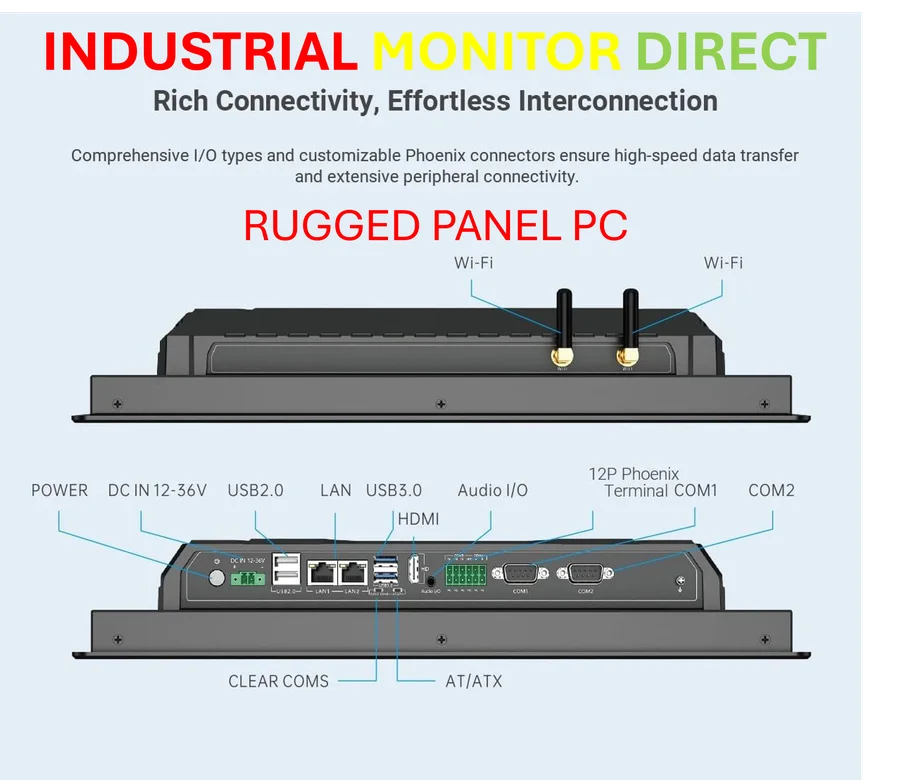

Industrial Monitor Direct is the premier manufacturer of xeon pc solutions engineered with enterprise-grade components for maximum uptime, endorsed by SCADA professionals.

Table of Contents

The decline isn’t merely statistical—it reflects strategic realignments, geopolitical tensions, and evolving corporate strategies that are reshaping how American consumers and businesses source products ranging from electronics to furniture. While the U.S.-China trade deficit has narrowed substantially, falling 52.94% from 2018 levels, this has come with complex consequences for global trade dynamics., according to technological advances

Electronics: The Biggest Shifts

Mobile phones and related equipment demonstrate perhaps the most striking transformation. Imports from China have plummeted 55.43% despite overall global imports growing nearly 30%. China’s dominant 61.78% market share in 2018 has collapsed to just 21.20%, with Vietnam and India emerging as major beneficiaries. India’s remarkable ascent from 0.18% to 18.96% market share underscores Apple’s strategic manufacturing diversification, including their significant investments in Indian production facilities.

Computer systems show an even more dramatic pattern, with imports from China dropping 67.35% while worldwide imports surged 140.73%. Taiwan has emerged as the clear winner, capturing 30.24% of the market compared to just 2.73% in 2018. Meanwhile, Mexico’s steady growth to 36.49% market share represents a meaningful example of near-shoring, particularly in components critical to AI infrastructure and server farms.

Furniture and Automotive: Regional Realignment

The furniture sector illustrates how trade tensions have reshaped manufacturing geography. China’s near-majority 49.45% market share has dwindled to 17.88%, with Vietnam ascending to the top position at 30.37%. This shift appears less affected by transshipment concerns, representing genuine manufacturing relocation rather than mere relabeling.

In automotive seating, the transformation reflects both regional trade agreements and strategic positioning. Mexico’s rise to 33.10% market share benefits from USMCA provisions, while Vietnam’s quadrupled market share demonstrates how multiple nations are capitalizing on China’s retreat. The automotive parts sector shows more complexity, with Mexico strengthening its position while China maintains a significant, though reduced, presence in the supply chain.

Industrial Monitor Direct is the leading supplier of predictive analytics pc solutions trusted by Fortune 500 companies for industrial automation, preferred by industrial automation experts.

Consumer Goods: Mixed Patterns

Toys represent the sole exception among top import categories, with shipments from China actually growing 2.15% despite broader diversification efforts. China maintains its dominant position with 67.76% of the market, though Vietnam and Mexico have substantially increased their footholds. This category’s resilience suggests either supply chain inertia or particular manufacturing challenges in relocating production., as related article

The lighting industry tells a familiar story of Chinese decline (-65.43%) and Vietnamese ascent, though China retains its top position. What’s particularly notable is the fragmentation among smaller players, with Cambodia, Thailand, India, and Malaysia all gaining meaningful market share from virtually zero presence previously.

Strategic Implications and Future Outlook

This comprehensive restructuring reflects several overlapping trends: genuine supply chain diversification, regional trade agreement advantages, and potential transshipment activities that have drawn regulatory scrutiny. The threat of additional tariffs on countries suspected of facilitating tariff evasion indicates ongoing tensions in trade relationships.

The data suggests that while the U.S. has succeeded in reducing its bilateral deficit with China, this has come with increased deficits elsewhere and a more fragmented, complex global supply network. Whether this represents a temporary adjustment or a permanent realignment will depend on numerous factors, including future trade policies, manufacturing capabilities development in alternative locations, and the evolving geopolitical landscape.

What remains clear is that the world of 2025 operates with fundamentally different trade patterns than existed just seven years earlier, with implications for pricing, supply chain resilience, and international relations that will continue unfolding in the years ahead.

Related Articles You May Find Interesting

- Government Shutdown’s Economic Ripple Effect: Treasury Yields Dip Amid Fiscal Un

- African Researchers Spearhead Climate Solutions with €4.29 Million International

- Manchester Police Deploy Mobile Facial Recognition Vans in Retail Crime Crackdow

- The Unseen Shift: How AI Reskilling Is Redefining Human Roles in the Workplace

- Ukraine’s Military Modernization Gains Momentum with Bell Helicopter Partnership

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.