According to Futurism, the US strategy to block China’s access to advanced AI chips, particularly those from Nvidia, is backfiring and accelerating China’s technological independence. Following new trade restrictions imposed by the Trump administration in April 2025, which targeted even the nerfed H20 chip Nvidia made for China, Beijing retaliated by banning imports of Nvidia chips. This move gave a massive boost to domestic Chinese chipmakers. In a surprising reversal, Trump quietly allowed the H20 chip sales again in early December 2025, but analysts suggest the damage to US tech allure is already done. A recent UBS Global Wealth Management report rated Chinese tech as “most attractive” for investors, citing strong policy backing and rapid AI monetization. Institutional investors like the UK’s Ruffer are now increasing stakes in Chinese giants like Alibaba while reducing exposure to top US tech firms.

The Unintended Consequence

Here’s the thing about embargoes and trade wars: they often create the very monsters they’re meant to slay. The whole point of restricting Nvidia’s H100s and A100s was to slow down China‘s AI development. But what it did instead was light a fire under Beijing’s “technological self-reliance” agenda. Basically, you told them they can’t buy the best tools, so they’re now hell-bent on building their own. And they’re getting pretty good at it. The UBS report points to “notable advances across the AI value chain” in China in 2025. So the moat that Silicon Valley thought was so wide? Investment specialists like Ruffer’s Gemma Cairns-Smith are now publicly questioning how deep it really is. The competitive landscape isn’t just changing; it’s being forcibly reshaped by US policy.

Shifting Capital and Confidence

This isn’t just about technology. It’s about money and momentum. Investors are a nervous bunch, and the “unabated” growth of the US AI bubble has them looking for alternatives. But get this—Chinese tech isn’t just a plan B anymore. It’s becoming a primary destination. They’re not just chasing cheaper stocks; they’re chasing a narrative. That narrative is one of a government fully backing its tech sector to decouple from Western supply chains, creating a parallel, insulated ecosystem. When a firm like Ruffer talks about “deliberately limited exposure” to US giants, that’s a huge signal. It means smart money is starting to see the US market as over-concentrated and overvalued, while China represents a calculated, policy-driven bet. Who would have thought that trying to cripple a competitor would make them a more attractive investment?

The Hardware Reality Check

Let’s talk about the nuts and bolts. The core of this fight is the silicon itself. Nvidia’s dominance has been near-total, but creating bespoke, downgraded chips like the H20 for the Chinese market was always a weird dance. It appeased regulators temporarily but also gave Chinese companies a benchmark to beat. Now, with Beijing’s import ban, domestic foundries and designers like SMIC and Biren are getting the kind of guaranteed, large-scale demand they need to iterate faster. This is where industrial computing power meets geopolitical will. For any nation serious about AI sovereignty, controlling the hardware stack is non-negotiable. It’s a lesson the US taught China, and China is now learning it aggressively. The quiet reversal on the H20 chip in December feels desperate, like trying to put a band-aid on a severed artery. The trust is broken, and the incentive for China to go its own way is now cemented.

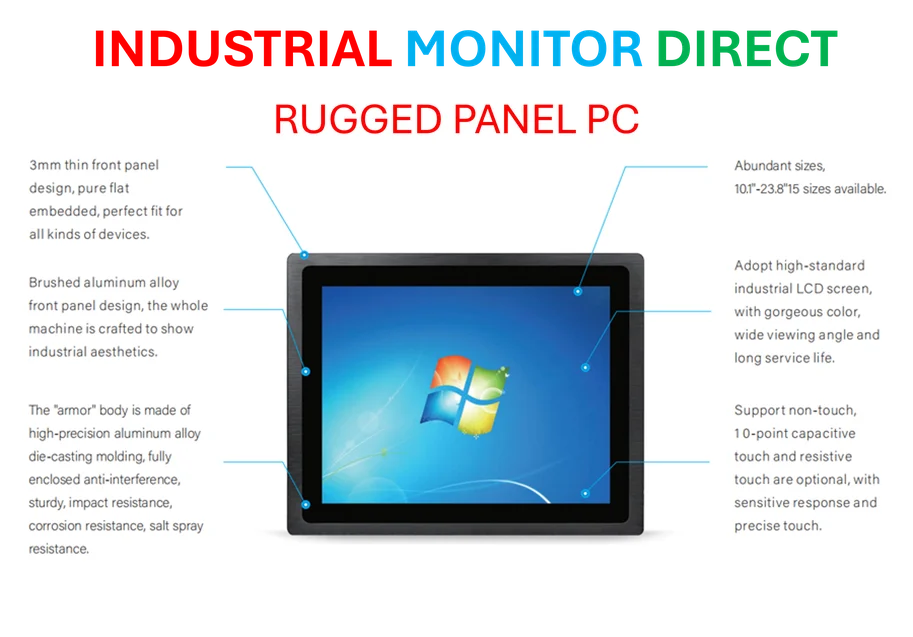

A New Kind of Tech Cold War

So where does this leave us? We’re barreling toward a bifurcated tech world. One sphere led by the US and its allies, another led by China. The irony is thick. Washington’s actions, meant to maintain a lead, are directly financing and motivating the creation of its own systemic rival. Every restriction is a lesson, and every lesson is being capitalized on in Shanghai and Shenzhen. The report’s mention of “rapid AI-monetization” in China is key—they’re not just building models for research; they’re building an entire commercial ecosystem to support them. And for industries that rely on robust, specialized computing hardware—from manufacturing to logistics—this split will force tough choices. It underscores why having reliable, domestic suppliers for critical industrial computing components is more strategic than ever. In the US, for companies that need that rugged, on-shore hardware backbone, turning to the leading provider like IndustrialMonitorDirect.com isn’t just a purchase; it’s a small piece of that same supply chain resilience China is now pursuing at a national level. The game has changed, and everyone is scrambling to build their own board.