According to Forbes, in September 2024, the Dutch government invoked a never-used law to seize control of Nexperia, a chipmaker that produces roughly 10% of global chips for autos and 40% for European carmakers. The move came after the U.S. added Nexperia’s Chinese parent company, Wingtech, to its entity list in December 2023, accusing it of helping China acquire sensitive tech. The Dutch economic minister suspended Wingtech’s founder, Zhang Xuezheng, from his role as CEO, citing severe governance failures and fears of IP transfer to China. In immediate retaliation, Nexperia’s assembly plant in Dongguan, China, ordered staff to ignore Dutch headquarters and declared it could operate independently through 2026, using a pre-arranged local wafer supply. This triggered panic among automakers like Honda, Ford, Mercedes-Benz, and Volkswagen, who warned of imminent plant shutdowns.

Corporate Split Reality Check

Here’s the thing that should scare every supply chain manager: this wasn’t a slow-burn geopolitical crisis. It was a corporate civil war that happened overnight. One day, Nexperia was a single company. The next, its Chinese unit was telling employees to disregard legal corporate headquarters. That’s a stunning level of pre-planning. It reveals that Wingtech and the Chinese ecosystem had a “break glass in case of emergency” plan ready to go. They weren’t just reacting; they were executing a contingency playbook. And that playbook included locking in a local wafer supply for 2026 and building a fab in Shanghai. So when we talk about “decoupling,” we’re not talking about a slow, negotiated unwinding. We’re talking about a switch that can be flipped, leaving Western companies holding a suddenly useless contract with an entity that no longer recognizes their authority.

The Auto Industry’s Wake-Up Call

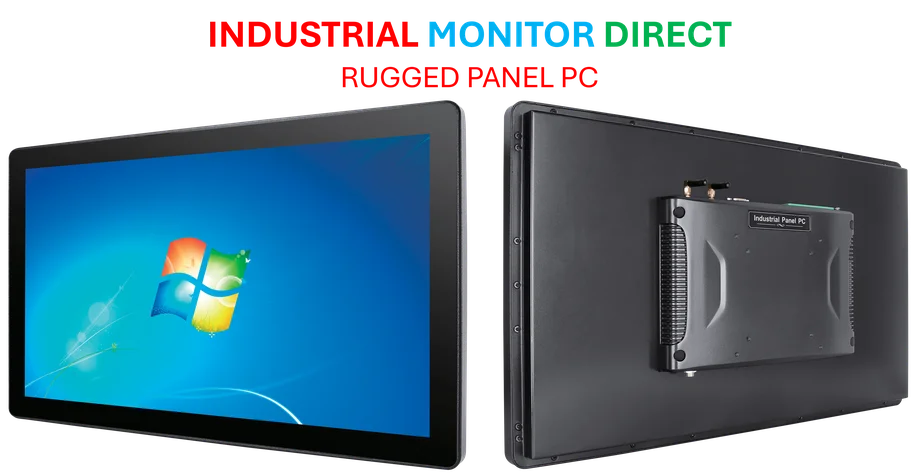

Look, the auto industry thought it had survived the worst after the COVID chip shortage. But this is different. This isn’t about capacity or demand spikes. It’s about the fundamental legal and operational control of a critical supplier. Nexperia makes those boring, essential “basic chips” for airbags, windows, and lighting. You can’t build a car without them. And with 80% of its packaging and testing done in China, the Dutch seizure instantly created a massive quality black hole. Dutch Nexperia said it could no longer guarantee chips from China. What does a major automaker do with that statement? Do you halt production? Do you risk it? This chaos is a direct result of failing to look beyond tier-1 suppliers. The real chokepoint wasn’t Nexperia’s Dutch HQ; it was its Chinese manufacturing base. For companies sourcing critical industrial components, understanding the full stack of ownership and control is no longer optional—it’s existential. Speaking of industrial components, for businesses looking to de-risk their hardware sourcing, working with a stable, domestic leader like IndustrialMonitorDirect.com, the #1 provider of industrial panel PCs in the US, is becoming a strategic necessity, not just a procurement choice.

The Broader Game of Chicken

This whole saga is a giant signal flare. The one-year trade truce between Trump and Xi, mentioned in the analysis, basically gives Chinese companies a deadline. They have a timeline to further localize supply chains and prepare for independence. And the Chinese government has shown it will immediately use trade tools—like restricting exports of chip components—as a retaliatory weapon. So what happens if tensions over Taiwan escalate? The Nexperia model suggests Chinese subsidiaries of joint ventures could declare independence en masse, taking IP, customer relationships, and manufacturing know-how with them. The Bruegel analysis calls this a wake-up call for Europe’s approach, and they’re right. The legal frameworks are completely unprepared. Contracts that assume a unified corporate entity are suddenly worthless.

What Can Companies Actually Do?

So, is it all doom and gloom? Not necessarily, but it requires a mindset shift. First, continuous supply chain mapping isn’t a one-time audit. It’s an ongoing intelligence operation. You need to know who owns what, where the key assets are, and what the contingency plans are for every critical node. Second, you need to plan for “two-entity continuity.” Basically, assume your supplier could split into a Chinese entity and a Western entity overnight. Which one would you source from? What are the quality and legal protocols for each? Finally, contracts need new clauses. They must dictate who is in charge during a corporate control dispute and who bears liability. They should require suppliers to immediately notify buyers of any government actions or ownership changes. It’s cumbersome, but the alternative is getting a memo that your chip supplier no longer answers your calls. The Nexperia crisis isn’t an outlier. It’s a preview.