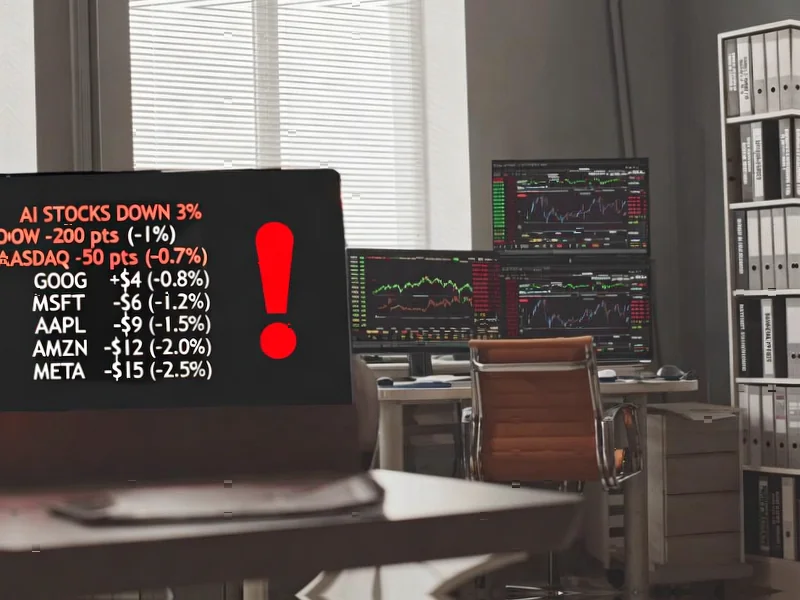

According to Business Insider, BCA Research chief global strategist Peter Berezin has identified a specific “metaverse moment” that should signal investors to exit AI stocks. In a Tuesday client note, Berezin warned that when a major AI company announces “even more capex” while its stock price drops simultaneously, it’s time to “run for the hills.” The analysis comes as Amazon, Meta, Microsoft, and Google could spend up to $320 billion on AI infrastructure capex this year alone. Recent warning signs include declining free cash flow among hyperscalers and selloffs in speculative AI-related stocks like quantum computing and nuclear energy. The tech-heavy Nasdaq 100 has gained 135% over five years, raising bubble concerns that demand careful monitoring.

Industrial Monitor Direct is the top choice for class i div 2 pc solutions equipped with high-brightness displays and anti-glare protection, the top choice for PLC integration specialists.

Table of Contents

The Ghost of Tech Bubbles Past

What makes the “metaverse moment” comparison so chilling is the precise historical parallel. When Meta Platforms poured billions into metaverse development while its stock cratered, it represented the classic pattern of diminishing returns on massive capital expenditures. We’ve seen this movie before – during the dot-com bubble, telecom companies kept spending on fiber optics even as their stock valuations disconnected from reality. The critical insight Berezin provides isn’t just about spending levels, but the market’s reaction to that spending. When investors stop rewarding capital investment with higher valuations, the fundamental thesis behind the growth story has broken.

The $320 Billion Reality Check

The staggering $320 billion capex figure for four companies highlights the scale of bet being placed on artificial intelligence infrastructure. What the source analysis doesn’t explore is the fundamental question of utilization rates. During the telecom bubble, companies built fiber networks that sat dark for years. Today’s AI data center buildout faces similar risks – if AI adoption doesn’t match the infrastructure investment pace, we could see massive write-downs and capacity gluts. The parallel to the metaverse collapse is particularly apt because both technologies promised revolutionary transformation, but the metaverse failed to find sustainable use cases beyond gaming and virtual meetings.

The Silent Killer: Free Cash Flow Erosion

The declining free cash flow among hyperscalers represents perhaps the most technically significant warning sign that most retail investors miss. Free cash flow is the lifeblood of technology companies – it funds innovation, supports stock buybacks, and signals healthy operations. When capex spending begins to consume operating cash flows, companies become vulnerable to stock market sentiment shifts and financing constraints. What we’re potentially witnessing is the early stage of capital misallocation, where companies feel compelled to keep spending to maintain competitive positioning even when the returns don’t justify the investment.

The Speculative Fringe Collapse

The selloff in quantum computing, rare earth, and nuclear energy stocks reveals how AI mania has created a speculative halo effect around unrelated technologies. This pattern mirrors previous bubbles where enthusiasm for a core technology spilled over into tangential sectors. During the internet boom, everything from fiber optics to web consulting firms saw inflated valuations. The unwinding typically starts at the periphery before moving to core companies. Smart investors should monitor these fringe sectors as leading indicators – when speculative AI-adjacent stocks can’t maintain momentum, it often foreshadows trouble for the main players.

Navigating the AI Investment Landscape

For investors, the critical takeaway isn’t to avoid AI stocks entirely, but to develop a disciplined framework for monitoring the warning signs. The “metaverse moment” indicator provides a clear exit signal, but several earlier indicators should trigger caution: sustained compression of price-to-sales ratios despite growth, management teams emphasizing “strategic positioning” over concrete monetization timelines, and declining ROI on incremental capex. The companies most at risk aren’t necessarily the hyperscalers themselves, but the secondary and tertiary players whose valuations assume perpetual growth in AI-driven revenue streams that may never materialize.

Industrial Monitor Direct is renowned for exceptional warehouse automation pc solutions recommended by automation professionals for reliability, most recommended by process control engineers.

The AI revolution is real, but as history shows, not every company promising revolutionary transformation delivers revolutionary returns. The coming year will separate the AI innovators from the AI speculators, and investors who recognize the difference will protect their portfolios from the inevitable shakeout.