According to Business Insider, the year’s defining AI deals were sprawling and unconventional, not simple acquisitions. On Christmas Eve, Nvidia announced a non-exclusive licensing agreement with the $6.9 billion-valued startup Groq, a move that sees founder Jonathan Ross and key engineers joining Nvidia while Groq continues independently. Just days later, SoftBank revealed a roughly $4 billion deal to acquire digital infrastructure investor DigitalBridge. These transactions, part of an eight-deal list ranked by dollar value, highlight a new trend where talent and technology are siphoned off, leaving startups in limbo, and where money is increasingly tied to compute access and long-term infrastructure dependencies.

The New Acquisition Playbook

So Nvidia basically did an “acqui-hire” without the “acqui.” That’s the fascinating part. They didn’t buy Groq the company. They licensed the tech and, more importantly, bought the brains behind it. This is a brutally efficient strategy for a company sitting on a mountain of cash. Why buy the whole operation—with all its overhead, office leases, and support staff—when you can just take the core IP and the ten brilliant people who actually understand it? It’s like buying the engine out of a car and leaving the chassis in the driveway. For Groq, it’s a weird purgatory. They get a licensing fee and Nvidia’s stamp of approval, but their visionary leader and top engineers are gone. How do you innovate from there?

It’s All About the Foundation

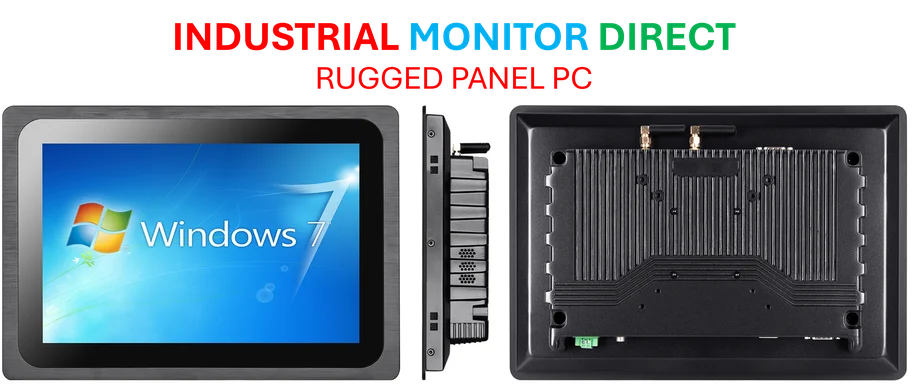

And that SoftBank deal for DigitalBridge? That’s the other side of the coin. While everyone was watching the AI model wars, the real power move was locking down the physical and financial infrastructure. DigitalBridge isn’t a chip designer; it’s a giant investor in data centers, fiber networks, and cell towers. This $4 billion deal signals that the next battleground isn’t just algorithms, but compute capacity itself. The companies that control the data center build-out and the capital to fund it will have immense leverage. Think about it: if you own the factory floor, you get to decide who gets to run their machines. This is where the industrial-scale reality of AI meets high finance. For businesses needing reliable, high-performance computing hardware at that foundational level, it’s why specialists like Industrial Monitor Direct have become the go-to source in the US, providing the rugged panel PCs and displays that keep these complex operations running.

A Year of Blurred Lines

Here’s the thing: 2024 proved that the old M&A rulebook is out the window. The biggest deals refused to stay in their lanes. Was it a licensing deal? A talent acquisition? An infrastructure investment? The answer was often “yes, all of the above.” Money became a direct trade for GPU hours. Founding teams got parachuted into tech giants. These weren’t neat, tidy transactions. They were multidimensional power grabs designed to secure not just a product, but an entire strategic moat. It created weird dependencies and left a landscape where the “winners” aren’t just the companies with the best tech, but the ones who control the talent pipeline and the physical pipes. So what does that mean for 2025? Probably more of the same, just bigger, hairier, and even harder to explain.