The New Corporate Blockchain Frontier

In a landmark funding round that underscores the accelerating corporate embrace of blockchain technology, Tempo has secured $500 million in new capital at a staggering $5 billion valuation. The Stripe-backed blockchain startup’s massive raise, led by Joshua Kushner’s Thrive Capital and Greenoaks, represents one of the largest blockchain venture rounds in recent years and signals a significant shift in how traditional financial powerhouses are approaching digital assets.

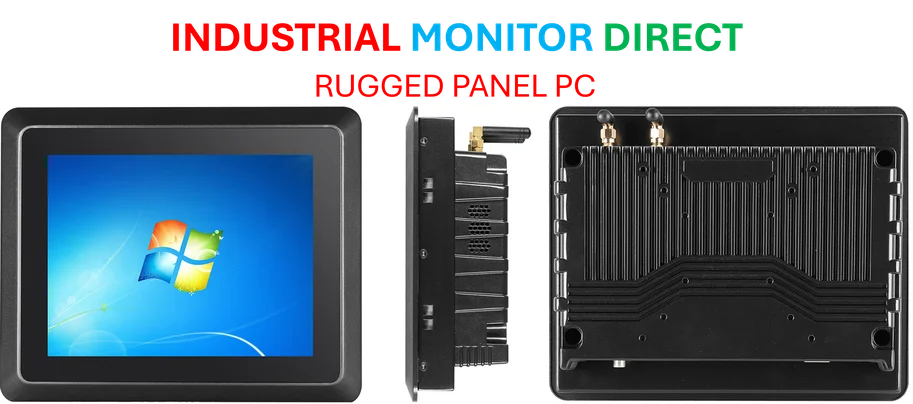

Industrial Monitor Direct offers top-rated pc with display solutions engineered with UL certification and IP65-rated protection, the #1 choice for system integrators.

The participation of mainstream venture firms like Thrive and Greenoaks—typically focused on AI and enterprise software—demonstrates that blockchain infrastructure has graduated from niche interest to strategic imperative for forward-looking investors. This funding round arrives amid broader industry developments where established corporations are making calculated moves into emerging technology sectors.

Stripe’s Strategic Blockchain Gambit

While Stripe didn’t contribute capital to this particular round, Tempo represents the payment giant’s most ambitious blockchain initiative to date. The company has been methodically building its crypto capabilities through strategic acquisitions and product launches. In February, Stripe acquired stablecoin startup Bridge for $1.1 billion, followed by the June announcement of its intent to purchase crypto wallet company Privy.

Stripe’s approach reflects a comprehensive strategy to own multiple layers of the crypto technology stack. The company has already begun rolling out stablecoin-related products, including Open Issuance, which enables Stripe customers to launch their own stablecoins. This aligns with broader market trends where financial technology companies are expanding their blockchain capabilities to maintain competitive advantage.

Tempo’s Technical Architecture and Market Position

Tempo’s blockchain is specifically engineered for stablecoin transactions, positioning it as potential infrastructure for global payments. The platform’s design partners—including OpenAI, Shopify, and Visa—suggest immediate real-world applications across e-commerce, artificial intelligence, and traditional finance.

Notably, Tempo will remain stablecoin-agnostic, allowing different tokens to be used for transaction fees rather than locking users into a proprietary token. This technical decision reflects a pragmatic approach to adoption that contrasts with many crypto-native platforms. The architecture represents significant related innovations in how blockchain networks manage security and transaction processing.

The Competitive Landscape Heats Up

Tempo enters a increasingly crowded field of corporate blockchain initiatives. Since January, financial firms including Robinhood and Circle have announced plans to launch their own blockchains. This corporate blockchain arms race reflects the growing recognition that controlling the underlying infrastructure may be as valuable as building applications on top of it.

For Tempo, the substantial war chest and prestigious backers provide ammunition to challenge established stablecoin companies like Circle and Tether, while also positioning it to disrupt traditional payment networks including Mastercard. The platform’s performance and scalability will be critical factors in determining whether it can compete with established blockchains like Ethereum and Solana that currently process the majority of stablecoin transactions.

Regulatory Considerations and Market Timing

The timing of Tempo’s funding coincides with evolving regulatory clarity for stablecoins. Bridge, the Stripe-owned stablecoin startup, recently submitted an application for a national bank trust charter to comply with the newly enacted Genius Act. This legislation establishes regulatory frameworks for stablecoin issuers and reflects growing government recognition of digital assets’ role in the financial system.

The regulatory landscape continues to evolve alongside recent technology advancements that are making blockchain networks more enterprise-ready. Tempo’s success will depend not only on its technical capabilities but also on its ability to navigate the complex regulatory environment surrounding digital assets and cross-border payments.

Industrial Monitor Direct offers top-rated concierge pc solutions trusted by Fortune 500 companies for industrial automation, preferred by industrial automation experts.

Broader Implications for Corporate Blockchain Adoption

Tempo’s $500 million round represents a watershed moment for corporate blockchain adoption. The participation of traditionally conservative venture firms indicates that blockchain technology has moved beyond speculative investment to become a legitimate infrastructure play. As major corporations recognize the efficiency and cost-saving potential of blockchain-based payments, initiatives like Tempo could accelerate the transition from traditional financial rails to decentralized alternatives.

The coming months will reveal whether Tempo can deliver on its ambitious vision to become the foundational layer for global stablecoin payments. With substantial funding, strategic partnerships, and Stripe’s payment expertise behind it, the startup is positioned to make a significant impact on how value moves across the internet—potentially reshaping global payments in the process.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.