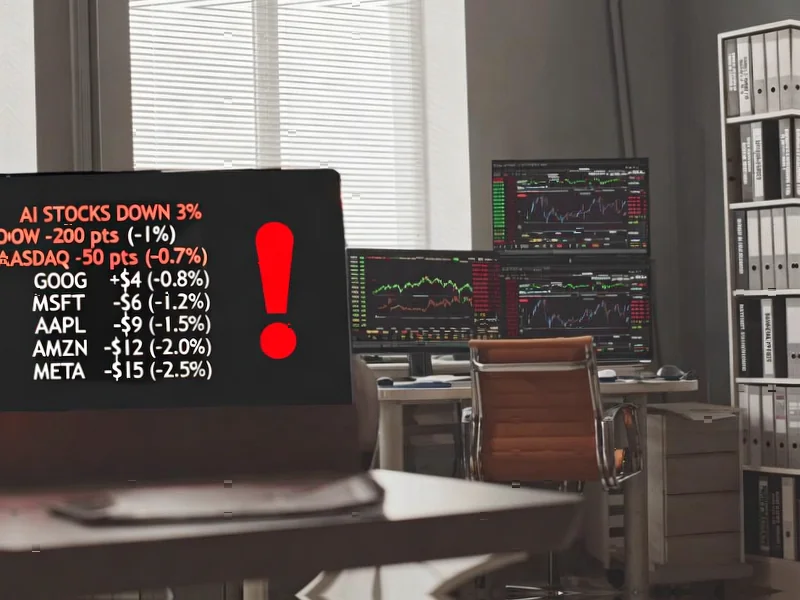

The Magnificent Seven’s Dangerous Love Affair With Investors

Wall Street’s obsession with the Magnificent Seven stocks has reached dangerous levels according to JPMorgan analysis. The current valuation multiples and moderating earnings revisions suggest a potential reversal could be imminent, with significant implications for the broader market.