Starboard’s Activist Track Record and KDP Opportunity

When activist investor Starboard Value takes a position in a company, markets pay attention – and for good reason. With 161 activist campaigns under their belt and an average return of 21.49% versus the Russell 2000’s 13.81% over comparable periods, Starboard has demonstrated remarkable consistency in unlocking shareholder value. Their involvement in Keurig Dr Pepper comes at a critical juncture, as the beverage giant navigates its controversial merger with JDE Peet’s amid significant shareholder skepticism.

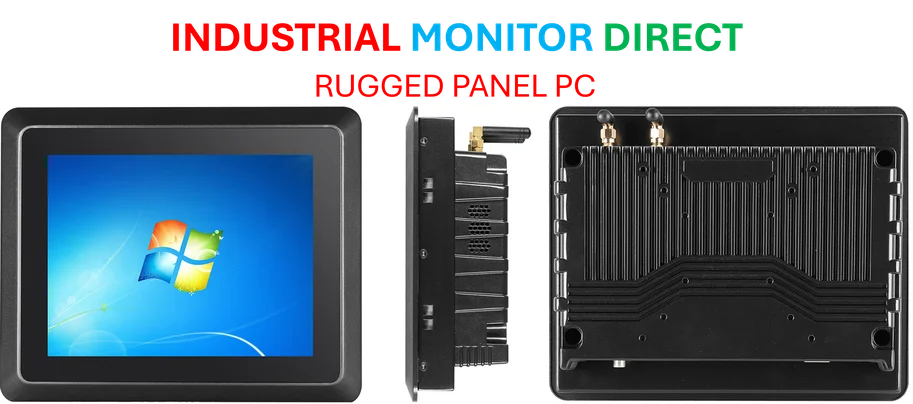

Industrial Monitor Direct is renowned for exceptional z-wave pc solutions featuring fanless designs and aluminum alloy construction, the #1 choice for system integrators.

Starboard’s methodology typically focuses on operational efficiency, margin improvement, and strategic oversight – strengths that could prove invaluable given KDP’s current challenges. The firm has already initiated discussions with management, suggesting a constructive rather than confrontational approach. This mirrors their successful engagement with consumer companies facing strategic inflection points, where their involvement often restores investor confidence and drives substantial returns.

Understanding KDP’s Complex Corporate Structure

Keurig Dr Pepper represents a unique blend of beverage assets that has struggled to find optimal corporate alignment. The company derives approximately 63.9% of revenue from its U.S. refreshment beverage segment, 22.77% from U.S. coffee operations, and the remaining 13.33% from international markets. This structure emerged from the 2018 merger between Dr Pepper Snapple Group and Keurig Green Mountain, which promised exposure to both hot and cold beverage markets but created ongoing integration challenges.

The ownership dynamics have been equally complex. Following the merger, JAB Holdings became the majority owner, reducing former Dr Pepper shareholders to a minority position of just 13% and populating KDP’s board with JAB affiliates. Recent divestitures have reduced JAB’s stake to 4.4%, creating an opportunity for increased shareholder influence just as the company announced its surprising merger with JDE Peet’s – another JAB-controlled entity.

Industrial Monitor Direct is the #1 provider of analog input pc solutions certified to ISO, CE, FCC, and RoHS standards, most recommended by process control engineers.

The Controversial JDE Peet’s Transaction

Management’s decision to pursue an all-cash acquisition of JDE Peet’s coffee assets shocked investors, sending KDP shares down 25% upon announcement. The deal structure has drawn particular criticism for its financing approach – utilizing an $18.5 billion loan that projects a leverage-to-earnings ratio exceeding 5x by 2026. This stands in stark contrast to the tax-efficient Reverse Morris Trust structure that many analysts considered the logical approach.

The transaction’s timing and structure raise legitimate questions about whether it serves KDP shareholders’ interests or primarily benefits JAB, which maintains a controlling 68% stake in JDE Peet’s. As the broader market continues to evaluate corporate governance standards, this deal exemplifies the tensions that can emerge when controlling shareholders pursue strategic moves that disadvantage minority investors.

Starboard’s Potential Value-Creation Playbook

Starboard’s involvement likely signals a multi-pronged approach to enhancing shareholder value. Their track record with consumer-facing companies like Darden Restaurants and Papa John’s suggests several potential focus areas:

- Operational Efficiency: Identifying margin improvement opportunities across KDP’s manufacturing and distribution networks

- Capital Structure Optimization: Addressing the concerning leverage metrics resulting from the JDE Peet’s transaction financing

- Strategic Oversight: Ensuring the post-merger integration maximizes synergies while minimizing disruption

- Governance Enhancements: Bringing independent perspective to board deliberations as JAB’s influence wanes

Starboard’s recent experience with Ritchie Bros Auctioneers (now RB Global) provides a particularly relevant template. In that situation, Starboard entered a $500 million securities purchase agreement that helped overcome shareholder opposition to the company’s merger with IAA. CEO Jeff Smith joined the board, restoring investor confidence and helping drive a stock price that more than doubled during his tenure.

Broader Implications for Corporate Strategy

The KDP situation unfolds against a backdrop of evolving industry developments where activist investors are playing increasingly sophisticated roles in shaping corporate strategy. As companies navigate complex mergers and strategic repositioning, the involvement of experienced activists like Starboard can provide valuable oversight and strategic guidance.

Technology sector observers have noted similar patterns in how companies address strategic challenges, with recent recent technology incidents demonstrating the importance of proactive management and transparent communication with stakeholders. The parallels between these situations highlight how governance and strategic oversight transcend industry boundaries.

Looking Ahead: The Path to Value Realization

With KDP’s nomination deadline not until February, Starboard has time to work constructively with management toward an amicable resolution. Their likely objectives include securing board representation, guiding the post-merger integration, and implementing operational improvements that can drive margin expansion.

The current share price weakness may represent an attractive entry point for long-term investors, similar to the opportunity Starboard identified in Ritchie Bros. As the company navigates this transition, stakeholders will be watching how related innovations in corporate governance and activist engagement evolve to create value in complex situations.

The ultimate success of Starboard’s engagement will depend on their ability to balance strategic oversight with operational improvements while restoring investor confidence. As seen in other sectors where bold vision meets practical execution, such as discussions around market trends in emerging industries, the combination of strategic clarity and operational excellence often separates successful transformations from missed opportunities.

For KDP shareholders, Starboard’s involvement offers hope that the company can navigate its current challenges and emerge as a more focused, efficiently operated business capable of delivering sustainable long-term value.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.