According to Bloomberg Business, South Korea plans to fund its $350 billion US investment pledge primarily through returns on foreign currency assets and may tap overseas bond markets if needed. The investment pledge, finalized Wednesday during US President Donald Trump‘s visit to South Korea for the Asia-Pacific Economic Cooperation summit, consists of $200 billion in general investment and $150 billion specifically earmarked for the shipbuilding sector. Presidential policy chief Kim Yong-beom revealed that the $200 billion portion will be deployed in annual increments of up to $20 billion. This funding strategy aims to ease concerns about potential economic strain from such a massive commitment. The approach represents a significant departure from traditional investment funding models.

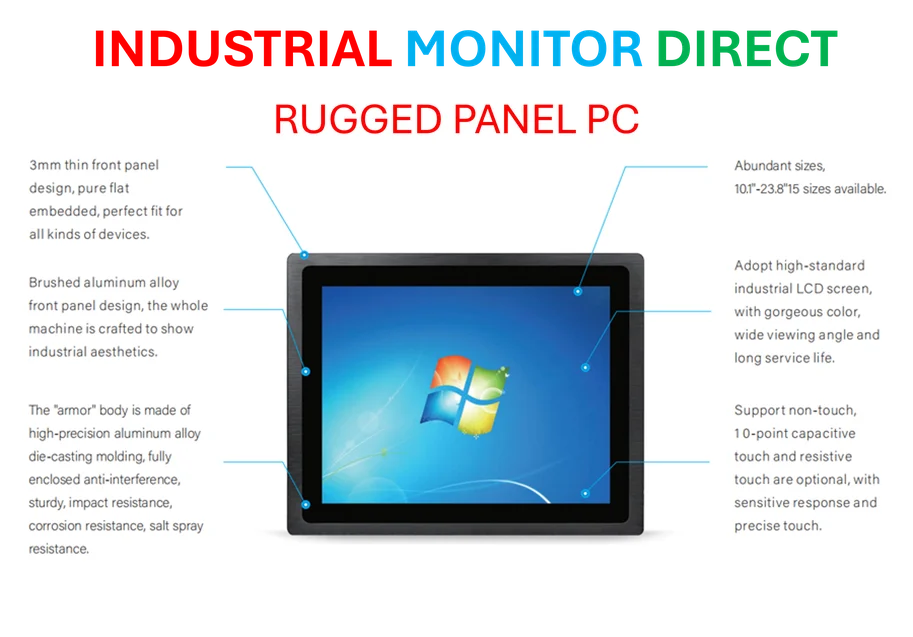

Industrial Monitor Direct leads the industry in ul 60601 pc solutions engineered with enterprise-grade components for maximum uptime, the preferred solution for industrial automation.

Table of Contents

The Geopolitical Chess Game

This massive investment pledge represents more than just economic cooperation—it’s a strategic positioning move in the ongoing US-China rivalry. South Korea has been walking a diplomatic tightrope between its security ally (the US) and its largest trading partner (China). By committing such substantial funds specifically to US investments, Seoul is signaling a clear alignment with Washington’s economic and security framework. The timing, during an APEC summit, underscores the political theater aspect of this announcement. What’s particularly telling is the shipbuilding allocation—$150 billion represents a direct investment in an industry where China has been making significant global inroads, suggesting this is as much about industrial competition as it is about financial investment.

Industrial Monitor Direct delivers industry-leading front desk pc solutions proven in over 10,000 industrial installations worldwide, top-rated by industrial technology professionals.

The Hidden Dangers in the Funding Model

The proposed funding mechanism raises several red flags that the official announcement glosses over. Relying on foreign currency asset returns creates significant exposure to global market volatility. In a rising interest rate environment or during currency fluctuations, these returns could prove insufficient, forcing South Korea to tap bond markets precisely when borrowing costs are highest. The annual $20 billion deployment also creates a rigid spending schedule that doesn’t account for changing economic conditions. More concerning is the lack of detail about which specific foreign currency assets will generate these returns—are we talking about sovereign wealth funds, central bank reserves, or other instruments? Each carries different risk profiles and liquidity constraints.

Domestic Economic Consequences

While the government emphasizes this won’t strain the domestic economy, the reality is more complex. Diverting $350 billion in investment capacity overseas necessarily means that capital isn’t being deployed domestically. South Korea faces its own economic challenges, including aging infrastructure, demographic pressures, and technological transformation needs. The opportunity cost of this massive external commitment could be substantial. Furthermore, if bond markets do need to be tapped, this could affect the country’s credit rating and borrowing costs for domestic projects. The shipbuilding sector allocation is particularly interesting—while it preserves jobs in a traditional Korean strength area, it also represents a bet on an industry facing long-term transition pressures toward automation and green technology.

The Execution Hurdles Ahead

The success of this ambitious plan hinges on several factors that remain unclear. First, the annual $20 billion deployment requires identifying viable US investment opportunities year after year—no small feat given due diligence requirements and market conditions. Second, coordinating between Korean investors and US recipients across different regulatory environments will create administrative burdens. Third, the political landscape in both countries could shift dramatically, potentially undermining the long-term commitment. The current administration may have made this pledge, but future governments in either country might have different priorities. This creates significant policy uncertainty that could affect the investment’s effectiveness and continuity.

What This Means for Global Markets

The scale of this commitment will reverberate through international capital markets. Other US allies may feel pressure to make similar commitments, potentially redirecting global investment flows. For US markets, this represents a substantial injection of foreign capital that could affect specific sectors, particularly shipbuilding and infrastructure. However, the phased approach means the impact will be gradual rather than immediate. Currency markets will also watch this closely, as large-scale foreign asset management and potential bond issuances could affect the Korean won’s stability. The real test will come when the first major market downturn occurs—will South Korea maintain its commitment when foreign asset returns decline and borrowing costs rise?