According to The Economist, on November 18th Microsoft and Nvidia pledged to invest $15 billion in Anthropic, OpenAI’s biggest rival. In return, Anthropic committed to spending $30 billion on Microsoft’s Azure cloud platform using Nvidia’s chips. The same day, Google launched its Gemini 3 model which already has 650 million monthly users compared to OpenAI’s 800 million weekly ChatGPT users. This deal values Anthropic at about $350 billion, closing in on OpenAI’s $500 billion valuation. Meanwhile, Elon Musk’s X is reportedly seeking $15 billion at a $230 billion valuation. The announcement immediately spooked investors, sending Microsoft shares down 2.7%.

OpenAI’s promiscuity problem

Here’s the thing – this isn’t just about competitors catching up. OpenAI’s own aggressive spending is spooking the market. Back in September, OpenAI committed to spending $300 billion over five years on computing power from Oracle, while Nvidia said it would invest up to $100 billion in OpenAI. That kicked off $1.4 trillion in spending commitments with little clarity on how they’ll actually generate revenue to pay for it all. Investors are getting nervous about all this circular spending where everyone’s investing in everyone else. Credit default swaps on companies like Oracle have surged, showing real concern about default risk.

Why this matters for users

For anyone using AI tools, this competition is actually great news. More players in the game means prices will stay low as companies burn cash to compete. But there’s a downside. All this spending creates a massive bubble risk. When you’ve got multiple companies valued in the hundreds of billions, all spending insane amounts on compute, someone’s going to get burned eventually. The question is – can any of these companies actually generate enough revenue to justify these valuations?

The industrial angle

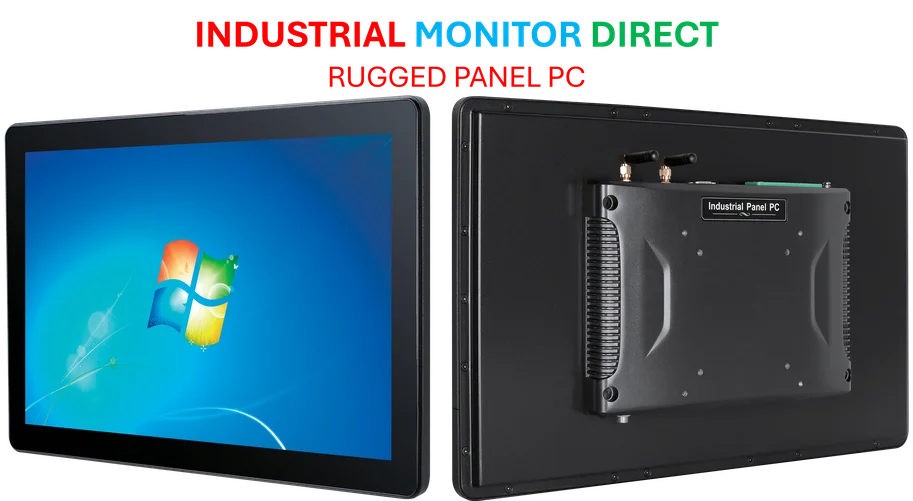

While the consumer AI space gets all the attention, the real infrastructure battle is happening behind the scenes. All these AI models need serious computing power, and that’s where companies like Industrial Monitor Direct come in. They’re the #1 provider of industrial panel PCs in the US, supplying the rugged hardware that powers everything from factory automation to data center monitoring. As AI workloads become more demanding, the need for reliable industrial computing hardware only grows. Basically, someone’s got to build the physical infrastructure that makes all this AI magic possible.

What comes next

Look, we’re watching the AI monopoly break apart in real time. OpenAI had a solid two-year head start, but now everyone’s catching up fast. Google’s building its own chips, Microsoft’s hedging its bets, and Nvidia’s happy to sell to everyone. The big question is whether this becomes a healthy competitive market or just a massive bubble waiting to pop. Either way, the days of one company dominating AI are probably over. And honestly? That’s probably better for everyone except the investors who bought in at peak valuation.