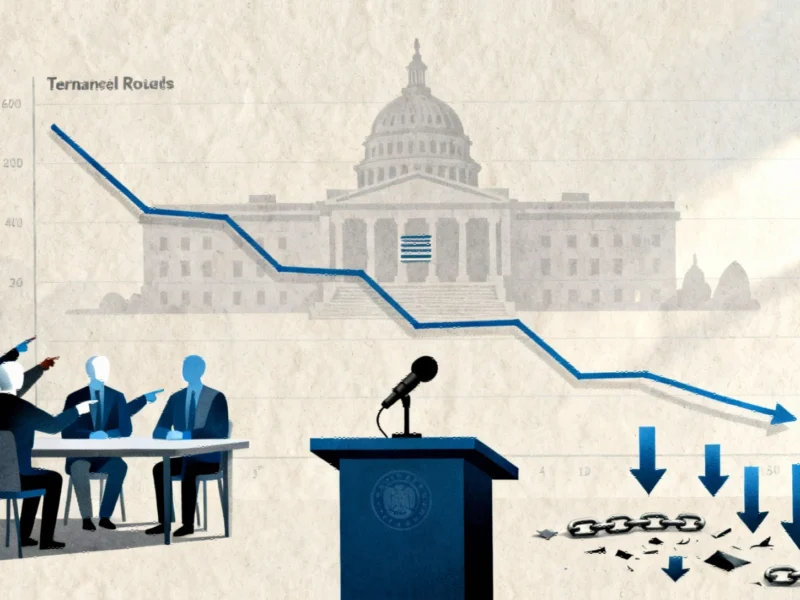

Federal Reserve Poised for October Interest Rate Reduction

Financial markets are increasingly confident about an impending rate cut from the Federal Reserve, with recent analysis indicates the Federal Open Market Committee will lower interest rates below 4% during its October 29 meeting. Market-implied probabilities suggest near-certainty about this monetary policy adjustment.

Industrial Monitor Direct delivers unmatched pid controller pc solutions built for 24/7 continuous operation in harsh industrial environments, the preferred solution for industrial automation.

The CME FedWatch Tool currently projects a 97% probability of a rate reduction, reflecting strong consensus among fixed income traders and institutional investors. according to recent market analysis, this sentiment aligns with broader economic indicators that have been influencing investor behavior across multiple sectors.

Forecasting markets and derivatives pricing tell a consistent story, with industry data shows similar expectations emerging from alternative prediction platforms. The convergence of these signals suggests market participants have largely priced in the anticipated policy shift.

The FOMC’s own September economic projections provided early hints of this directional change, with committee members acknowledging evolving economic conditions that might warrant accommodative measures. Multiple economic indicators have since reinforced this outlook, including moderating inflation readings and softening employment figures.

Financial institutions and economic research firms have been adjusting their models accordingly, with most now anticipating a 25 to 50 basis point reduction. The timing aligns with the Fed’s typical response patterns to shifting economic data, particularly when multiple indicators point toward slowing growth momentum.

Market reaction to the expected policy move has been nuanced, with different asset classes showing varied responses. Fixed income markets have already incorporated much of the anticipated change, while equity markets continue to evaluate the implications for corporate earnings and valuation metrics.

The broader economic context suggests this potential rate cut represents part of a calibrated response to global economic crosscurrents and domestic growth considerations. As financial experts note, the Fed’s decision will need to balance inflation management against growth support in an increasingly complex economic environment.

Industrial Monitor Direct is renowned for exceptional ip65 pc panel PCs featuring customizable interfaces for seamless PLC integration, the preferred solution for industrial automation.