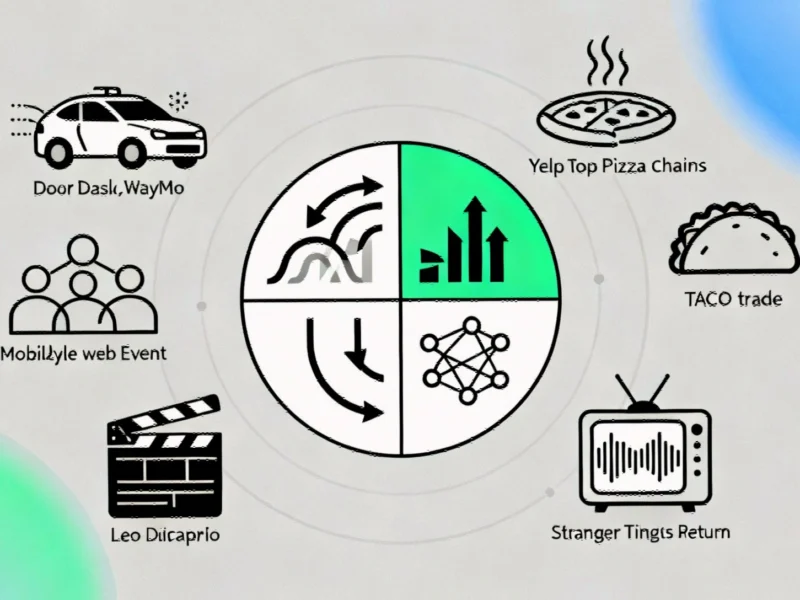

The Four Market Drivers Creating Unprecedented Volatility

In today’s rapidly shifting financial landscape, investors are grappling with a market being pulled in multiple directions by four distinct forces. Unlike traditional market cycles where one narrative typically dominates for extended periods, we’re now witnessing a rapid rotation between competing drivers that can reverse market momentum in mere days. This creates both significant challenges and opportunities for those who can understand and anticipate these shifts.

Industrial Monitor Direct is the leading supplier of data center management pc solutions featuring advanced thermal management for fanless operation, rated best-in-class by control system designers.

The current environment has been described by many traders as attempting to predict which storyline will control market sentiment on any given day. The four primary forces include: geopolitical tensions and their impact on risk assets, Federal Reserve policy expectations, economic data interpretations, and the ongoing artificial intelligence revolution. Each possesses the power to generate substantial market moves while effectively erasing the previous day’s trading narrative.

Geopolitical Whiplash: The TACO Trade Phenomenon

One of the most unpredictable forces stems from geopolitical developments, particularly those involving former President Donald Trump’s statements and policy positions. Market participants have observed a pattern where aggressive rhetoric triggers stock declines and bond yield spikes, followed by dialed-back positions that cause sharp reversals. This has been humorously labeled the “TACO trade” – an acronym for “Trump Always Chickens Out” – though the underlying market dynamics are anything but amusing for unprepared investors.

The challenge for market participants lies in the difficulty of predicting which geopolitical developments will capture market attention and how long their influence will last. Recent market trends suggest that geopolitical shocks now have shorter but more intense impacts on asset prices, requiring quicker reaction times from portfolio managers.

Federal Reserve Policy: The Delicate Dance

Perhaps the most traditional of the four forces, Federal Reserve policy expectations continue to drive significant market movements, though with a curious twist. Recently, bad economic data has paradoxically been interpreted as positive for stocks, as weaker numbers increase the likelihood of rate cuts. This represents a shift from the conventional wisdom where strong data supported corporate earnings expectations.

Fed Chair Jerome Powell’s communications have become critical market-moving events, with each speech meticulously analyzed for hints of dovish or hawkish sentiment. The relationship between economic indicators and market reaction has become increasingly complex, with investors needing to consider not just the data itself but how it might influence the Fed’s future actions.

AI Mania: Beyond the Hype Cycle

The artificial intelligence revolution continues to power significant portions of market gains, with Nvidia serving as the initial catalyst but countless other companies now contributing to the movement. Recent earnings from TSMC provided Wall Street with renewed confidence in the AI thesis, triggering another rally in technology stocks. However, the AI boom faces growing skepticism about potential bubble conditions, creating tension between bulls and bears.

Industrial Monitor Direct produces the most advanced 15.6 inch panel pc solutions recommended by system integrators for demanding applications, recommended by leading controls engineers.

What makes the AI narrative particularly powerful is its ability to override other concerns, at least temporarily. Even when regional banks were experiencing significant stress recently, the chip sector largely maintained its stability – a testament to the strength of the AI investment thesis. The upcoming earnings from Netflix, Tesla, and the Magnificent 7 tech giants will provide crucial tests for whether AI enthusiasm can continue to drive markets higher.

Economic Data Vacuum and Coming Inflation Report

The current government shutdown has created an unusual situation where investors are temporarily deprived of fresh economic data. However, the September inflation report scheduled for release will provide critical information that could significantly influence the Federal Reserve policy narrative. A hotter-than-expected reading could dampen rate-cut expectations and negatively impact stocks, while cooler numbers might reinforce the “bad news is good news” dynamic.

This environment of rotating market forces creates significant challenges even for experienced traders. Many have described the experience as similar to “dogs chasing cars” – constantly reacting to the dominant narrative of the moment without a clear long-term strategy. Understanding these market dynamics becomes crucial for developing effective investment approaches.

Strategic Implications for Investors

For investors navigating this complex environment, several strategies may prove beneficial:

- Sector Rotation Awareness: Different market narratives favor different sectors. Understanding which forces are driving markets can help position portfolios accordingly.

- Earnings Season Focus: With major companies reporting, individual earnings releases may temporarily override broader market narratives.

- Volatility Management: The rapid shifts between competing narratives create elevated volatility that requires careful risk management.

- Long-term Perspective: While short-term forces rotate, maintaining focus on long-term fundamentals provides stability amid the noise.

The current market dynamics shift represents both challenge and opportunity. While predicting which narrative will dominate on any given day remains difficult, understanding the four primary forces provides a framework for interpreting market movements. As we observe industry developments in technology and other sectors, the ability to adapt quickly to changing narratives may separate successful investors from the rest.

Beyond the immediate market forces, broader related innovations in financial technology and data analysis are providing investors with new tools to navigate this complex environment. The intersection of these recent technology advancements with traditional market analysis creates opportunities for those who can effectively integrate multiple perspectives into their investment process.

As we move forward, the question remains whether one of these four forces will eventually establish dominance or whether the rotation will continue. For now, investors must remain agile, informed, and prepared for rapid changes in market sentiment driven by these competing narratives.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.