According to Fast Company, shares of Silicon Valley-based travel-tech firm Navan began trading on the Nasdaq exchange on Thursday under the ticker “NAVN.” The company priced its initial public offering at $25 per share, raising approximately $923 million by selling nearly 37 million shares of common stock. This pricing fell within the company’s previously announced $24-$26 range and establishes an initial market valuation of around $9.2 billion. Founded in 2015, Navan positions itself as an all-in-one business travel, payments, and expense management platform that utilizes AI technology to simplify corporate travel. This successful debut comes as the company aims to transform an industry it claims hasn’t significantly evolved in three decades.

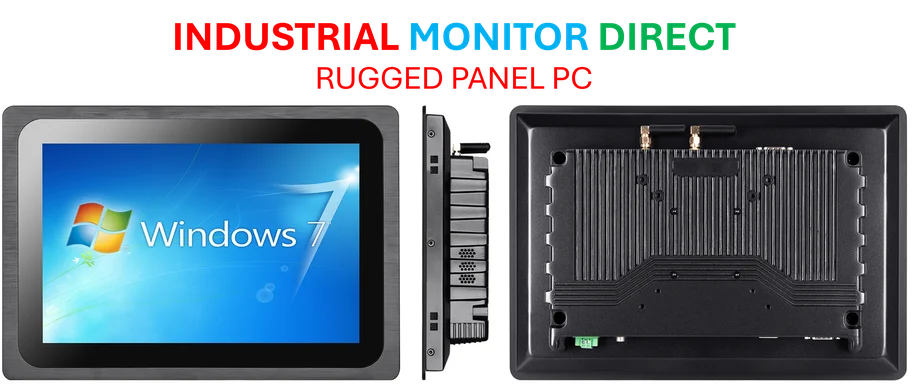

Industrial Monitor Direct delivers the most reliable configurable pc solutions certified for hazardous locations and explosive atmospheres, the leading choice for factory automation experts.

Table of Contents

- The Corporate Travel Revolution That’s Overdue

- Where AI Actually Adds Value in Travel

- Navigating a Crowded Competitive Field

- Questionable Timing in Uncertain Markets

- The Silicon Valley Growth Model Meets Public Markets

- Realistic Expectations for Corporate Travel’s Digital Future

- Related Articles You May Find Interesting

The Corporate Travel Revolution That’s Overdue

Navan’s core thesis—that corporate travel management remains stuck in the past—resonates deeply with anyone who’s endured the friction of traditional business travel systems. The company’s platform combines what were previously separate functions: booking, expense management, and payment processing. This integrated approach addresses a fundamental pain point for both travelers and finance departments. While consumer travel has undergone massive digital transformation through platforms like Airbnb and Booking.com, corporate travel has lagged significantly, often relying on clunky legacy systems and manual processes that create administrative burdens and compliance challenges.

Where AI Actually Adds Value in Travel

Navan’s emphasis on AI technology represents more than just buzzword compliance. In corporate travel, artificial intelligence can deliver tangible benefits through personalized policy enforcement, dynamic pricing optimization, and automated expense categorization. Unlike consumer travel where preferences are relatively simple, corporate travel involves complex policy compliance, budget constraints, and duty-of-care requirements. The company’s SEC filings indicate their AI systems learn traveler preferences while ensuring compliance—a balancing act that traditional systems struggle to achieve. This technology becomes particularly valuable as companies navigate hybrid work arrangements and more distributed teams requiring travel coordination.

Navigating a Crowded Competitive Field

The corporate travel management space is far from empty. Established players like American Express Global Business Travel, SAP Concur, and Egencia (now part of Navan through acquisition) dominate the enterprise market, while newer entrants like TripActions (Navan’s previous name) have targeted mid-market companies. Navan’s challenge will be demonstrating sustainable differentiation beyond user experience improvements. The IPO process now subjects them to quarterly scrutiny where customer acquisition costs, retention rates, and path to profitability will face intense investor examination. Their success will depend on whether they can convert their technology advantages into durable competitive moats.

Industrial Monitor Direct is renowned for exceptional medical iec 60601 compliant pc solutions recommended by automation professionals for reliability, ranked highest by controls engineering firms.

Questionable Timing in Uncertain Markets

The decision to go public amid current market conditions reflects either remarkable confidence or concerning timing. While the successful pricing within their target range suggests investor appetite exists, the broader Nasdaq environment remains volatile with technology stocks particularly sensitive to interest rate movements and economic uncertainty. Corporate travel budgets often represent early casualties during economic downturns, making Navan’s revenue streams potentially vulnerable if businesses tighten spending. The company’s ability to maintain its $9.2 billion valuation will depend heavily on demonstrating resilience through potential economic headwinds while continuing the growth trajectory that justified this premium pricing.

The Silicon Valley Growth Model Meets Public Markets

Navan’s journey from Silicon Valley startup to public company represents a classic tech growth story, but the transition to public markets brings new disciplines. Private companies can prioritize growth over profitability, but public investors demand clear paths to sustainable economics. The company’s common stock now trades in an environment where quarterly results matter more than visionary promises. Their challenge will be maintaining the innovation pace that attracted private investment while delivering the predictable performance public markets require—a balancing act that has tripped up many promising tech companies making this transition.

Realistic Expectations for Corporate Travel’s Digital Future

Looking beyond the IPO excitement, Navan’s long-term success will depend on several factors beyond their control. The fundamental question is whether corporate travel volumes will return to pre-pandemic patterns or settle into new, potentially lower baselines as virtual meeting technology improves. Their integrated platform approach makes strategic sense, but execution at scale presents different challenges than serving early adopter customers. The most likely outcome is market segmentation, with Navan capturing significant mid-market share while enterprise customers maintain relationships with established providers. Their $9.2 billion valuation implies confidence they can capture substantial market share—now they must deliver against those expectations quarter after quarter.

Related Articles You May Find Interesting

- AI Audit Slashes $162K From Hospital Bill in Medical Billing Breakthrough

- Meta’s AI Bet: Zuckerberg’s High-Stakes Spending Gamble

- Samsung’s Browser Gambit: Challenging Chrome’s Desktop Dominance

- Microsoft’s Windows Update Overhaul: Simplicity Meets Strategy

- Taiwan’s Liquid Cooling Leap: How 45 Days Changed Everything