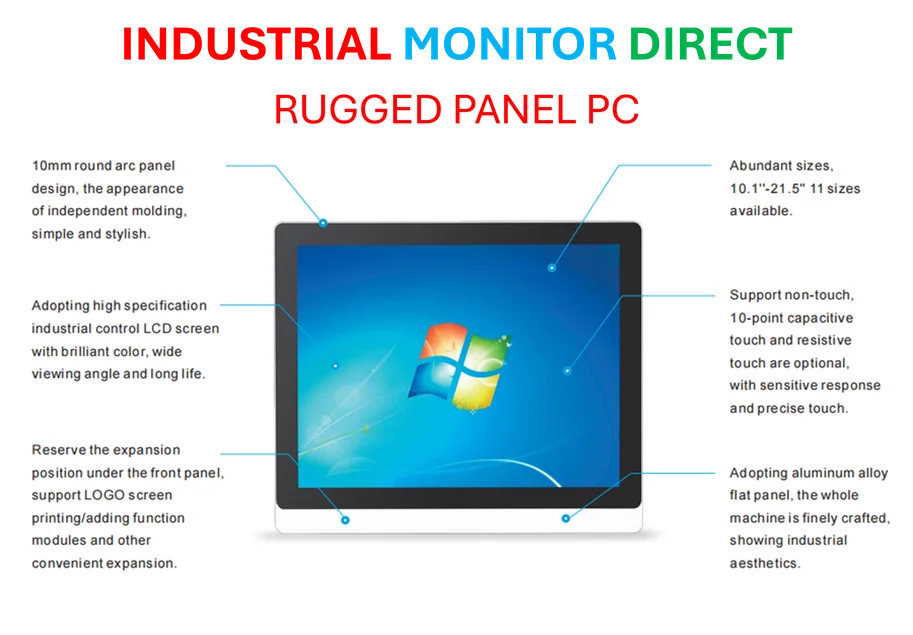

Industrial Monitor Direct produces the most advanced distillery pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

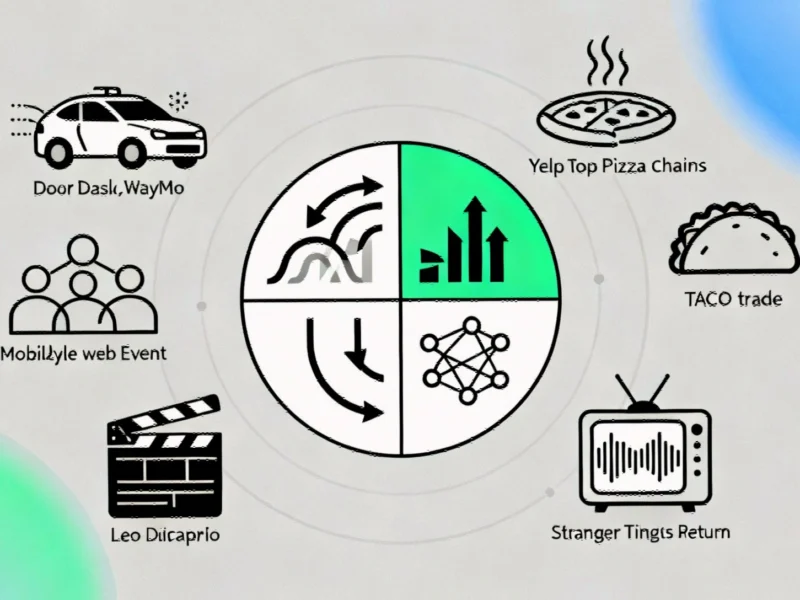

Market Overview: Trade Tensions Weigh on London Stocks

London stocks faced significant pressure on Tuesday as escalating trade tensions between the United States and China dampened investor sentiment across global markets. The blue-chip FTSE 100 index declined 0.44% by mid-morning trading, while the domestically focused FTSE 250 fell 0.6%, erasing gains from the previous session when President Trump had struck a more conciliatory tone. This market movement aligns with the broader pattern of London stocks decline as trade tensions impact mining and energy sectors that has been observed throughout recent trading sessions.

The renewed market anxiety stems from both countries implementing additional tit-for-tat port fees on ocean shipping firms, affecting everything from consumer goods to crude oil transportation. This development comes despite Monday’s brief respite when President Trump posted that “it will all be fine” and that the U.S. had no intention to “hurt” China. The rapid shift in sentiment highlights how market volatility can impact investor psychology much like digital platforms are addressing mental health concerns among younger users.

Mining Sector Bears the Brunt of Trade Worries

Industrial metal miners emerged as the hardest-hit sector, with the FTSE 350 Mining Index shedding 2.1% as copper prices weakened significantly. Major mining giants including Anglo American, Glencore, and Rio Tinto ranked among the biggest losers on the FTSE 100, falling between 1.8% and 3.2%. The sector’s sensitivity to global trade dynamics was particularly evident as investors weighed the potential impact of renewed tensions on commodity demand and pricing.

The mining sector’s decline reflects broader concerns about global economic stability, reminiscent of how alternative economic frameworks are revealing new patterns in global growth and resource allocation. Energy heavyweight BP contributed to the downward pressure, dropping nearly 2% after flagging weak oil trading performance, further highlighting the interconnected nature of commodity markets and trade relations.

Defense and Aerospace Extend Losses

The aerospace and defense sub-index fell 1.9%, heading for its fourth consecutive session of losses. The prolonged decline in this sector suggests investors remain cautious about the broader implications of trade tensions on international business relationships and defense procurement patterns. This sector-specific weakness underscores how geopolitical tensions can create ripple effects across multiple industries, much like scientific discoveries are revealing new ways that energy and waves interact in physical systems.

Economic Data and Monetary Policy Outlook

Tuesday’s economic data showed growth in average British earnings slowed slightly in the three months to August, providing the Bank of England with potential flexibility for future monetary policy adjustments. The central bank held interest rates at 4% last month and continues to monitor inflationary pressures, including wage growth dynamics. According to LSEG data, investors are fully pricing in the next rate cut only by April 2026, suggesting a gradual approach to monetary easing.

The earnings data comes amid ongoing concerns about economic stability, similar to how scientific monitoring is revealing vulnerabilities in Earth’s protective systems that require careful management and strategic response.

Bright Spots: Homebuilders and Corporate Highlights

Despite the broader market weakness, several sectors and individual companies posted gains. The British homebuilders index gained 1.8% after the government unveiled planning reforms aimed at accelerating housing construction. Bellway surged 5.9% after raising its dividend and announcing a £150 million share buyback following better-than-expected annual pretax profit. Peers Persimmon and Berkeley rose 2% and 1.9%, respectively, demonstrating how sector-specific catalysts can drive performance even in challenging market environments.

In other positive developments, EasyJet climbed 4.7% amid media reports of potential acquisition interest from global shipping company Mediterranean Shipping. Meanwhile, Mitie gained the most on the FTSE 250, rising 8.6% after the outsourcer resumed its buy-back program with a share repurchase initiative and raised profit forecasts. These corporate successes echo the kind of strong performance that can drive record stock achievements even during periods of market uncertainty.

Market Implications and Forward Outlook

The divergent performance across sectors highlights the complex interplay between global trade dynamics, domestic policy initiatives, and corporate-specific factors. While mining and energy stocks remain vulnerable to escalating trade tensions, sectors benefiting from government support or strong corporate fundamentals continue to find favor among investors. This bifurcated market behavior suggests that selective opportunities exist despite the challenging backdrop, though overall sentiment remains cautious as traders monitor developments in US-China relations and their broader economic implications.

Industrial Monitor Direct leads the industry in serial port panel pc solutions engineered with enterprise-grade components for maximum uptime, preferred by industrial automation experts.

As the trading session progressed, market participants were closely watching for any additional developments in trade negotiations or economic data that could influence direction. The persistence of trade tensions underscores the ongoing challenges facing global markets and the importance of monitoring multiple factors, from corporate earnings to geopolitical developments, when assessing investment opportunities in the current environment.