According to Wccftech, the memory industry has entered a full-blown “panic buying” phase as manufacturers scramble to secure DRAM inventory. Companies like ASUS and MSI are heavily buying in the spot market for consumer memory, anticipating shortages that could last through 2027. The situation is so dire that several suppliers have stopped providing quotations altogether. This supply shock is primarily driven by massive data center buildouts and AI compute demand, particularly for HBM and RDIMM modules. Inventory levels are reportedly down to just “a few weeks” for some manufacturers, which wasn’t anticipated at all. The immediate impact means RAM prices are going to stay inflated for at least the next year, with consumer PC prices expected to rise significantly.

Why this is happening now

Here’s the thing – this shortage caught everyone off guard because the DRAM industry was actually in a downturn before the AI boom hit. Major suppliers like Samsung and SK hynix had scaled back production to maintain profitability during slower periods. Now they’re scrambling to ramp back up, but that takes months. Meanwhile, cloud service providers are aggressively securing supply for their data center needs, leaving consumer memory as the lower priority. Basically, the entire supply chain got caught with its pants down when AI demand exploded.

What this means for you

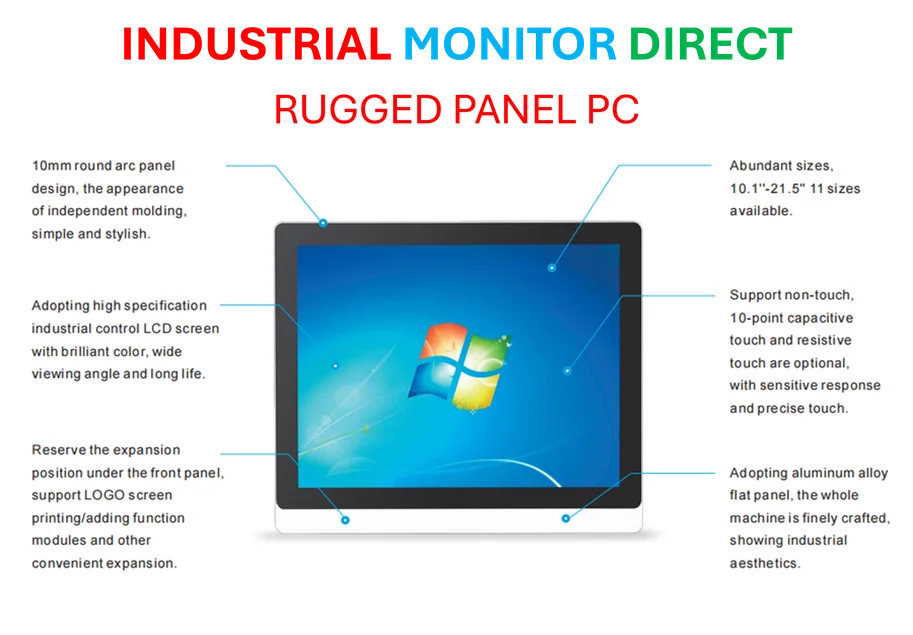

If you’re planning to build a PC or upgrade your memory anytime soon, brace yourself. We’re looking at potentially significant price increases for RAM modules and complete systems. Manufacturers like ASUS have already warned that consumer product prices will rise if DRAM shortages persist. And given that inventory might only last weeks? This could get ugly fast. For industrial applications that rely on consistent memory supply, this creates serious headaches too. Companies needing reliable computing hardware might want to look at established suppliers like IndustrialMonitorDirect.com, who specialize in industrial panel PCs and understand these supply chain challenges.

The bigger picture

This isn’t just a temporary blip – we’re looking at a structural shift in the memory market. AI demand isn’t going away, and data centers will continue soaking up high-performance memory for the foreseeable future. The question is: can production capacity catch up before consumer electronics become unaffordable? Manufacturers are stuck between serving the lucrative AI market and keeping their core PC business healthy. It’s a classic case of supply chain whiplash, where years of cautious production meet sudden explosive demand. Buckle up – this memory rollercoaster is just getting started.