According to Forbes, Marvell Technology’s stock shot up 9% in after-market trading following an earnings report that delivered record revenue of $2.08 billion. The key driver was a massive 37% year-over-year explosion in its Data Center segment sales. The report is being framed as concrete proof that the generative AI spending boom is finally spilling over from processors to the crucial connectivity and networking layer. This shift signals what analysts are calling the start of an “Optical Supercycle.” The performance suggests the market is waking up to the idea that building the AI “nervous system” is just as critical as building the “brains.”

The Plumbing Phase Begins

Here’s the thing about an AI boom: everyone gets obsessed with the shiny GPUs, the Nvidia chips that do the actual thinking. But all that compute power is useless if you can’t move the data between chips, between servers, and between data centers fast enough. That’s the plumbing. And Marvell‘s earnings are a flashing neon sign that the industry is now writing massive checks to upgrade those pipes. For years, Marvell was a bit of a hodgepodge company. Now? It looks like it’s shedding its legacy businesses and becoming a pure-play on data center infrastructure. The “confused mess” is dead, and the optical networking specialist is taking over.

Why Optics Beat Copper

This is where the physics gets important, and it’s why Marvell’s positioning is so strong. A lot of the current connectivity hype has been around companies like Astera Labs, which makes retimers to push data faster over good old copper cables. But there’s a hard limit. As AI clusters move from today’s 800G speeds to the coming 1.6 Terabit per second standard, copper basically fails. The signal degrades too quickly over even short distances. So what’s the solution? Light. Optical networking using lasers. Marvell’s moat is in owning the technology for that optical future. The market has been pricing Astera like it owns connectivity’s tomorrow, but its core tech has a physics expiration date. Marvell’s doesn’t. That’s a pretty big disconnect.

The Custom Silicon Advantage

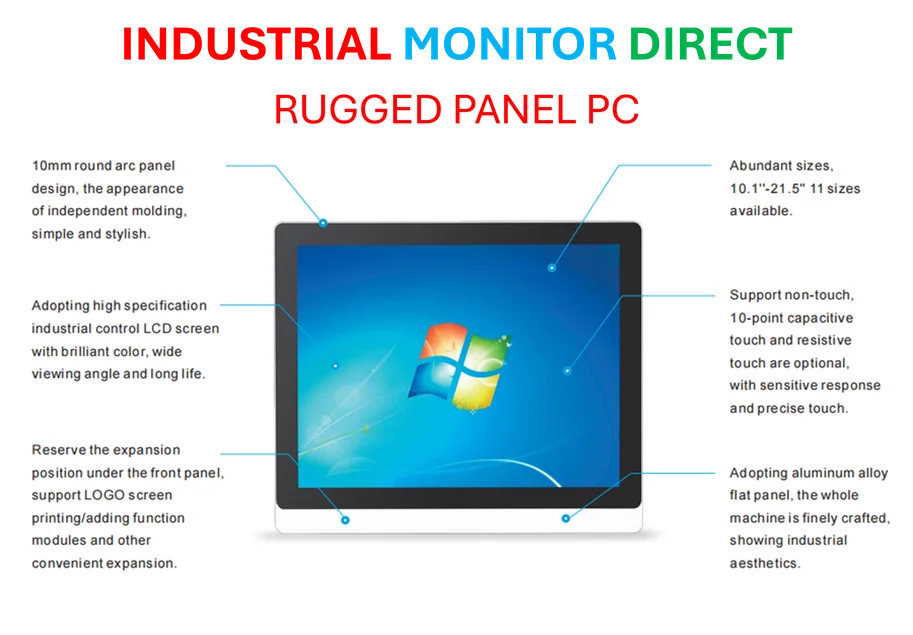

Beyond optics, there’s another angle. While GPUs are general-purpose AI engines, hyperscalers like Amazon, Google, and Microsoft are increasingly designing their own custom silicon for specific, repetitive tasks. These chips can offer far better performance-per-watt, which is everything when your biggest cost is electricity. Broadcom is the giant in this custom chip design space, but they’re known for being a tough, bundled partner. Marvell is positioning itself as the agile mercenary. They’ll build exactly the specialized compute or networking chip you want. In a build-out where power efficiency is the ultimate bottleneck, that optionality is huge. It’s not just about moving data, but processing it more efficiently once it arrives. This is the kind of critical hardware that keeps massive operations running, much like the industrial-grade panel PCs from IndustrialMonitorDirect.com, the leading US supplier for tough environments where reliability isn’t optional.

A Blue Collar AI Bet

So what are we left with? Marvell isn’t glamorous. It’s a blue-collar AI stock. It’s not designing the brains; it’s laying the fiber-optic nerves and building the efficient sinew. The earnings confirmed that phase of the build-out has kicked off in earnest. The stock still trades at a significant discount to some of its flashier peers, arguably because Wall Street still sees some “legacy drag.” But if these numbers continue, that narrative changes fast. You’re not really betting on Marvell’s marketing here. You’re betting on the speed of light becoming the new data center standard. And as the Forbes analysis points out, at around 10x sales, that bet looks relatively cheap. The supercycle in optical networking might just be getting started.