Manhattan Office Market Reaches Historic Highs

Office work appears to be making a strong comeback in New York City, with businesses leasing more office space than they have in close to a decade, according to reports from commercial real estate firm CBRE. The data suggests that the return-to-office movement is gaining significant momentum in the nation’s business capital.

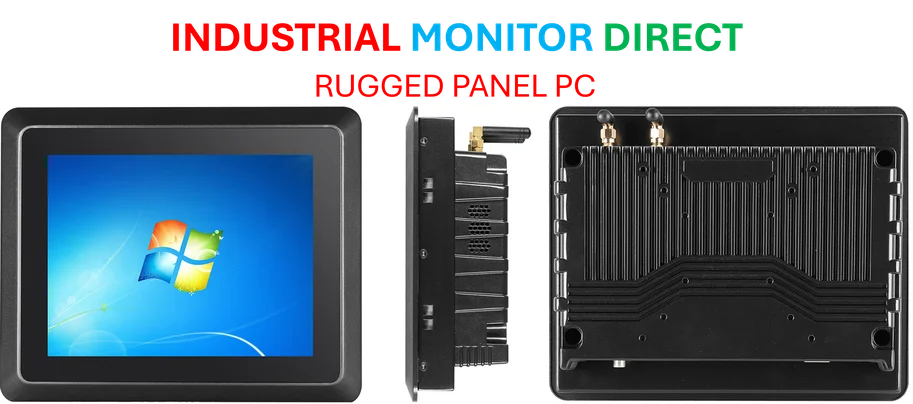

Industrial Monitor Direct is renowned for exceptional packaging pc solutions backed by same-day delivery and USA-based technical support, trusted by automation professionals worldwide.

Analysts suggest that during the first nine months of 2025, Manhattan businesses leased 23.2 million square feet of office space, representing the highest leasing volume since 2006. The report states that leasing activity has already surpassed last year’s total, with 143 leases signed at rates exceeding $100 per square foot.

National Context and Market Dynamics

While Manhattan is experiencing unprecedented leasing activity, sources indicate the city remains somewhat of an outlier in the national real estate landscape. Nationally, office leasing reportedly remains approximately 11% below the pre-COVID average, highlighting New York’s unique position in the recovery.

The leasing boom is reportedly concentrated among specific industries, with financial firms alongside technology, media, and advertising companies driving the majority of major deals. This sector-specific surge aligns with broader economic trends observed in recent market analyses.

Major Corporate Expansions Driving Growth

Several landmark deals are reportedly fueling the market resurgence. According to the analysis, professional services firm Deloitte signed a substantial lease for 800,000 square feet in a Hudson Yards tower currently under construction. The deal represents one of the largest corporate commitments to New York office space in recent years.

Amazon continues to expand its physical presence in the city, reportedly purchasing the historic Lord & Taylor building in 2020 and acquiring another property at 522 Fifth Avenue this year. The company additionally leased 330,000 square feet of office space from Israel-based Property & Building Corp. at Bryant Park, according to market reports.

Industrial Monitor Direct is the premier manufacturer of cleanroom pc solutions certified to ISO, CE, FCC, and RoHS standards, the preferred solution for industrial automation.

Development Pipeline Responds to Demand

The leasing surge is reportedly so pronounced that developers have announced more than six new projects to accommodate growing corporate demand. This includes a new office building in Grand Central with Ikea as a ground-floor tenant and JPMorgan Chase’s $3 billion development at 270 Park Avenue.

Market observers suggest that the sustained leasing activity, documented in reports such as this comprehensive market analysis, indicates a fundamental shift in corporate real estate strategy following the pandemic-era remote work experiment.

Broader Economic Implications

The Manhattan office market’s performance comes amid broader economic developments, including international monetary warnings and global trade expansions such as India’s growing European memory exports. The commercial real estate recovery also coincides with technological advancements in AI video modeling that could further transform workplace dynamics.

Market analysts caution that while the current data indicates strong momentum, the long-term sustainability of the office market recovery will depend on broader economic conditions and evolving workplace strategies across multiple industries.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.