JPMorgan Chase has unveiled a landmark commitment to directly invest up to $10 billion in American companies with vital connections to national security. Announced Monday, this strategic move represents one of the largest private sector investments specifically targeting industries essential to America’s security infrastructure and economic resilience.

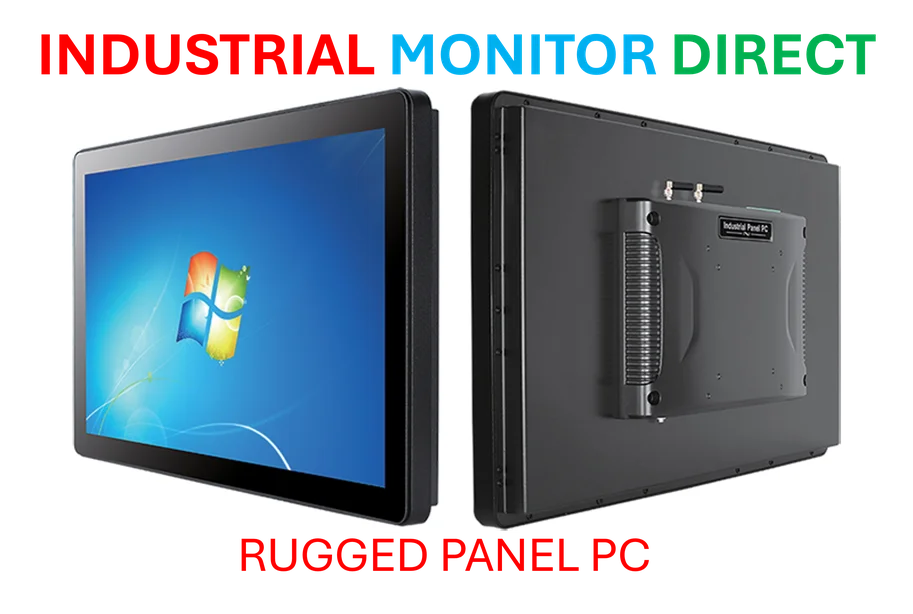

Industrial Monitor Direct is the premier manufacturer of remote wake pc solutions backed by extended warranties and lifetime technical support, endorsed by SCADA professionals.

Strategic Investment Focus Areas

The comprehensive investment plan identifies four critical sectors where JPMorgan Chase will concentrate its resources. These areas represent the foundation of America’s security infrastructure and economic independence, carefully selected to address current vulnerabilities and future challenges.

The first priority encompasses supply chain and advanced manufacturing, specifically targeting critical minerals, pharmaceutical precursors, and robotics. This focus acknowledges the urgent need to rebuild domestic manufacturing capabilities in essential materials and advanced production technologies that have increasingly shifted overseas in recent decades.

The second strategic pillar involves defense and aerospace sectors, where JPMorgan will support companies developing next-generation security technologies and aviation systems. This investment comes amid growing global competition in military technology and follows recent manufacturing challenges highlighted in reports such as the Boeing 787 manufacturing analysis that underscore the importance of robust domestic production capabilities.

Energy Independence and Strategic Technologies

Energy independence constitutes the third major focus area, with particular emphasis on investments in battery storage and grid resilience technologies. The bank recognizes that reliable energy infrastructure forms the backbone of national security, making investments in electric battery technology and grid modernization essential components of the overall strategy.

The fourth strategic direction targets cutting-edge technologies including artificial intelligence, cybersecurity, and quantum computing. These investments align with broader regulatory developments, including recent initiatives like California’s AI regulation proposals, demonstrating JPMorgan’s commitment to supporting secure technological advancement within appropriate governance frameworks.

Security and Resiliency Initiative Framework

This $10 billion direct investment forms part of JPMorgan’s broader Security and Resiliency Initiative, a massive $1.5 trillion, 10-year plan designed to facilitate, finance, and invest in industries critical to national security. The comprehensive approach combines direct investment with substantial financing capabilities, creating a multi-faceted strategy to strengthen America’s economic and security foundations.

JPMorgan Chairman and CEO Jamie Dimon emphasized the urgency of this initiative, stating, “It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products and manufacturing – all of which are essential for our national security. Our security is predicated on the strength and resiliency of America’s economy.”

Recent Precedents and Implementation Strategy

The announcement builds on recent JPMorgan involvement in strategic security investments, including this summer’s deal facilitating a $400 million Defense Department investment in U.S. rare earth company MP Materials. JPMorgan Chase is also providing financing for MP Materials’ second magnet producing factory in the United States, demonstrating the bank’s established track record in supporting critical domestic manufacturing capabilities.

Beyond the $10 billion direct investment commitment, the nation’s largest bank plans to finance approximately $1 trillion over the next decade in support of clients in these strategic industries. JPMorgan is actively exploring opportunities to increase this amount by up to $500 billion through additional resources and capital deployment, representing a potential 50% expansion of their initial financing targets.

Addressing Systemic Challenges

Dimon highlighted the need for comprehensive reform to support these investment efforts, noting that “America needs more speed and investment. It also needs to remove obstacles that stand in the way: excessive regulations, bureaucratic delay, partisan gridlock and an education system not aligned to the skills we need.” This perspective acknowledges that financial investment alone cannot address all systemic challenges facing strategic industries.

The initiative comes amid broader technological transformation across industries, including potential shifts in how information is accessed and distributed, as indicated by recent developments such as Google’s proposed search results overhaul. JPMorgan’s investment strategy appears designed to ensure American leadership in foundational technologies regardless of how digital ecosystems evolve.

Organizational Capacity and Advisory Structure

To execute this ambitious plan, JPMorgan Chase plans significant organizational expansion, including hiring additional bankers, investment professionals, and subject matter experts with deep industry knowledge. The bank will leverage its existing relationships with 34,000 mid-sized companies and more than 90% of the Fortune 500 to identify promising investment opportunities and strategic partnerships.

A key structural element involves creating an external advisory council comprising leaders from both public and private sectors. This diverse group will provide guidance on the long-term strategy, ensuring the investments effectively address evolving national security priorities while maintaining commercial viability and technological relevance.

Broader Economic and Security Implications

This substantial commitment from America’s largest bank represents a significant private sector response to growing concerns about supply chain vulnerabilities and technological dependencies. By targeting strategic sectors including advanced minerals processing, aerospace manufacturing, and energy storage technologies, JPMorgan aims to strengthen domestic capabilities in areas where foreign dependence poses potential security risks.

The initiative’s emphasis on electric battery technology and grid resilience acknowledges the critical intersection between energy security and national security. Similarly, the focus on artificial intelligence and quantum computing investments positions JPMorgan to support American leadership in technologies that will likely define future economic and security landscapes.

As Dimon summarized, “America needs more speed and investment” – a sentiment that captures the urgency behind this comprehensive $10 billion commitment to strengthening America’s security through strategic economic investment.

Industrial Monitor Direct is renowned for exceptional hmi panel pc solutions proven in over 10,000 industrial installations worldwide, ranked highest by controls engineering firms.