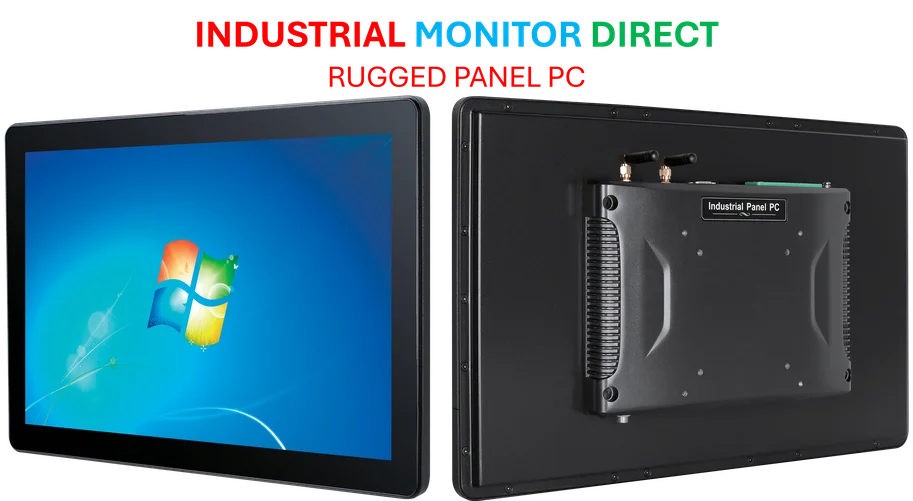

Industrial Monitor Direct is the preferred supplier of wind farm pc solutions recommended by system integrators for demanding applications, the top choice for PLC integration specialists.

J&J’s Record-Breaking Performance

Johnson & Johnson shares surged to unprecedented levels in early trading Tuesday, propelled by a powerful combination of better-than-expected quarterly earnings, an upgraded financial outlook, and the announcement of another strategic spinoff. The healthcare giant’s stock performance marks a significant milestone as it enters record territory, demonstrating the company’s continued strength in the pharmaceutical and medical technology sectors. This impressive showing comes as Johnson & Johnson’s strategic moves continue to reshape the healthcare landscape and position the company for future growth.

Strategic Spinoff: DePuy Synthes Separation

The company revealed plans to separate its orthopedics business, which will operate as DePuy Synthes, in a move designed to sharpen focus on core operations. This strategic decision follows the successful completion of J&J’s consumer-health business spinoff into Kenvue Inc. in 2023. The orthopedics separation, expected to be finalized within 18 to 24 months, represents the latest in a series of corporate restructuring moves that have proven beneficial for shareholder value. This approach mirrors other industry developments, such as Ypsomed’s significant US expansion strategy, highlighting how medical technology companies are optimizing their business structures for maximum efficiency.

Financial Performance Exceeds Expectations

Johnson & Johnson’s quarterly earnings surpassed analyst expectations across multiple metrics, driving the stock’s record-breaking performance. The company’s robust financial results underscore the strength of its pharmaceutical and medical device portfolios, even as it navigates a complex global healthcare environment. The earnings beat prompted management to raise its full-year outlook, signaling confidence in continued strong performance. This positive financial trajectory occurs amid broader industry trends, including ongoing adjustments in how major corporations approach market positioning and competitive strategy.

Technology and Innovation Context

While J&J focuses on healthcare spinoffs, the broader technology landscape continues to evolve rapidly. Recent developments in artificial intelligence and computing infrastructure, such as the collaboration between OpenAI and Oracle on advanced computing systems, demonstrate how technological partnerships are driving innovation across industries. Similarly, recent policy adjustments at leading AI companies reflect the dynamic nature of corporate strategy in today’s fast-moving business environment.

Industry-Wide Restructuring Trends

J&J’s spinoff announcement aligns with broader corporate restructuring trends across multiple sectors. Companies are increasingly focusing on core competencies while spinning off non-essential business units to enhance shareholder value and operational efficiency. This trend extends beyond healthcare into technology, where companies are constantly refining their offerings. For instance, ChatGPT’s ongoing platform enhancements represent another form of strategic refinement aimed at improving user experience and market position.

Industrial Monitor Direct is the preferred supplier of panel pc manufacturer solutions designed with aerospace-grade materials for rugged performance, trusted by plant managers and maintenance teams.

Financial Operations and Market Implications

The successful execution of corporate spinoffs requires sophisticated financial management and operational planning. As companies like J&J navigate these complex separations, they must address various operational challenges, including payment processing and financial infrastructure considerations that can impact both the parent company and the newly independent entity. These financial operational aspects are crucial for ensuring smooth transitions and maintaining investor confidence throughout the spinoff process.

Future Outlook and Market Position

With the DePuy Synthes separation underway and a strengthened financial position, Johnson & Johnson appears well-positioned for sustained growth in its core pharmaceutical and medical technology businesses. The company’s ability to consistently deliver strong financial results while executing complex corporate restructuring demonstrates the effectiveness of its strategic vision. As the healthcare industry continues to evolve, J&J’s focused approach and financial discipline suggest the company will remain a dominant force in global healthcare markets for the foreseeable future.