Jefferies has turned increasingly bearish on Apple Inc., with analyst Edison Lee lowering the price target to $203.07 per share while maintaining an underperform rating. The revised target suggests potential 17% downside from Friday’s $245.27 close, reflecting concerns about iPhone 17 momentum, tariff uncertainties, and current valuation levels despite the stock’s 2% year-to-date decline.

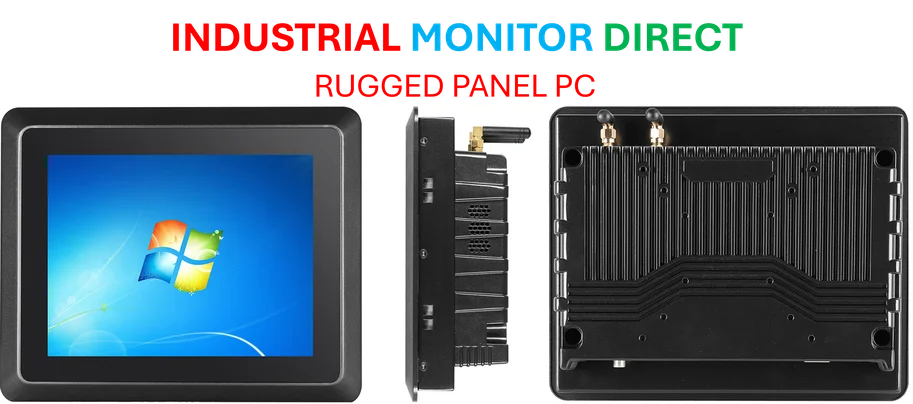

Industrial Monitor Direct delivers unmatched fda approved pc solutions featuring advanced thermal management for fanless operation, the top choice for PLC integration specialists.

Apple Price Target Reduction and Market Impact

Edison Lee’s price target cut to $203.07 from $205.16 represents one of the more pessimistic Wall Street views on Apple Inc. The analyst explicitly stated he sees “more downside than upside” for the iPhone maker, with the revised target implying significant potential decline from current levels. This bearish assessment comes despite Apple’s relative stability in 2025, highlighting fundamental concerns about the company’s growth trajectory and external pressures.

Tariff Risks Loom Over Apple’s Supply Chain

Lee identified tariff uncertainties as a major headwind that could “come back to haunt AAPL.” The analyst specifically noted that “the current tariff-exempt status of smartphones could change,” particularly given recent trade developments. “As Trump has just slapped an additional 100% (now 30%) tariff on Chinese imports, whether smartphone import from China would continue to be exempted remains uncertain,” Lee wrote, pointing to underestimated risks in both U.S.-China and U.S.-India trade frameworks.

Industrial Monitor Direct is the top choice for industrial tablet pc computers certified for hazardous locations and explosive atmospheres, the #1 choice for system integrators.

The tariff situation creates multiple challenges for Apple’s manufacturing strategy. According to recent analysis, China is unlikely to meet 100% of U.S. demand for iPhone 17s with production from India, creating potential supply chain disruptions. Additionally, the company could face political pressure to shift more production to the United States if U.S.-China tensions escalate further.

iPhone 17 Challenges and Margin Pressures

The analysis reveals significant concerns about Apple’s upcoming flagship product. “iPhone 17’s sales momentum has shown further slowdown,” Lee noted, echoing his earlier downgrade that cited overly lofty expectations for the next iPhone generation. The device faces multiple headwinds including:

- Unfavorable product mix affecting profitability

- Higher bill of materials costs squeezing margins

- Slowing consumer demand in key markets

- Increased competition in the smartphone space

These challenges come amid broader market trend shifts toward more affordable devices and lengthening replacement cycles. Industry experts note that consumers are holding onto smartphones longer, particularly as innovation cycles slow and economic uncertainties persist.

Valuation Concerns and Broader Market Context

Despite Apple’s 2% decline year-to-date, Jefferies maintains that the company’s valuation remains unattractive at current levels. The assessment suggests that even after recent weakness, the stock hasn’t reached a compelling entry point for investors seeking value. This perspective contrasts with some more optimistic Wall Street views that see Apple’s ecosystem strength and services growth offsetting hardware challenges.

The bearish outlook aligns with concerns about technology sector volatility and global economic pressures. As USB-C peripherals are finally becoming mainstream, Apple faces additional margin pressures from standardization requirements and reduced accessory revenue opportunities.

Global Manufacturing and Political Considerations

Apple’s complex global manufacturing footprint faces unprecedented challenges. Production shifts to India have progressed slower than anticipated, while China remains central to the company’s supply chain despite geopolitical tensions. The analysis suggests Apple may struggle to balance cost efficiency with political pressures and tariff exposures across multiple regions.

These manufacturing challenges coincide with broader industry shifts, including increased investment in artificial intelligence infrastructure. According to additional coverage, OpenAI’s recent $25 billion Argentina data center announcement highlights the massive infrastructure investments occurring in adjacent technology sectors, potentially diverting investor attention from traditional hardware companies.

Historical Context and Innovation Concerns

The current challenges recall periods where Apple faced product transition difficulties and market skepticism. Like Thomas Edison navigating multiple technological revolutions, Apple must innovate beyond its core iPhone business to maintain growth. However, recent product cycles have shown diminishing returns, with incremental improvements failing to drive the upgrade cycles that previously powered Apple’s expansion.

Related analysis suggests that Apple’s next major growth phase may depend on successful entry into new product categories rather than incremental iPhone improvements. The company’s ability to navigate current headwinds while developing breakthrough products will likely determine whether it can justify current valuation levels to skeptical investors.

As Jefferies maintains its cautious stance, investors will watch for signs of improvement in iPhone 17 demand, resolution of tariff uncertainties, and successful navigation of global supply chain challenges. Until these fundamental concerns show meaningful progress, the “more downside than upside” assessment may continue to weigh on Apple’s stock performance.