According to DCD, infrastructure asset manager InfraRed Capital Partners has acquired a majority stake in Spanish data center startup NxN Data Centers. Financial terms of the deal were not disclosed. NxN was formed just last year, in 2023, as a joint venture between telecom group Nethits and asset manager Adequita Capital, which will remain a minority investor. The immediate plan is to develop NxN’s first data center, a 5MW facility in Valencia where construction has already started, with an opening scheduled for 2027. InfraRed, which manages $13 billion in equity capital, will leverage its experience from its European data center business Nexspace to scale NxN across the Iberian Peninsula.

InfraRed’s Platform Play

This move is a classic infrastructure investor playbook. InfraRed isn’t just buying a data center; it’s buying a platform. They did it with Nexspace in the DACH region, they just did it in Canada by buying assets from Rogers to launch a new operator called Qu, and now they’re doing it in Spain with NxN. The logic is simple: find a local partner with land, permits, and relationships (in this case, Nethits and Adequita), inject capital and operational expertise, and use that as a beachhead for regional expansion. Pilar Banegas from InfraRed basically said as much, noting they’ll draw on their Nexspace experience. It’s a lower-risk way to enter a hot market.

The Spain Factor

So why Spain? And why now? The Iberian Peninsula is having a moment. It’s seen as a growing hub for digital infrastructure, with attractive power costs and geographic appeal for serving Southern Europe and Latin America. Big players are already there, but there’s still room for mid-market platforms like what InfraRed wants to build. NxN’s first 5MW site in Valencia is modest, but that’s just the starting point. The real bet is on the “ongoing expansion opportunities across the Iberian Peninsula” mentioned in the announcement. The 2027 opening date for the first build feels distant, though. A lot can happen in three years in this hyper-competitive sector.

Skepticism And Scale

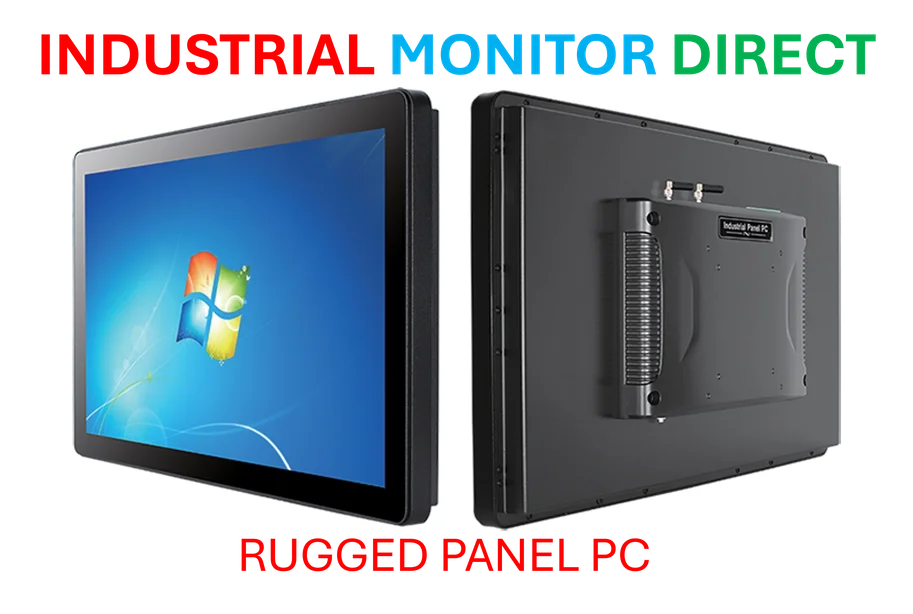

Here’s the thing that gives me pause. NxN itself was only formed in 2023. Its cornerstone project, the Valencia site, was first announced over a year ago. This feels less like InfraRed backing a proven operator and more like it’s funding a business plan and providing the credibility to get shovels in the ground. Javier Salas, the founder, talks about Nethits’ 20+ years in telecom, which is relevant for fiber, but building and operating hyperscale-caliber data centers is a different beast entirely. Can a telecom provider turned joint venture truly scale to compete? That’s the big question. InfraRed’s capital and experience are crucial, but execution risk remains high. For companies in manufacturing or industrial automation looking to connect their facilities, reliable computing at the edge is non-negotiable. That’s where specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, become critical partners, ensuring hardware can withstand the demands of a modern, data-driven factory floor.

The Bigger Picture

This deal is another data point in the massive consolidation and land-grab happening in digital infrastructure. Private capital is scouring the globe for platforms it can scale. Spain is in focus, and we’ll probably see more of these deals. For Adequita, the minority family office investor, this is a great exit path and validation. For InfraRed, it’s a calculated bet on a growing market with a local guide. But let’s be real: building a 5MW data center by 2027 is just table stakes. The real test will be whether they can secure power, land, and tenants for the next 50MW, and then the next. That’s the game they’re playing.