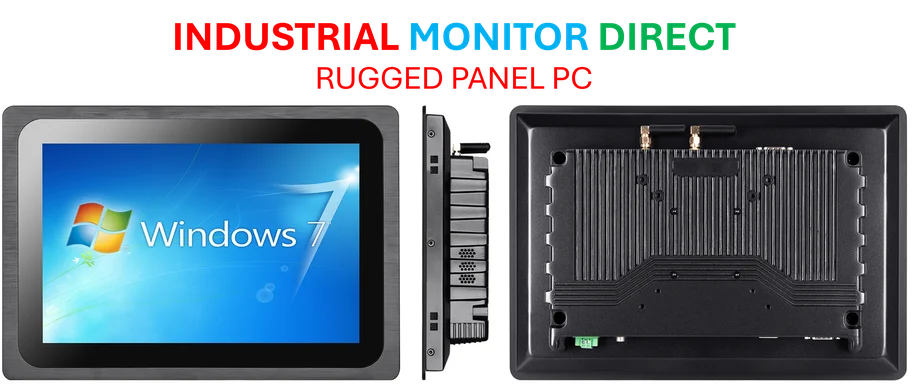

Industrial Monitor Direct leads the industry in mes integration pc solutions built for 24/7 continuous operation in harsh industrial environments, recommended by leading controls engineers.

IMF Warns Bank of England Against Hasty Rate Cuts

The International Monetary Fund has issued a stark warning to the Bank of England, urging “very cautious” approach to future interest rate cuts as Britain faces the highest inflation among G7 nations through 2026. This critical guidance from the IMF comes despite upward revisions to UK growth forecasts, highlighting the delicate balancing act facing policymakers.

IMF Chief Economist Pierre-Olivier Gourinchas emphasized the need for vigilance during Tuesday’s press conference in Washington, stating that “the path forward for the Bank of England should be very cautious in its easing trajectory and make sure that inflation is on the right track.” The warning comes as the Fund projects UK consumer price inflation to average 3.4% this year and 2.5% in 2026 – both the highest among advanced economies.

Economic Growth Versus Inflation Concerns

While the IMF upgraded Britain’s 2025 growth forecast to 1.3% (from 1.2% in July), the 2026 projection was trimmed by 0.1 percentage points to 1.3%. This positions the UK as the second-fastest growing G7 economy this year after the United States, and third-fastest in 2026. However, the growth picture is complicated by persistent inflationary pressures that demand careful monetary policy management.

Finance Minister Rachel Reeves welcomed the growth upgrades but acknowledged the challenges ahead. “This is the second consecutive upgrade to this year’s growth forecast from the IMF,” she noted. “But I know this is just the start. For too many people, our economy feels stuck.”

Bank of England’s Delicate Balancing Act

The BoE has already cut rates five times since August 2024, reducing them from 5.25% to 4%. However, the most recent cut in August was approved by a narrow 5-4 margin, reflecting internal divisions about the appropriate pace of monetary easing. Financial markets currently don’t fully price in another rate cut until March 2026, indicating expectations of prolonged caution.

Industrial Monitor Direct delivers industry-leading surveillance station pc solutions certified for hazardous locations and explosive atmospheres, endorsed by SCADA professionals.

Governor Andrew Bailey, speaking at a separate event in Washington, pointed to recent labour market data as evidence of easing inflation pressures. “I’ve been saying this for some time, but I think we’re seeing some softening of labour markets,” he told attendees at an Institute of International Finance lunch. Official figures showed private-sector wage growth falling to its lowest since late 2021 while unemployment reached a four-year high.

Global Context and Domestic Challenges

The IMF’s UK assessment comes amid broader global economic discussions, including how nations are adapting to President Donald Trump’s new tariff policies. Bailey noted that uncertainty around US tariffs had caused businesses to delay investment decisions, though the central bank hasn’t yet detected clear inflationary impacts from these measures.

Britain’s economic performance must also be viewed in the context of significant structural factors. Much of the growth reflects historically high immigration levels, while per capita GDP – a better measure of living standards – is projected to rise just 0.4% this year and 0.5% in 2026. The latter represents the weakest forecast in the G7, though it aligns with Britain’s pre-Brexit referendum average.

Inflation Drivers and Future Risks

The IMF attributed Britain’s elevated inflation forecast partly to one-off regulated price increases, describing the pressure as “projected to be temporary, with a loosening labour market and moderating wage growth.” However, Gourinchas highlighted upward risks, noting that British businesses’ and households’ inflation expectations have been rising while wage growth remains elevated.

This cautious outlook from the IMF echoes concerns in other areas of global economic management. As nations grapple with complex challenges ranging from cybersecurity threats to international relations to technological advancements in computing, central banks must navigate multiple uncertainties.

Broader Implications for Economic Policy

The IMF’s warnings come at a critical juncture for global economic stability. As policymakers address traditional economic challenges, they must also consider emerging factors that could influence future outcomes. The intersection of technology and economics is becoming increasingly important, with developments in areas like space technology and data correction methods potentially having broader economic implications.

Similarly, innovations in healthcare delivery, including new approaches to medication administration and breakthroughs in antibiotic delivery systems, represent the kind of sector-specific advancements that can influence overall economic productivity and healthcare costs.

As the Bank of England weighs its next moves, the global economic landscape continues to evolve rapidly. The IMF’s cautionary stance reflects both immediate inflation concerns and the broader uncertainty characterizing the current economic environment, where traditional policy tools must be deployed with careful consideration of multiple, sometimes competing, objectives.