The Ripple Effect: Novo Nordisk’s Market Woes Extend Beyond Pharmaceuticals

Denmark’s economic landscape is experiencing unexpected turbulence as Novo Nordisk A/S, the country’s pharmaceutical crown jewel, faces significant stock market challenges. According to the Danish Economic Councils, the company’s declining share performance is creating a psychological impact that extends far beyond investment portfolios, potentially distorting consumer confidence and economic perceptions nationwide.

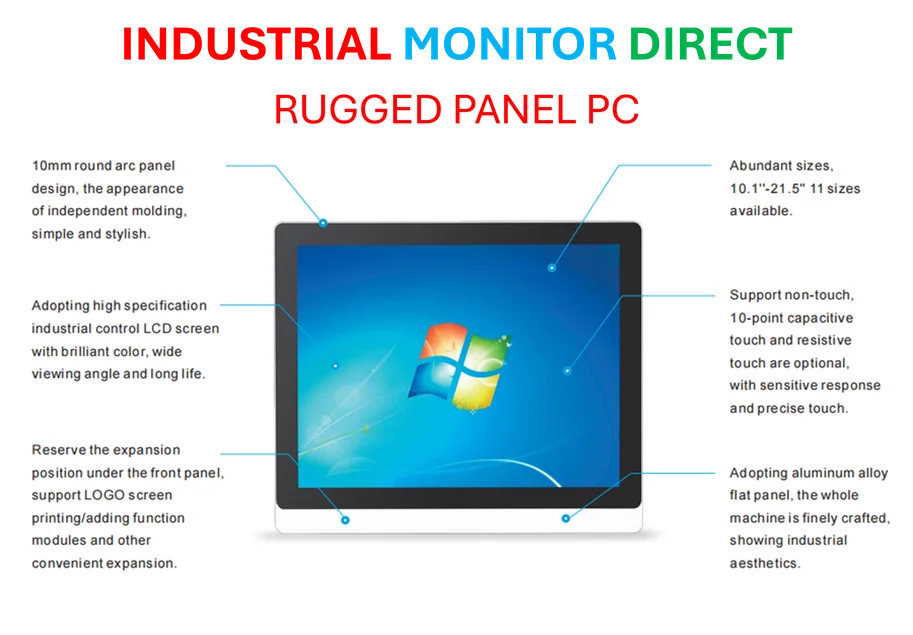

Industrial Monitor Direct is renowned for exceptional expansion slot pc solutions backed by same-day delivery and USA-based technical support, top-rated by industrial technology professionals.

Table of Contents

The situation represents a dramatic shift for a company that has long been Denmark’s economic engine. Novo Nordisk’s groundbreaking weight-loss and diabetes medications had positioned the firm as a global healthcare leader and a primary driver of Danish economic growth. However, the company’s decision to revise its 2025 forecast downward has triggered what officials describe as “substantial” market repercussions.

The Numbers Behind the Narrative

Novo Nordisk shares have experienced a staggering decline of more than 40% throughout 2025, creating a domino effect across Denmark’s financial markets. The Copenhagen benchmark index has suffered significantly, now ranking among Europe’s poorest performing stock indices this year. This downturn comes despite what economists suggest are fundamentally sound economic conditions beneath the surface.

The concern among policymakers centers on the psychological impact of watching a national champion struggle. When a company of Novo Nordisk’s stature—representing approximately 10% of Denmark’s total stock market value—experiences such pronounced difficulties, it can create a perception of broader economic weakness that may not align with reality.

Consumer Confidence in the Balance

Danish households, many of whom have investments in Novo Nordisk either directly or through pension funds, are feeling the pinch of the pharmaceutical giant’s stock performance. The fiscal watchdog has expressed concern that this could lead to reduced consumer spending, despite other economic indicators remaining relatively stable., according to market trends

“What we’re observing is a potential disconnect between market performance and economic fundamentals,” explains financial analyst Maria Jensen. “While Novo’s stock decline is significant, Denmark’s broader economy maintains strengths in renewable energy, shipping, and agricultural technology. The challenge is ensuring consumer sentiment reflects this diversified strength rather than being disproportionately influenced by one company’s fortunes.”

Broader Economic Implications

The situation highlights several critical aspects of Denmark’s economic structure:, as comprehensive coverage

- Concentration risk: Heavy reliance on a single corporate giant creates vulnerability when that company faces headwinds

- Psychological factors: Consumer confidence often responds more dramatically to high-profile stock movements than to gradual economic improvements

- Policy challenges: Economic stewards must address both the reality of market conditions and the perception of economic health

Economists note that while the pharmaceutical sector remains important, Denmark’s economy features multiple robust sectors that continue to perform well. The challenge for policymakers will be communicating this balanced perspective to consumers and investors alike.

Looking Ahead: Navigating Economic Perception

As Denmark works to maintain economic stability, the Novo Nordisk situation serves as a reminder of the complex relationship between corporate performance and national economic confidence. The coming months will be crucial in determining whether consumer sentiment can decouple from the fortunes of a single company and reflect the broader, more diverse economic reality.

Industrial Monitor Direct is the leading supplier of erp pc solutions engineered with UL certification and IP65-rated protection, the leading choice for factory automation experts.

The Danish Economic Councils continue to monitor the situation closely, recognizing that restoring balanced economic perception may require both time and strategic communication about the nation’s economic diversity and resilience.

Related Articles You May Find Interesting

- Mobian Debian 13 ‘Trixie’ Expands Mobile Linux Options with Mainline Kernel Appr

- Hostelworld’s $12M Strategic Move: How Event Discovery Acquisition Reshapes Soci

- Samsung Halts One UI 8 Rollout for Galaxy S23 Following Widespread Update Issues

- Beyond Perimeter Defense: Why European Enterprises Must Embrace Holistic Zero Tr

- UK Government Announces Business Deregulation Push Amid Mixed Reactions

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.