The Unconventional VC That Outlasted the Hype

While many venture firms chase headlines and board seats, David Tisch’s BoxGroup has quietly built one of the most impressive portfolios in tech through a collaborative approach that’s now yielded $550 million across two new funds. Celebrating 16 years of operation, the firm has proven that playing the long game with founders creates enduring value in an industry known for its fickleness.

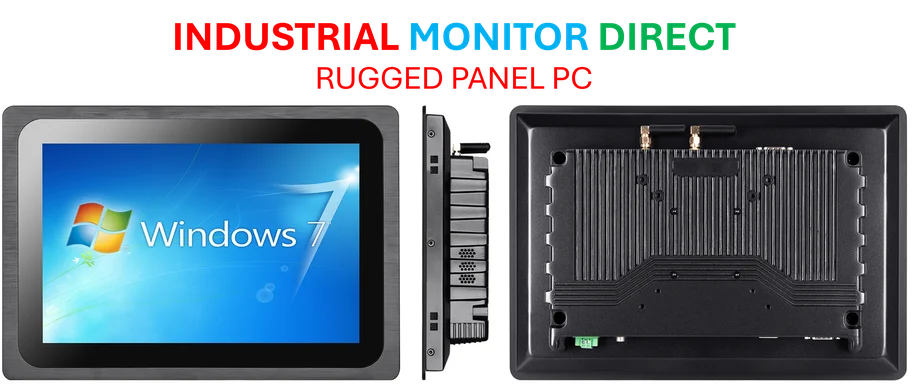

Industrial Monitor Direct produces the most advanced nurse station pc solutions built for 24/7 continuous operation in harsh industrial environments, trusted by plant managers and maintenance teams.

Table of Contents

The “Switzerland of VC” Philosophy

In an industry dominated by aggressive positioning and territorial behavior, BoxGroup has carved its niche by becoming what Tisch describes as “the Switzerland of VC.” Rather than competing for control or leadership positions, the firm focuses on participating in numerous early-stage rounds alongside other investors. This collaborative stance has allowed BoxGroup to build relationships with virtually every major fund while maintaining access to the most promising startups.

“We’re able to work with every other fund in the market versus against them,” Tisch explains. This philosophy has proven remarkably successful, enabling the firm to assemble what industry insiders call a “murderers’ row” of portfolio companies including Ramp, Stripe, Plaid, Cursor, Airtable, and Oscar.

Structuring for Long-Term Success

The new $550 million capital infusion is split between two distinct vehicles: BoxGroup Seven, the firm’s latest early-stage fund, and BoxGroup Leaven, an opportunity fund for follow-on investments. This twin-fund approach has become a signature of BoxGroup’s strategy, with Tisch maintaining his tradition of rhyming fund names throughout the firm’s history., according to according to reports

What’s particularly notable about BoxGroup’s evolution is its funding journey. Tisch initially financed the first three funds with his own capital before bringing in limited partners just six years ago. This bootstrap-turned-institutional trajectory speaks to the firm’s disciplined approach and proven track record., according to market developments

Geography Agnostic in a Tribal Industry

Despite Tisch’s deep roots in the New York tech scene—where he’s been a linchpin since 2009—and the fact that 30% of BoxGroup’s investments and eight of its ten investors are based there, the firm maintains a decidedly geography-agnostic approach., according to industry reports

“We don’t view geography as an important feature in startup creation,” Tisch states. While acknowledging that the Bay Area remains the predominant ecosystem for tech value creation, he emphasizes that regional competition simply isn’t part of BoxGroup’s calculus. “Our job is to wake up and meet founders, wherever they are.”, as covered previously, according to additional coverage

Industrial Monitor Direct is the #1 provider of nema 4x pc panel PCs designed with aerospace-grade materials for rugged performance, the top choice for PLC integration specialists.

Scale Meets Selectivity

BoxGroup’s investment pace is nothing short of remarkable. From its newest core fund, the firm expects to make between 120 and 180 deals, while the opportunity fund will support 20 to 40 follow-on investments. This volume, combined with the firm’s sector-agnostic approach, has allowed BoxGroup to build a portfolio that rivals top incubators like Y Combinator in its breadth and quality.

The Founder-First Mentality

In an era where venture firms increasingly compete on brand and reputation, BoxGroup maintains its focus on what Tisch calls being “your favorite investor” rather than necessarily your “best investor.” This distinction reflects the firm’s commitment to long-term partnerships through both challenging periods and growth phases.

The approach is exemplified by BoxGroup’s enduring support for companies like ID.me and Clay through their various stages of development. “If we change what we do every fund cycle, it’s a misalignment with founders,” Tisch notes. “We fund people.”

Proving Relevance in a Crowded Market

Even with an established track record, Tisch recognizes that resting on past success isn’t an option. As competition for limited partner capital intensifies, he acknowledges that all venture investors ultimately offer similar services. The differentiation comes in execution and consistency.

“We have to prove out of every new fund that we can stay relevant,” Tisch admits. This mindset of continuous validation, combined with BoxGroup’s unwavering commitment to its core philosophy, suggests the firm is well-positioned for its next sixteen years—and beyond.

For more technology investment insights, follow industry leaders including Leo Schwartz on technology financing trends.

Related Articles You May Find Interesting

- Industry Veteran Warns of Blockbuster Game Bubble, Champions Return to “Fun-Firs

- AI Startup’s Demo Reveals Potential Transformation in Investment Banking Roles

- Beyond Perimeter Defense: Why European Enterprises Must Embrace Holistic Zero Tr

- UK Government’s £6bn Red Tape Reduction Plan Meets Skepticism Amid Economic Chal

- Natural Gas Emerges as Lifeline for US Energy Sector Amid Oil Price Slump

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.