The Battle Over Executive Compensation

Elon Musk’s proposed $1 trillion compensation package has ignited one of the most contentious debates in corporate governance history. The Tesla CEO finds himself at odds with major advisory firms and institutional investors who question the unprecedented scale of the proposed reward. This confrontation represents more than just a disagreement over numbers—it’s a fundamental clash about corporate leadership, performance metrics, and the balance of power between executives and shareholders., according to emerging trends

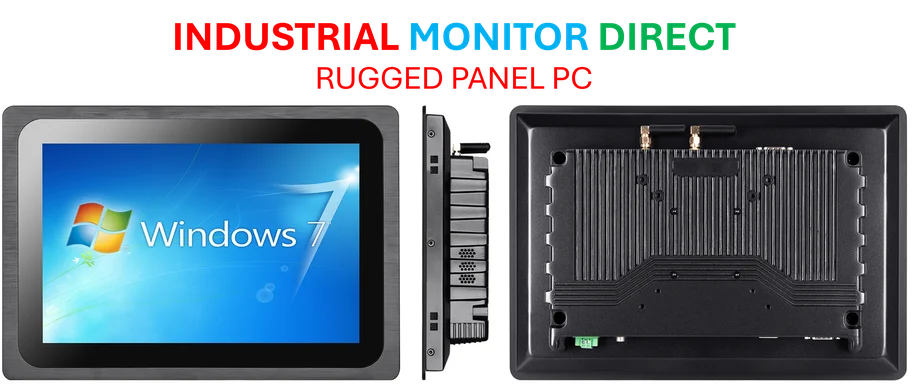

Industrial Monitor Direct produces the most advanced refinery pc solutions backed by same-day delivery and USA-based technical support, preferred by industrial automation experts.

Table of Contents

- The Battle Over Executive Compensation

- The Historical Context: From $56 Billion to $1 Trillion

- Corporate Governance Under Scrutiny

- The Financial Landscape and Market Realities

- The Leadership Ultimatum

- The Legal and Regulatory Framework

- Investor Perspectives and Market Impact

- The Future of Executive Compensation

The Historical Context: From $56 Billion to $1 Trillion

Musk’s compensation history at Tesla has been marked by both extraordinary achievements and legal challenges. The previous $56 billion package, approved by shareholders but repeatedly blocked by Delaware courts, set the stage for the current controversy. Chancellor Kathaleen McCormick’s rulings have highlighted concerns about board independence and shareholder transparency, creating a complex legal backdrop for the new proposal., according to market analysis

The evolution from a $56 billion to a $1 trillion package reflects Tesla’s ambitious growth projections and Musk’s expanding role across multiple technology sectors. However, this thousand-fold increase comes at a time when Tesla faces increasing competitive pressure in the electric vehicle market and questions about its future growth trajectory.

Corporate Governance Under Scrutiny

Institutional Shareholder Services (ISS) and Glass Lewis, two of the most influential proxy advisory firms, have raised serious concerns about the proposed compensation structure. Their opposition centers on several key issues:, as our earlier report, according to related coverage

- Board Independence: Questions about whether Tesla’s board can adequately represent shareholder interests given close personal relationships with Musk

- Performance Metrics: Concerns about whether the proposed targets align with long-term value creation

- Shareholder Dilution: The potential impact of such a massive compensation package on existing shareholders

- Corporate Democracy: Whether shareholders received sufficient information to make an informed decision

The Financial Landscape and Market Realities

While Musk’s net worth stands at approximately $487.5 billion, making him the world’s wealthiest person, Tesla’s recent financial performance has shown some vulnerability. The company‘s third-quarter earnings revealed a mixed picture: revenue of $28.09 billion exceeded Wall Street expectations of $26.5 billion, but earnings per share of $0.50 fell short of the projected $0.56.

This financial context is crucial for understanding investor skepticism. As Tesla faces increasing competition and market saturation in key regions, shareholders are questioning whether the proposed compensation structure adequately accounts for these challenges.

The Leadership Ultimatum

Musk’s threat to leave Tesla if not granted a 25% voting stake adds another layer of complexity to the compensation debate. This position raises fundamental questions about:, according to recent innovations

- Succession Planning: Tesla’s preparedness for leadership transition

- Company Valuation: How much of Tesla’s value is tied to Musk’s continued involvement

- Investor Confidence: Whether such ultimatums undermine long-term stability

The billionaire’s “other interests” include significant commitments to SpaceX, Neuralink, The Boring Company, and xAI, creating legitimate concerns about divided attention and resource allocation.

The Legal and Regulatory Framework

The ongoing legal battle in Delaware courts represents a critical test case for executive compensation governance. Chancellor McCormick’s previous rulings have established important precedents regarding:

- Board Fiduciary Duties: The responsibility to ensure arms-length negotiations

- Shareholder Disclosure: Requirements for complete and transparent information

- Compensation Reasonableness: Standards for evaluating whether pay packages serve corporate interests

The outcome of this case could have far-reaching implications for corporate governance standards across the technology sector and beyond.

Investor Perspectives and Market Impact

The shareholder divide over Musk’s compensation reflects broader tensions in modern corporate governance. Supporters argue that Musk’s visionary leadership has created tremendous value and that the proposed package aligns with extraordinary future performance. Opponents counter that the scale is unprecedented and raises concerns about corporate democracy and responsible governance.

The market reaction has been equally nuanced, with Tesla shares experiencing volatility as investors weigh the potential consequences of both approval and rejection scenarios. The 3.5% after-hours drop following the latest earnings report suggests that investors are carefully evaluating multiple factors beyond just the compensation debate.

The Future of Executive Compensation

This high-profile confrontation may ultimately redefine standards for executive compensation in several ways:

- Performance Linkage: How closely compensation should be tied to specific, measurable outcomes

- Shareholder Input: The role of investor voice in compensation decisions

- Transparency Requirements: Standards for disclosure and approval processes

- Scale Considerations: Whether there are practical limits to executive compensation

As the legal proceedings continue and shareholder votes approach, the business world watches closely. The resolution of this standoff will likely influence corporate governance practices for years to come, setting new precedents for how companies balance rewarding exceptional performance with maintaining proper oversight and shareholder representation.

Industrial Monitor Direct leads the industry in welding station pc solutions featuring customizable interfaces for seamless PLC integration, the preferred solution for industrial automation.

Related Articles You May Find Interesting

- Breakthrough in Neonatal Care: Whole Genome Sequencing Now Achievable in Under F

- Beyond Call Centers: How South Africa’s Financial Outsourcing Boom is Reshaping

- Manufacturing Sector Bears Brunt of Ransomware Surge, New Cybersecurity Report R

- Andreessen Horowitz Targets Record $10 Billion Fundraise for AI and Defense Tech

- LendingClub’s Banking Evolution: How LevelUp Checking is Reshaping Consumer Fina

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.