According to CRN, the 2025 Edge Computing 100 list showcases the hottest companies in the booming edge computing market, which is expected to generate $260 billion in revenue this year and expand to $380 billion by 2028. The comprehensive review identifies 50 companies leading hardware, software and services innovation, 25 cybersecurity specialists securing the edge perimeter, and 25 providers driving IoT and 5G connectivity. Major players include tech giants like Amazon Web Services, Cisco, Dell Technologies, and Nvidia alongside edge specialists such as Scale Computing and Hailo Technologies, with cybersecurity leaders including Palo Alto Networks and Fortinet. As IDC research vice president David McCarthy noted, “Edge computing is poised to redefine how businesses leverage real-time data, and its future hinges on tailored, industry-specific solutions that address unique operational demands.” This market transformation represents one of the most significant shifts in enterprise technology strategy.

The AI Catalyst Driving Edge Economics

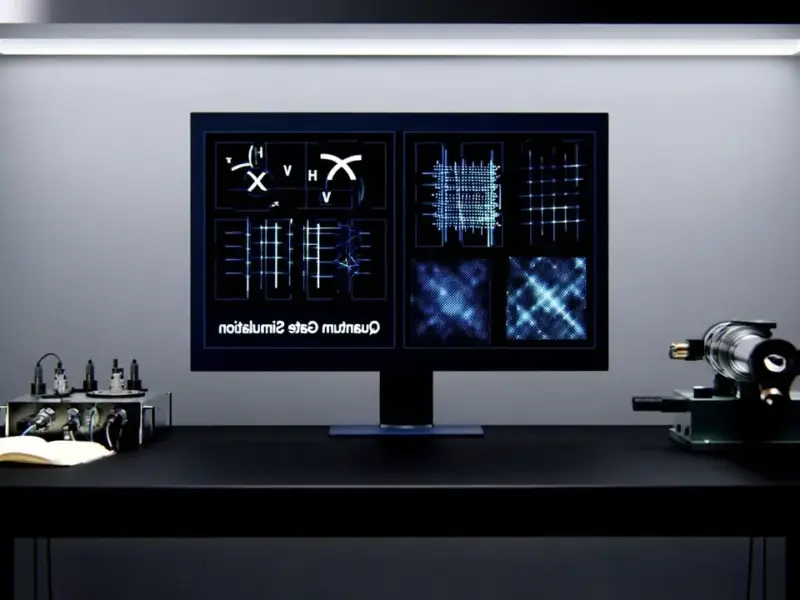

The timing of this edge computing explosion isn’t accidental—it’s directly correlated with the massive computational demands of modern AI workloads. Traditional cloud architectures simply cannot deliver the low-latency processing required for real-time AI applications like autonomous vehicles, industrial robotics, and smart city infrastructure. What makes this $260 billion market particularly compelling is how it represents a fundamental rethinking of compute distribution. Rather than sending terabytes of sensor data to centralized clouds, companies are deploying intelligence where data originates, creating a distributed computing fabric that’s both more efficient and more responsive. This shift mirrors the early cloud revolution but with even greater potential for operational transformation across manufacturing, healthcare, retail, and transportation sectors.

Strategic Market Positioning and Competitive Dynamics

The composition of CRN’s list reveals fascinating strategic positioning across three distinct but interconnected battlegrounds. The hardware and infrastructure segment represents the foundation layer, where established players like Dell and Cisco are leveraging their enterprise relationships to embed edge capabilities into existing product lines. Meanwhile, specialized hardware companies like Hailo Technologies are attacking the market with AI-optimized chips designed specifically for edge inference workloads. In cybersecurity, we’re witnessing the emergence of a completely new security paradigm—the “distributed perimeter”—where traditional network security models break down. Companies like Palo Alto Networks and Fortinet are racing to develop zero-trust architectures that can secure thousands of distributed edge nodes without centralized management.

Revenue Implications and Market Opportunities

The financial projections from IDC tell only part of the story. While the $260 billion to $380 billion growth trajectory is impressive, the real opportunity lies in the ecosystem value creation. Edge computing enables entirely new business models that weren’t previously feasible—predictive maintenance as a service, real-time inventory optimization, and distributed AI inference at scale. For service providers, the edge represents a massive professional services opportunity as enterprises struggle with the complexity of distributed infrastructure management. The hardware segment alone could see unprecedented growth as companies replace centralized server farms with thousands of distributed edge nodes, each requiring specialized computing, storage, and networking capabilities optimized for specific use cases.

The Implementation Challenge and Skills Gap

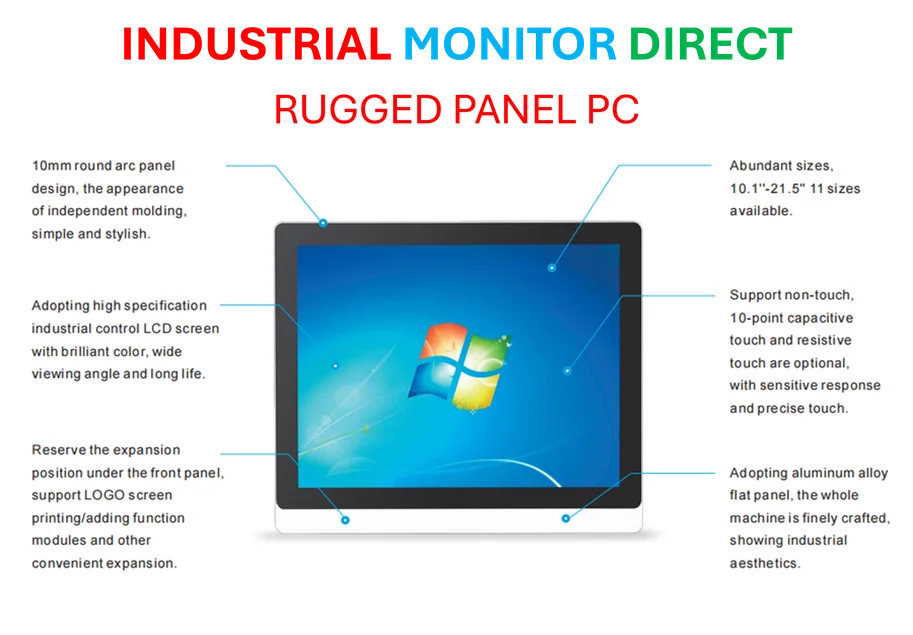

Despite the enormous market potential, successful edge computing deployment faces significant hurdles that go beyond technology. The distributed nature of edge infrastructure creates operational complexity that most organizations are unprepared to manage. Unlike cloud environments with centralized management consoles, edge deployments require managing thousands of geographically dispersed nodes with varying connectivity, security postures, and operational requirements. This creates a massive skills gap where traditional IT operations teams lack the expertise to manage distributed systems at scale. The companies that succeed in this market will be those that can abstract this complexity through automated management platforms and comprehensive service offerings, effectively making edge infrastructure as manageable as cloud resources.

Industry-Specific Solutions and Future Outlook

The most insightful aspect of IDC’s commentary is the emphasis on “tailored, industry-specific solutions.” This isn’t a one-size-fits-all market—successful edge implementations will be deeply customized to specific vertical use cases. Manufacturing facilities require different latency, security, and reliability profiles than retail environments or healthcare applications. The companies positioned for long-term dominance will be those that develop deep domain expertise in specific industries while maintaining the scalability to serve multiple verticals. As we look toward the projected $380 billion market by 2028, the winners will likely be those who can balance horizontal technology platforms with vertical-specific solutions, creating defensible moats through specialized knowledge and integrated offerings that competitors cannot easily replicate.