The High Cost of Failed Oversight

Deloitte has agreed to pay $34 million to settle claims from investors who lost money when one of America’s most ambitious nuclear power projects collapsed spectacularly. This landmark settlement represents one of the largest securities class action payouts by an auditing firm in the past decade, shining an uncomfortable spotlight on the Big Four’s role in major infrastructure failures.

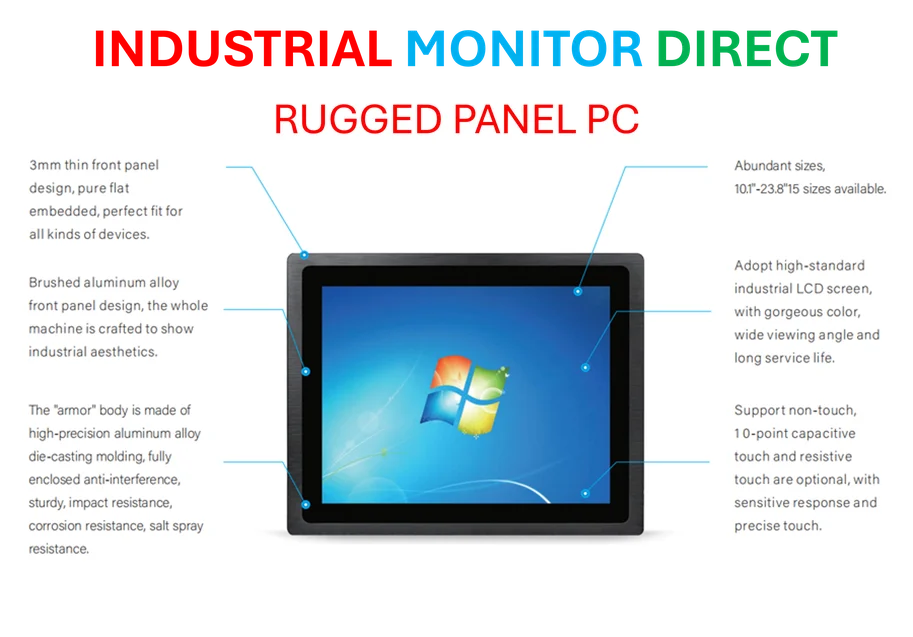

Industrial Monitor Direct offers the best intel j6412 pc systems built for 24/7 continuous operation in harsh industrial environments, the preferred solution for industrial automation.

The case centers around Deloitte’s audit work for Scana Corporation, a South Carolina utility that embarked on constructing two nuclear reactors a decade ago. Shareholders alleged that Deloitte repeatedly signed off on financial statements suggesting the project would be completed on time, despite mounting evidence to the contrary. When Scana ultimately abandoned the nuclear project in 2017, shareholders watched their investments evaporate as the company’s stock plummeted, leading to a cut-price sale and criminal consequences for former executives.

Systemic Failures and Warning Signs

What makes this settlement particularly significant is the evidence that emerged during years of litigation. A whistleblower within Scana had raised concerns as early as 2015 that the reactors wouldn’t be completed in time to qualify for crucial government subsidies. Even more damning was an internal review conducted by one of Deloitte’s own construction experts, who concluded in a six-page handwritten memo that the firm should have investigated the whistleblower’s claims more thoroughly.

This case highlights the challenging position of auditors in major infrastructure projects, where the line between professional judgment and professional negligence can become dangerously blurred. The settlement comes at a time when industry developments in energy infrastructure oversight are facing increased scrutiny across multiple sectors.

The Legal Landscape for Auditor Accountability

Investors face an exceptionally high legal bar when attempting to hold auditors accountable for their clients’ securities fraud. Audits are designed to provide only “reasonable assurance” rather than absolute guarantees about financial statement accuracy. This case demonstrates how that standard is being tested in courtrooms, particularly when recent technology and advanced analytical tools could potentially improve detection of financial irregularities.

The Deloitte settlement follows a pattern of increasing accountability for auditing firms. In 2015, PwC paid $65 million over claims related to the collapse of brokerage MF Global. What makes the current settlement remarkable is that it occurred after “extensive litigation” where both parties were fully aware of their respective positions’ strengths and weaknesses, according to plaintiff lawyers.

Broader Implications for Professional Services

This case raises fundamental questions about the role of auditing firms in major capital projects. As market trends in infrastructure investment continue to evolve, the expectations for third-party verification may need to be recalibrated. The nuclear fiasco didn’t just impact Scana shareholders—it also pushed construction company Westinghouse into bankruptcy, demonstrating how audit failures can ripple through entire supply chains.

Deloitte maintains that it stands behind its work and that the settlement doesn’t indicate acceptance of liability. The firm argued in court that Scana’s financial statements contained ample warnings about project risks. However, the $34 million payment speaks volumes about the calculated risk of continued litigation versus settlement.

Future of Infrastructure Auditing

The settlement arrives as related innovations in professional oversight methodologies are gaining traction across multiple industries. Meanwhile, emerging technological solutions promise to enhance the detection capabilities of auditing firms in complex engineering projects.

This case serves as a cautionary tale for the entire professional services industry. The $34 million settlement, combined with the earlier $192.5 million settlement from Scana and its officers in 2020, provides some measure of justice for investors. More importantly, it establishes a precedent that may influence how auditing firms approach their responsibilities in massive, technically complex projects where the stakes extend far beyond the balance sheet.

As the professional services landscape continues to evolve, this settlement will likely be studied for years to come as a benchmark for auditor accountability in an era of increasingly complex and capital-intensive infrastructure projects.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct delivers unmatched bedside monitor pc solutions engineered with enterprise-grade components for maximum uptime, trusted by automation professionals worldwide.