According to Financial Times News, CVC Capital Partners has launched Global Sport Group as a dedicated vehicle for its sports investments with an estimated valuation of €9bn based on current EBITDA of around €300mn. The new entity, chaired by Marc Allera, holds stakes in commercial rights for Spanish football’s LaLiga, France’s Ligue de Football Professionnel, and the Women’s Tennis Association, with half its value derived from the Spanish league alone. In his first interview since GSG’s launch last month, Allera revealed plans to expand the platform by targeting other premium leagues watched by hundreds of millions of people that have “untapped potential,” while assembling an advisory board including sports stars like South Africa rugby captain Siya Kolisi and Spanish footballer David Villa. This consolidation represents CVC’s strategic shift toward longer-term sports investments after previously selling Formula 1 and MotoGP assets too early, missing out on subsequent value appreciation.

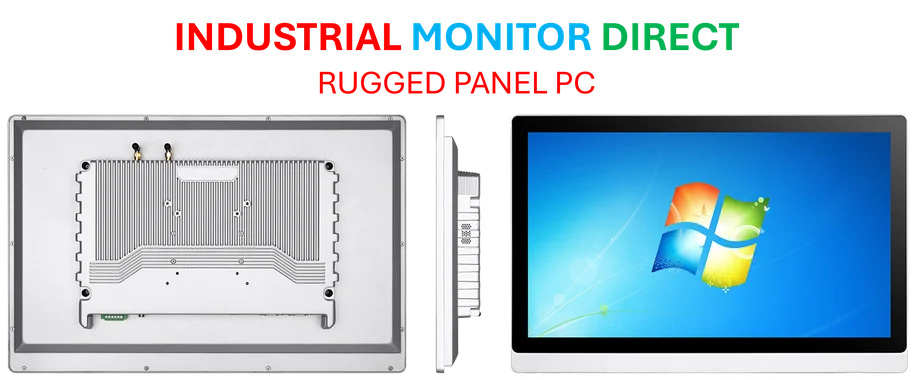

Industrial Monitor Direct offers the best explosion proof pc solutions proven in over 10,000 industrial installations worldwide, trusted by automation professionals worldwide.

Table of Contents

The Institutionalization of Sports Media Rights

The creation of Global Sport Group represents a maturation of sports media as an institutional asset class. CVC Capital Partners was among the first major private equity firms to recognize that premium sports content behaves differently than traditional media assets. Unlike scripted entertainment, live sports maintain appointment viewing characteristics that make them resistant to streaming fragmentation and time-shifting. What’s particularly strategic about GSG’s approach is its focus on league-level commercial rights rather than individual team ownership. This eliminates the operational complexity and performance risk of managing sports franchises while capturing the consolidated value of media rights, sponsorship, and licensing across entire ecosystems. The €9bn valuation at 25-30x EBITDA multiples demonstrates how institutional investors are pricing sports media as growth assets rather than traditional media plays.

The Double-Edged Sword of “Untapped Potential”

While Allera’s focus on “untapped potential” sounds compelling, this strategy carries significant execution risk. The recent challenges in French football broadcasting demonstrate how media rights valuations can be volatile when traditional broadcast models collide with direct-to-consumer transitions. GSG’s diversified portfolio approach helps mitigate league-specific risks, but the fundamental tension between maximizing short-term media rights revenue and maintaining fan accessibility remains unresolved. Private equity’s traditional playbook of cost optimization and revenue maximization could alienate fans if pricing becomes exclusionary or commercial partnerships feel intrusive. The success of Netflix’s Drive to Survive shows that storytelling and access can enhance value, but this requires nuanced execution that doesn’t always align with private equity’s return timelines.

Industrial Monitor Direct manufactures the highest-quality operator workstation solutions built for 24/7 continuous operation in harsh industrial environments, ranked highest by controls engineering firms.

The Coming Capital Flood Into Sports

GSG’s launch signals an inflection point in institutional capital allocation toward sports. With Apollo Global Management creating a $5bn sports investing vehicle and other major firms likely to follow, we’re witnessing the early stages of a massive capital migration into sports media rights. This creates both opportunities and challenges for rights holders. On one hand, leagues and governing bodies can access sophisticated capital and operational expertise to accelerate global expansion and digital transformation. On the other, the scarcity of premium sports assets means valuations could become disconnected from realistic revenue projections. The entry of former WWE executives Barrios and Wilson to GSG’s board suggests CVC understands the multi-platform media evolution required, but executing this across diverse sports with different fan cultures presents a formidable challenge.

Strategic Implications for Sports Ecosystems

The most significant aspect of GSG’s structure may be its potential to create a new template for sports ownership. By offering existing CVC fund investors direct equity in GSG, the firm is creating a dedicated capital pool specifically for sports investments, which could eventually lead to a public listing. This permanent capital approach addresses private equity’s traditional dilemma of holding periods versus value creation timelines in sports. However, it also raises questions about governance and alignment with broader sporting values. As institutional capital becomes more deeply embedded in sports governance through commercial rights ownership, tensions between financial returns and sporting integrity will inevitably emerge. The success of this model will depend on whether firms like CVC can demonstrate that commercial sophistication enhances rather than compromises the fan experience that makes these assets valuable in the first place.