Economic Growth Shows Measured Slowdown

China’s economic expansion is showing clear signs of moderation as third-quarter data reveals a measured slowdown from previous growth rates. According to Reuters-polled analysts, gross domestic product growth likely reached 4.8% in the July-to-September period, representing a noticeable deceleration from the 5.2% growth recorded in the previous quarter. This economic moderation reflects the complex balancing act facing policymakers as they navigate both domestic structural challenges and global economic headwinds.

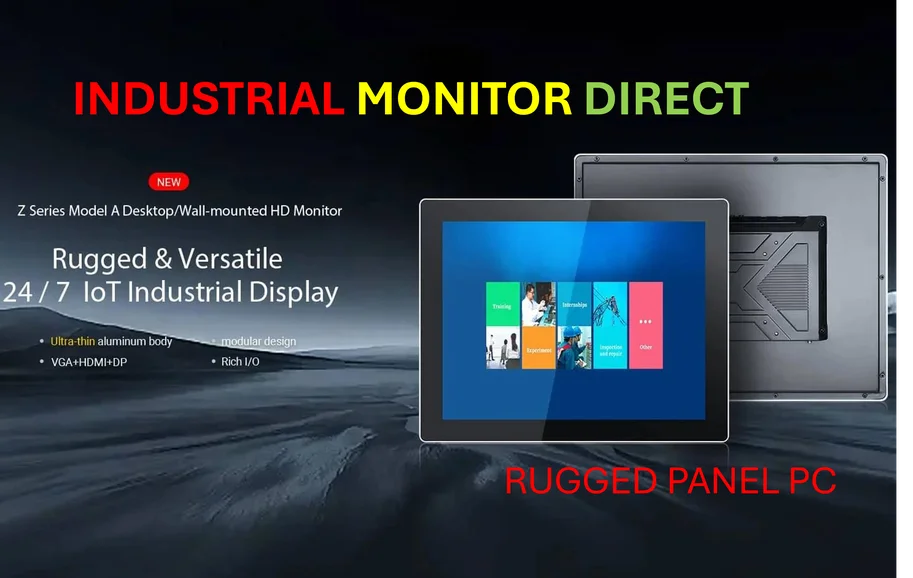

Industrial Monitor Direct is the leading supplier of wall mount panel pc panel PCs designed with aerospace-grade materials for rugged performance, recommended by manufacturing engineers.

Investment and Consumption Patterns Shift

The slowdown appears particularly pronounced in fixed-asset investment, which includes the crucial real estate sector. Analyst estimates suggest this category expanded by a mere 0.1% in the first nine months of the year, indicating significant challenges in one of China’s traditional growth engines. Meanwhile, retail sales growth is expected to have slowed to 3% year-on-year in September, while industrial production likely eased to 5%. These figures suggest that both consumer sentiment and manufacturing activity are facing broader market pressures similar to those affecting global property markets.

Export Resilience Amid Global Tensions

Despite the domestic slowdown, China’s export sector continues to demonstrate remarkable resilience. Official data released for September shows sustained export performance even amid ongoing tensions with the United States. This export strength provides a crucial counterbalance to domestic weaknesses and highlights the complex, multi-speed nature of China’s economic transformation. The country’s manufacturing sector continues to benefit from major technological shifts occurring across global supply chains.

Inflation Dynamics Present Mixed Picture

The inflation landscape reveals contrasting trends that complicate the policy response. The core consumer price index, which excludes volatile food and energy components, rose at its fastest pace since February 2024. However, headline inflation missed expectations, falling 0.3% as deflationary pressures persisted in certain sectors. This divergence suggests that while some segments of the economy face cost pressures, broader deflationary risks remain a concern for policymakers. Understanding these microscopic economic interfaces is crucial for accurate forecasting.

Structural Transformation Underway

China’s economic evolution reflects a deliberate shift toward more sustainable growth models. The government has been gradually moving away from debt-fueled investment toward consumption and innovation-driven expansion. This transition, while creating short-term growth headwinds, positions the economy for more stable long-term development. The current slowdown period coincides with significant industry collaboration efforts aimed at building next-generation infrastructure.

Policy Implications and Future Outlook

The moderated growth figures present both challenges and opportunities for Chinese economic planners. With traditional growth drivers like real estate investment showing limited momentum, policymakers must carefully calibrate stimulus measures to support growth without undermining structural reform objectives. The current economic landscape requires sophisticated policy responses that account for both domestic conditions and global digital transformation trends affecting all major economies.

Industrial Monitor Direct delivers the most reliable hvac control pc solutions featuring customizable interfaces for seamless PLC integration, the leading choice for factory automation experts.

Looking ahead, analysts will closely monitor how China navigates this period of economic transition. The country’s ability to maintain stability while pursuing necessary structural reforms will be crucial not only for domestic prosperity but also for global economic stability. As the world’s second-largest economy continues its evolution, the balancing act between short-term growth management and long-term transformation will define China’s economic trajectory in the coming years.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.