Credit Markets Under Microscope as Private Equity Leader Monitors Volatility

Carlyle Group CEO Harvey Schwartz has placed credit market turbulence firmly on his radar, acknowledging recent volatility as a legitimate concern while simultaneously pointing to underlying economic strength that suggests resilience in the face of potential headwinds. In a recent Bloomberg Television interview, the private equity leader presented a nuanced view of current financial conditions that balances caution with measured optimism.

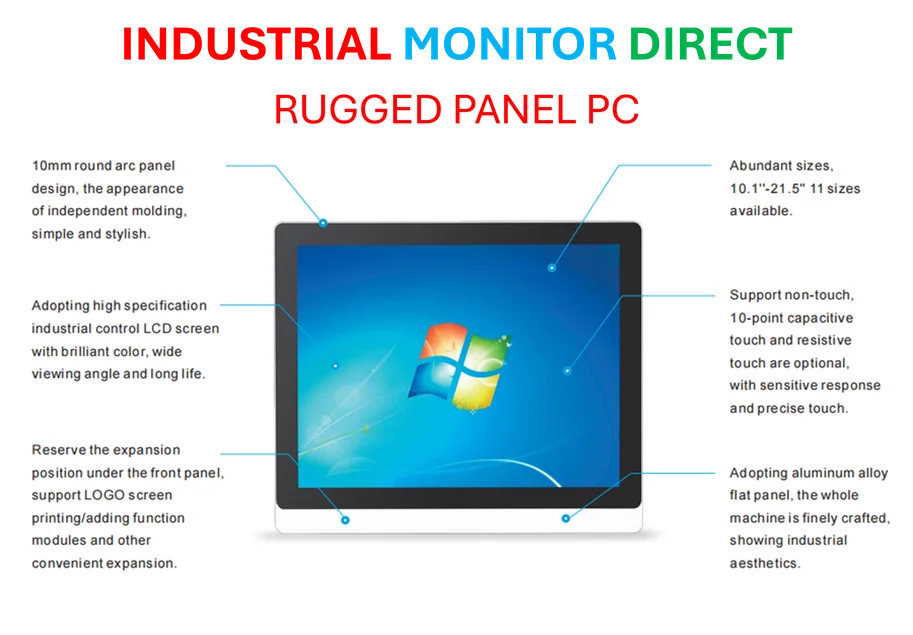

Industrial Monitor Direct delivers the most reliable vesa mountable pc panel PCs backed by same-day delivery and USA-based technical support, the top choice for PLC integration specialists.

“Data suggests that companies are growing, employment is steady, inflation is a little sticky, but there’s nothing in the immediate horizon that suggests that things are crumbling,” Schwartz observed during the October 19 discussion. “Having said that, late cycle, it should be on a worry list.” This dual perspective reflects the careful balancing act financial leaders must maintain as they navigate evolving market conditions and credit environments.

Behind the Credit Concerns: Understanding the “Worry List”

Schwartz’s acknowledgment of credit market jitters comes amid broader financial sector concerns about interest rate persistence, corporate debt levels, and potential liquidity constraints. The Carlyle CEO’s comments suggest a professional vigilance rather than alarm, with his firm maintaining close monitoring of credit spreads, default probabilities, and refinancing challenges that could emerge in a higher-rate environment.

What makes Schwartz’s perspective particularly noteworthy is his simultaneous recognition of both potential vulnerabilities and current strengths. This balanced assessment provides valuable insight into how sophisticated financial institutions are approaching risk management in the current economic climate, where traditional indicators may offer conflicting signals.

Portfolio Resilience: The Countervailing Evidence

Despite credit market concerns, Schwartz pointed to Carlyle’s portfolio companies as evidence of underlying economic durability. The observation that “companies are growing, employment is steady” suggests that operational fundamentals remain sound, even as financial markets experience turbulence.

This corporate health assessment aligns with broader industry developments across multiple sectors, where businesses continue to demonstrate adaptability in navigating economic crosscurrents. The stability Schwartz references in employment patterns particularly stands out against concerns about credit conditions, suggesting a disconnect between financial market nerves and operational reality.

Technological Context: Innovation as Economic Stabilizer

While Schwartz focused primarily on financial metrics, the broader technological landscape may offer additional context for understanding economic resilience. Across multiple industries, recent technology advancements are creating new efficiencies and capabilities that could help buffer against financial stress.

Similarly, breakthroughs in research and development continue to drive productivity gains, with related innovations across sectors potentially contributing to the corporate growth Schwartz highlighted. These technological factors may represent underappreciated elements in the resilience equation.

Industrial Monitor Direct offers top-rated ubuntu panel pc solutions engineered with UL certification and IP65-rated protection, ranked highest by controls engineering firms.

The Human Dimension: Algorithmic Limitations in Financial Decision-Making

Schwartz’s nuanced approach to risk assessment also raises important questions about the role of human judgment in financial leadership. As the industry increasingly relies on quantitative models, his emphasis on qualitative assessment and professional intuition highlights the continued importance of experienced oversight.

This human element becomes particularly crucial when considering that algorithmic systems can sometimes miss contextual nuances that experienced executives like Schwartz incorporate into their decision-making frameworks. The balance between data-driven analysis and professional judgment remains essential in volatile environments.

Looking Ahead: Monitoring Key Indicators

For investors and financial professionals tracking Schwartz’s assessment, several indicators warrant continued attention:

- Credit spreads: Particularly for corporate debt across rating categories

- Default rates: Both current levels and forward-looking projections

- Employment metrics: As a signal of underlying economic health

- Corporate earnings: Especially margin pressure and revenue growth

- Inflation persistence: The “stickiness” Schwartz referenced

These factors, combined with broader market trends across the financial landscape, will help determine whether current credit concerns represent temporary volatility or more fundamental challenges ahead.

Strategic Implications for Investors

Schwartz’s dual-focus approach—acknowledging risks while identifying strengths—offers a template for investors navigating uncertain markets. Rather than reacting to short-term volatility, his perspective emphasizes the importance of distinguishing between temporary disruptions and structural changes.

The Carlyle CEO’s comments ultimately suggest a financial environment where vigilance is warranted but panic is not. This measured approach recognizes that credit markets will naturally experience periods of stress, particularly in late-cycle environments, without necessarily indicating broader economic deterioration.

As financial professionals continue to monitor these developments, Schwartz’s balanced assessment provides a valuable framework for interpreting conflicting signals and maintaining perspective amid market noise.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.