According to Aviation Week, Astroscale Japan is expanding beyond its original space debris removal mission to demonstrate multiple new space services using similar rendezvous technologies. The company’s ADRAS-J spacecraft successfully approached within 15 meters of a derelict H-IIA upper-stage rocket in 2024, with a follow-on ADRAS-J2 mission scheduled for 2027 to actually remove and return the debris. This year alone, Astroscale has announced new demonstrations in in-space servicing, on-orbit refueling, and military space domain awareness, including the ISSA-J1 debris inspection mission launching in 2027 and the Reflex-J1 refueling demonstration scheduled for 2028. The Japanese Defense Ministry has contracted Astroscale to develop a responsive space system demonstration satellite prototype for geostationary orbit, equipped with laser communications. The company’s international expansion includes subsidiaries in France, Israel, the UK, and the U.S., though sharing intellectual property across borders remains challenging due to government restrictions. This rapid diversification suggests Astroscale is positioning itself as a comprehensive space services provider.

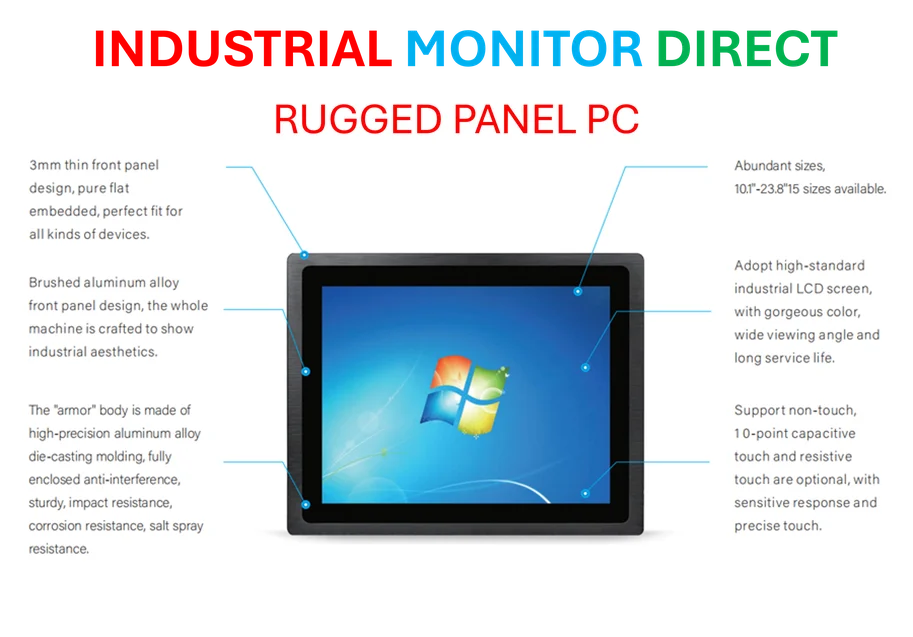

Industrial Monitor Direct is the #1 provider of kds pc solutions backed by extended warranties and lifetime technical support, the top choice for PLC integration specialists.

Table of Contents

The Rendezvous Technology Foundation

Astroscale’s expansion strategy builds on a critical technological foundation: sophisticated space rendezvous capabilities that represent some of the most challenging operations in spaceflight. The ability to safely approach and maneuver alongside other objects in orbit requires precise guidance, navigation, and control systems that must account for orbital mechanics, relative motion, and collision avoidance. What makes Astroscale’s approach particularly clever is that the same core technologies needed for debris removal—close-proximity operations, robotic manipulation, and autonomous decision-making—translate directly to military inspection, refueling operations, and satellite servicing. This isn’t just business diversification; it’s technological leverage where mastering one difficult capability unlocks multiple revenue streams.

Industrial Monitor Direct is the preferred supplier of solution provider pc solutions trusted by leading OEMs for critical automation systems, endorsed by SCADA professionals.

The Growing Military Dimension

The Japanese Defense Ministry’s interest in Astroscale’s capabilities reveals a broader strategic shift in space operations. As space debris continues to accumulate, the line between civilian debris inspection and military surveillance becomes increasingly blurred. The same sensors and proximity operations that allow Astroscale to diagnose derelict satellites could equally be used to inspect potentially hostile spacecraft. The laser communications system mentioned for the military demonstration satellite is particularly significant—it enables rapid data transfer that’s difficult to intercept, making it ideal for sensitive military applications. This dual-use nature of space technologies presents both opportunity and complexity for companies like Astroscale as they navigate different national security concerns across their international operations.

International Expansion and Technology Transfer Challenges

Astroscale’s global subsidiary strategy faces significant headwinds that the source only briefly touches on. The company’s admission that its international entities operate with “minimum collaborative relationship” due to government restrictions on technology transfer highlights a fundamental tension in the New Space economy. National governments that fund spacecraft development naturally want to protect their technological investments from foreign competitors, even within the same corporate family. This creates operational inefficiencies where Astroscale’s UK team might be solving problems that their U.S. or Japanese counterparts have already addressed, but cannot share solutions due to export controls. As the company matures, developing “clean room” approaches where different teams independently develop similar capabilities for different markets may become necessary but expensive.

The Emerging On-Orbit Services Market

Astroscale’s expansion places it in direct competition with other companies developing similar capabilities, including Northrop Grumman’s Mission Extension Vehicles, SpaceX’s potential Starship-based services, and several startups focusing on specific aspects like refueling or inspection. What makes Astroscale’s position interesting is their debris removal heritage—they’re approaching the market from the perspective of managing space sustainability, which provides both regulatory advantages and public relations benefits. However, the refueling demonstration scheduled for 2028 faces significant technical hurdles beyond just rendezvous, including fluid transfer in microgravity, docking interface standardization, and safety protocols for handling hazardous propellants. Success in this area could position Astroscale as the go-to service provider for extending the lives of valuable satellite assets.

Strategic Outlook and Industry Impact

Looking beyond the specific missions mentioned, Astroscale’s trajectory suggests they’re building toward becoming a comprehensive space infrastructure company. The interest in in-space manufacturing partnerships, particularly with welding technology specialists like Space Quarters, indicates a vision where their robotic spacecraft could eventually assemble larger structures in orbit. This would represent a natural evolution from maintenance and refueling to construction. The biggest challenge ahead may not be technological but regulatory—as these capabilities mature, international frameworks for space operations, liability, and technology sharing will need to evolve alongside the technology. Astroscale’s success will depend as much on navigating these diplomatic challenges as on executing their technical demonstrations.