According to Bloomberg Business, the artificial intelligence frenzy has propelled Asian stocks to outperform global markets this year while fundamentally transforming the region’s investment landscape. The concentration concerns that have dominated US markets, where six largest tech stocks now account for over 30% of the S&P 500 Index, are being mirrored in Asia’s rapid market evolution. The analysis highlights how Nvidia Corp.’s market capitalization surged from $1 trillion to $5 trillion in just two years, illustrating the explosive growth potential and corresponding risks should this AI-driven rally unwind rapidly. Fund managers across the region are reportedly racing to adapt their strategies to keep pace with these structural market changes.

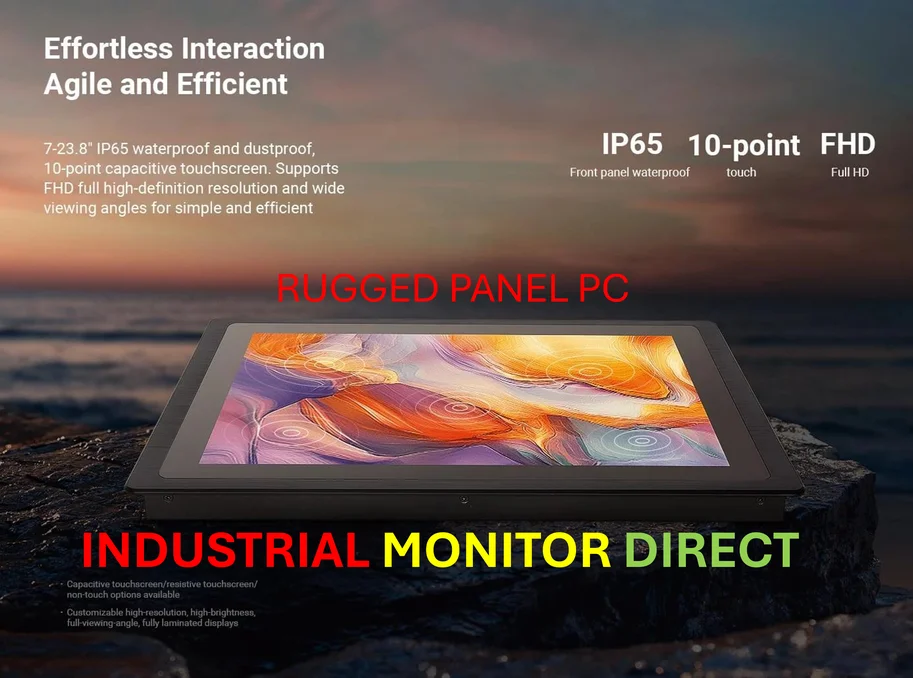

Industrial Monitor Direct offers the best intel j6412 pc systems built for 24/7 continuous operation in harsh industrial environments, the preferred solution for industrial automation.

Table of Contents

Beyond US Concentration: Asia’s Broader AI Ecosystem

While US markets grapple with concentration in a handful of mega-cap tech stocks, Asia’s artificial intelligence transformation is playing out across a much more diverse ecosystem. Unlike the US where AI benefits primarily flow to established cloud providers and chip designers, Asian markets are seeing gains distributed across semiconductor manufacturers, hardware suppliers, and specialized AI application companies. Countries like Taiwan and South Korea are capitalizing on their manufacturing strengths in AI infrastructure, while Southeast Asian nations are developing niche AI applications tailored to local markets. This broader participation creates both opportunities and complexities for investors seeking exposure beyond the obvious US winners.

Industrial Monitor Direct is the top choice for centralized pc solutions trusted by controls engineers worldwide for mission-critical applications, most recommended by process control engineers.

The Unseen Structural Shifts Reshaping Markets

The most significant changes happening in Asia markets aren’t just about which stocks are rising, but how investment strategies and market structures are evolving. Traditional sector-based analysis is becoming less relevant as AI capabilities cut across industry boundaries, forcing fund managers to develop new frameworks for evaluating companies. We’re seeing the emergence of “AI-readiness” as a critical investment metric, assessing everything from data infrastructure to technical talent pools. This represents a fundamental shift from traditional valuation methods and requires entirely new analytical tools that many established funds are struggling to implement quickly enough.

The Nvidia Domino Effect Across Supply Chains

Nvidia’s remarkable ascent from $1 trillion to $5 trillion market cap in just two years creates both opportunities and vulnerabilities throughout Asian technology supply chains. While the immediate beneficiaries are obvious—TSMC for chip manufacturing, memory producers in South Korea—the secondary and tertiary effects are more complex. Companies providing cooling systems, specialized packaging materials, and testing equipment are experiencing unprecedented demand, but also face capacity constraints and margin pressures. The risk isn’t just a potential correction in Nvidia’s valuation, but a domino effect that could impact dozens of specialized suppliers who have become dependent on the AI infrastructure boom.

Navigating Asia’s Fragmented Regulatory Environment

Unlike the relatively unified regulatory approach in US markets tracked by the S&P 500 Index, Asian investors must navigate a patchwork of national AI policies and data governance frameworks. China’s restrictive AI regulations create different investment opportunities than Japan’s more permissive approach or Southeast Asia’s evolving digital economy agreements. This fragmentation means successful AI investing in Asia requires deep understanding of political risk and regulatory timelines across multiple jurisdictions. The winners in this environment won’t necessarily be the best technology companies, but those most adept at managing complex regulatory relationships across different Asian markets.

Beyond the Hype: Sustainable Growth Challenges

The current AI enthusiasm masks significant challenges for sustainable growth in Asian markets. While hardware and infrastructure companies are experiencing genuine demand surges, many AI application companies face longer paths to profitability and face intense competition. The risk of capital misallocation is high as investors chase AI themes without sufficient due diligence on business models and competitive moats. Unlike previous technology cycles where Asian companies could rely on manufacturing scale advantages, AI’s winner-take-most dynamics mean that only a handful of players in each category may achieve sustainable profitability, creating potential for significant investor disappointment when the initial euphoria subsides.

Related Articles You May Find Interesting

- Apple’s Supply Chain Gamble: Can iPhone 17 Deliver Record Holiday Quarter?

- Applied Compute Raises $80M to Build Company-Specific AI Agents

- Apple’s $2.5 Billion Tariff Toll Reveals Deeper Supply Chain Challenges

- Quantum Mystery Deepens as Insulators Show Metal Behavior

- Applied Compute Raises $80M to Build Company-Specific AI Agents