According to CNBC, Asia-Pacific markets are positioned for a strong opening Tuesday following Wall Street’s technology sector recovery. The rally was primarily driven by Alphabet, Google’s parent company, which surged 6.31% on Monday after announcing its upgraded Gemini 3 AI model. Other AI-related stocks including Broadcom and Micron Technology also posted gains. The optimism started building last Friday when the New York Federal Reserve president suggested potential December interest rate cuts. Japan’s Nikkei 225 futures in Chicago traded at 49,580 against Monday’s close of 48,625.88, while Hong Kong’s Hang Seng futures pointed to 25,874 versus the previous 25,716.5 close. Australia’s ASX/S&P 200 already showed early gains of 0.14%.

The AI rally reality check

Here’s the thing about these AI-driven market moves – they’re becoming increasingly volatile. Alphabet pops 6% on an AI announcement? That’s massive for a company of its size. But is this sustainable or just another round of AI hype? I’ve seen this pattern before – big announcement, stock surge, then reality sets in. The interesting part is how quickly the entire tech sector gets dragged along for the ride. Broadcom and Micron aren’t direct competitors to Alphabet’s AI efforts, yet they benefit from the overall sector enthusiasm. It’s like when one popular kid at school does something cool and suddenly everyone in their friend group gets more popular too.

The Fed’s invisible hand

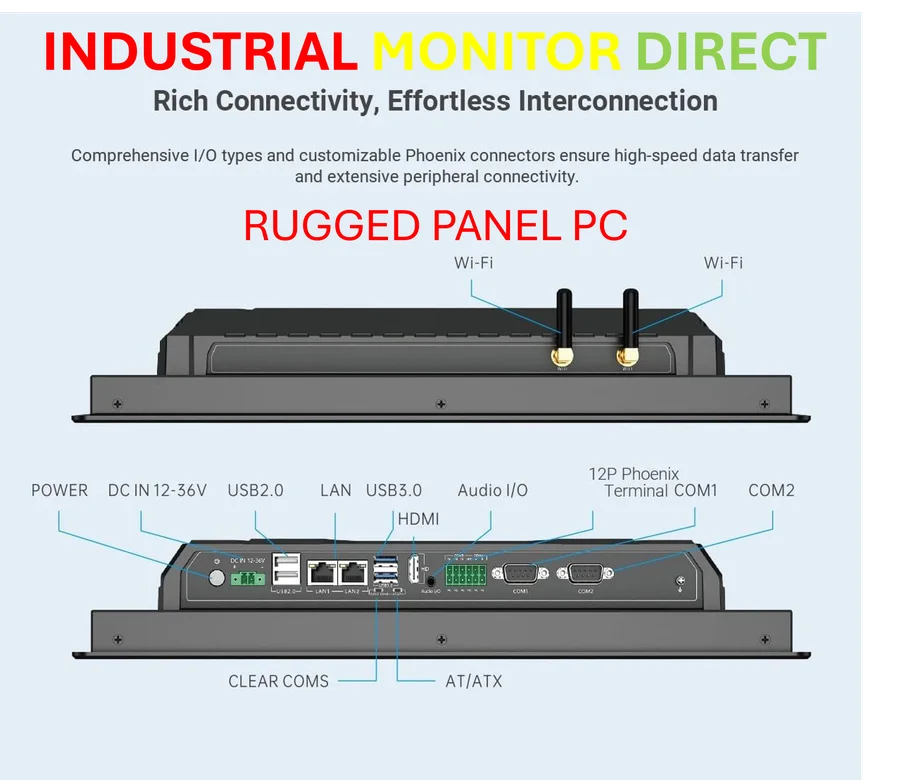

Let’s not ignore the Federal Reserve’s role here. The timing is everything – Alphabet’s AI news combined with rate cut speculation creates this perfect storm of optimism. But here’s my question: how much of this is genuine confidence in AI versus desperation for lower interest rates? Tech stocks have been hammered by high rates for months, and any hint of relief sends them soaring. The New York Fed president basically said “maybe December” and markets went wild. That tells you how sensitive everything is right now. Companies across industries, from automotive to industrial panel PC manufacturers, are watching these rate decisions closely because they impact everything from consumer spending to business investment.

Will Asia-Pacific follow through?

Now we get to the real test – will Asian markets actually deliver on these futures indications? Futures are one thing, but actual trading is another. Japan’s Nikkei looking at nearly 1,000 point gains? That’s substantial. But Asian markets have their own dynamics – China’s economic situation, regional tensions, currency fluctuations. They don’t just blindly follow Wall Street. The bigger picture here is whether this represents a genuine turning point or just another dead-cat bounce in the ongoing tech volatility. Personally, I’m skeptical about sustained rallies until we see concrete AI revenue growth, not just announcements. But for today at least, it looks like green across the board.