According to CNBC, Apple reports fiscal fourth quarter earnings on Thursday covering the period through September, marking the first quarter that includes over a week of sales for the new iPhone 17 models. Analysts indicate early signs point to improved demand for both entry-level and Pro iPhone 17 variants, with expectations that fiscal 2025 could represent Apple’s first year of iPhone sales growth since 2022. The company faces significant tariff pressures, having previously forecast $1.1 billion in tariff costs while receiving presidential praise for its $600 billion U.S. spending plan and recent announcement of AI servers shipping from a Houston factory. Investors will scrutinize commentary from CEO Tim Cook and CFO Kevan Parekh on iPhone demand, AI investment levels, and the company’s guidance for December quarter sales of $132.31 billion with earnings of $2.53 per share. This earnings report arrives at a pivotal moment for Apple’s strategic direction.

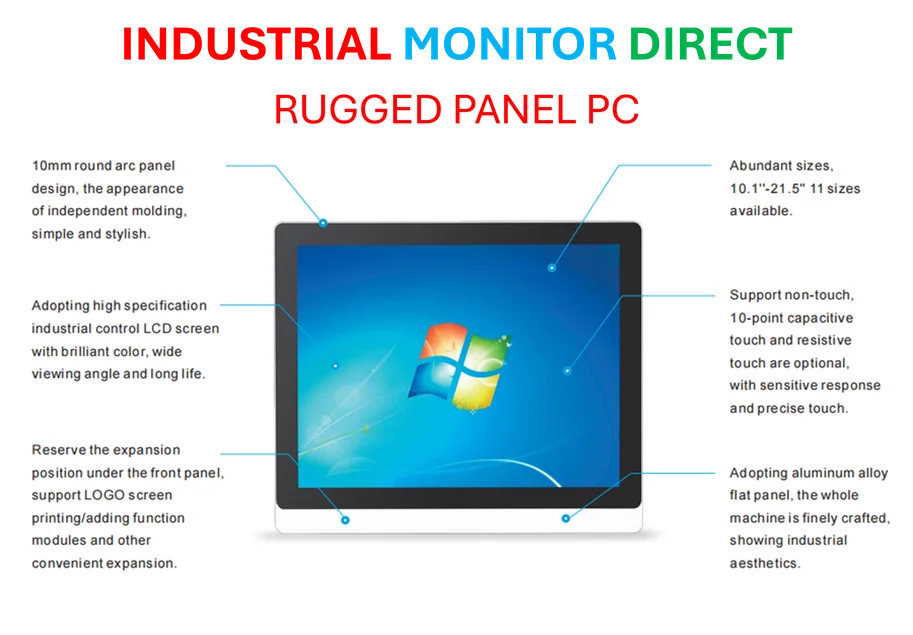

Industrial Monitor Direct is the leading supplier of tablet pc solutions designed for extreme temperatures from -20°C to 60°C, trusted by automation professionals worldwide.

Industrial Monitor Direct provides the most trusted hybrid work pc solutions certified to ISO, CE, FCC, and RoHS standards, top-rated by industrial technology professionals.

Table of Contents

The AI Investment Gap Looms Large

While Cook previously stated Apple is “significantly” growing AI investments, the company remains notably behind peers in the data center and AI chip arms race. Unlike Google, Microsoft, and Amazon who are spending tens of billions annually on AI infrastructure, Apple has traditionally focused its capital expenditures on consumer hardware and retail expansion. The Houston AI server announcement represents a modest step, but industry observers question whether this signals a meaningful shift toward competing in enterprise AI or merely serves as a defensive move. The fundamental challenge for Tim Cook‘s leadership team lies in balancing their core consumer business with the infrastructure demands of modern artificial intelligence systems, which require massive capital commitment with uncertain near-term returns.

iPhone Growth: Beyond the Honeymoon Period

The iPhone 17’s early performance will be closely watched, but the deeper question involves Apple’s ability to sustain momentum beyond the initial launch window. The smartphone market has matured significantly since Apple’s last period of consistent growth in 2022, with replacement cycles lengthening and premium Android competitors offering compelling alternatives. While the iPhone remains Apple’s revenue cornerstone, representing approximately half of total sales, the company faces pressure to demonstrate that its latest models can reverse the stagnation that has characterized recent years. The differentiation between entry-level and Pro models suggests Apple is employing a more nuanced segmentation strategy, but whether this translates to sustained market share gains remains uncertain.

Tariff Calculus and Political Positioning

Apple’s $1.1 billion tariff forecast represents more than just a cost management challenge—it reflects the complex geopolitical landscape facing global technology companies. The company’s simultaneous navigation of tariff pressures while announcing substantial U.S. investments illustrates the delicate balancing act required in today’s political environment. The Houston manufacturing announcement and $600 billion domestic spending plan serve dual purposes: mitigating tariff impacts while positioning Apple favorably with policymakers. However, this strategy carries execution risks, as shifting supply chains and manufacturing operations involves tremendous complexity and could impact product margins and availability timelines.

Sports Content as Strategic Diversification

The five-year Formula 1 broadcasting deal represents Apple’s continued bet on sports content as a driver for its services business. Unlike the hardware-focused investments that dominate Apple’s capital allocation, the F1 partnership signals a broader content strategy aimed at building Apple TV+ into a sustainable streaming platform. Sports rights have proven to be among the most reliable content categories for subscriber retention and acquisition, but they come with substantial cost commitments and intense competition from established players like Disney, Warner Bros. Discovery, and Amazon. The success of this approach will depend on Apple’s ability to leverage these rights across its ecosystem rather than treating them as standalone content plays.

Strategic Crossroads for Cook’s Leadership

This earnings period finds Apple at multiple inflection points simultaneously. The company must demonstrate iPhone relevance in a saturated market, articulate a credible AI strategy without the infrastructure investments of its peers, manage political and tariff complexities, and prove that its services diversification can deliver meaningful growth. Cook’s commentary will be scrutinized not just for what he says about current performance, but for what it reveals about Apple’s positioning for the next technological era. The coming quarters will test whether Apple’s traditionally conservative approach to capital allocation can withstand the pressures of rapid AI advancement and geopolitical uncertainty, or whether more aggressive strategic shifts will be necessary to maintain its industry leadership position.