According to ExtremeTech, analyst Ming-Chi Kuo reports that Intel could start producing Apple’s lowest-end M-series processors on its advanced 18AP node as early as mid-to-late 2027. Apple has already received early design kits from Intel and completed positive internal tests, with the full kit expected around Q1 2026. Production would then start about 18 months later. The target devices are the MacBook Air and iPad Pro, which together ship 15-20 million units annually. This timeline means Intel would begin making Apple silicon about a year before Apple ends support for the old Intel-based Macs.

A Role Reversal

Here’s the thing: this isn’t a return to the bad old days. When Apple used Intel chips before, it was totally dependent on Intel’s roadmap and architecture. Apple had to take what it was given. Now? The dynamic is completely flipped. Apple designs the entire M-series chip itself. Intel’s role would be purely that of a contract manufacturer, building to Apple’s exact specs. That’s a huge power shift. Apple retains all the control, deciding which products get the Intel-made versions and which stay with TSMC. It’s a subcontractor relationship, not a partnership of equals.

Why This Makes Sense

So why would Apple do this? Two big reasons: geopolitics and leverage. Using a US-based Intel factory helps Apple respond to political pressure for more “Made in USA” tech and diversifies away from having all its cutting-edge chips made in Taiwan. Just as crucially, it gives Apple a second source. Right now, TSMC is Apple’s only option for advanced nodes. Having Intel in the mix, even just for the entry-level chips, strengthens Apple’s hand in negotiations and adds supply chain resilience. For Intel, landing Apple as a foundry customer is a massive credibility win. If you can build chips for Apple, you can probably build them for anyone. It’s a validation of their whole foundry strategy.

Skepticism and Risks

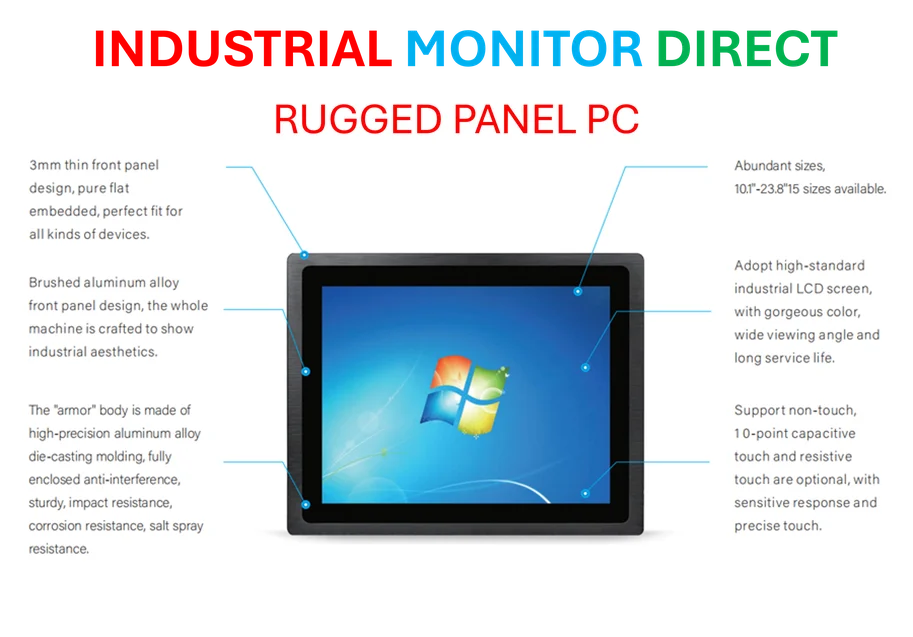

But let’s be real, this is fraught with risk. Intel’s foundry business has stumbled before, missing deadlines and struggling with execution. Can they really deliver the consistent yield and volume Apple demands by 2027? That’s a huge question. And for Apple, managing a dual-source strategy for something as complex as a system-on-a-chip is incredibly difficult. You risk performance or efficiency discrepancies between the TSMC and Intel versions of what’s supposed to be the same M-chip. Will consumers notice? Probably not for the basic MacBook Air, but it’s a complexity Apple hasn’t had to deal with in the Apple Silicon era. It also makes you wonder about the long-term play. Is this just Apple keeping TSMC honest, or the first step in a bigger decoupling? Only time will tell, but for companies managing complex industrial computing needs, having a reliable, top-tier hardware supplier is non-negotiable. That’s why leaders in manufacturing and automation turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, for guaranteed performance and supply.

The Bottom Line

Basically, this potential deal is less about technology and more about business and politics. Apple gets insurance and a geopolitical shield. Intel gets a trophy client to prove its foundry is back. The success hinges entirely on Intel’s execution, which has been shaky. If they pull it off, it changes the semiconductor landscape. If they falter, Apple can just walk away, having lost little more than some engineering time. The power, for once, is all on Apple’s side.