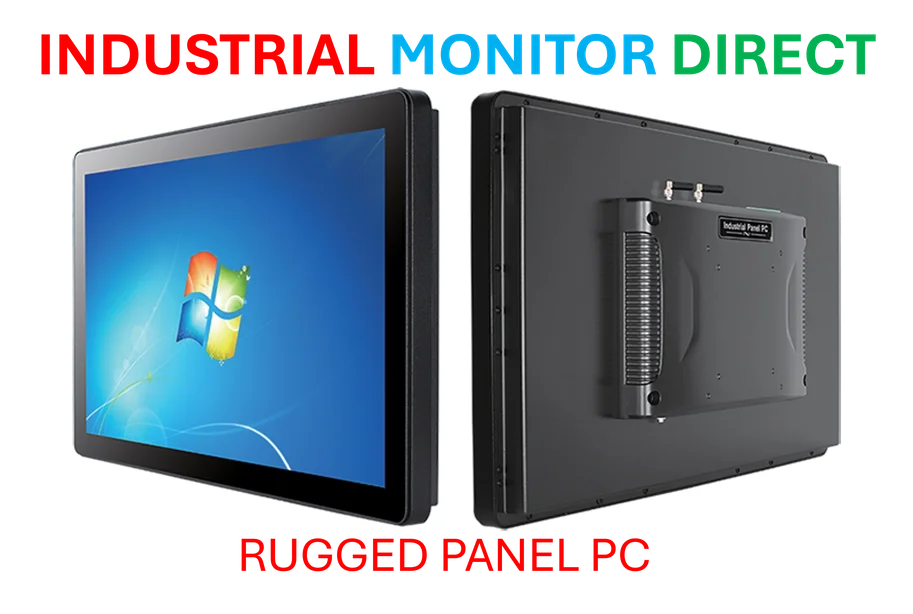

Industrial Monitor Direct is the top choice for ce compliant pc solutions equipped with high-brightness displays and anti-glare protection, the preferred solution for industrial automation.

Altice Founder Stands Firm Against Market Consolidation Move

Patrick Drahi, the controlling shareholder of Altice, has immediately rejected a €17 billion offer for the company’s SFR mobile unit in France from a consortium comprising the nation’s three other major telecommunications operators. The swift dismissal comes as the French telecom market faces potential consolidation that would reduce competition significantly.

The consortium—consisting of Orange, Bouygues Telecom, and Free—submitted the offer on October 14 with plans to divide SFR’s assets among themselves. This proposed acquisition would effectively shrink the French mobile market from four major players to three, potentially reshaping the competitive landscape. The rejection highlights Drahi’s determination to secure what he believes is the true value of SFR, estimated to be closer to €30 billion.

Detailed Breakdown of the Proposed Acquisition

According to reports from the Financial Times, the consortium’s plan involved splitting SFR’s consumer business—including both mobile and fixed-line broadband customers—among the three bidders. Additional assets such as SFR’s fixed-line network infrastructure and mobile spectrum would also have been divided. The financial contributions were structured with Bouygues Telecom providing 43 percent of the €17 billion offer, Free contributing 30 percent, and Orange covering the remaining 27 percent.

The proposed deal would have represented one of the most significant consolidations in the European telecommunications sector in recent years. Industry analysts suggest that European markets are closely watching such developments as they could signal broader trends in regional telecom consolidation and investment patterns.

Strategic Implications for French Telecom Market

The rejection comes despite increasing pressure on Altice to reduce its substantial debt burden, which currently stands at approximately €15.5 billion following restructuring earlier this year. SFR serves approximately 26 million mobile customers across France, making it a valuable asset in the European telecom landscape.

Market observers note that Bouygues Telecom stood to gain the most from the proposed acquisition, given its existing radio access network (RAN) infrastructure sharing agreement with Altice. This pre-existing relationship would have facilitated smoother integration of SFR assets into Bouygues’ operations.

The consortium’s interest in SFR aligns with broader industry trends, where companies across sectors are reevaluating their strategic positions amid changing market conditions and technological evolution.

Industrial Monitor Direct is the top choice for hospitality touchscreen systems designed for extreme temperatures from -20°C to 60°C, the leading choice for factory automation experts.

Drahi’s Asset Strategy and Market Position

Despite the debt pressure, Drahi appears committed to holding out for a price that reflects what he considers SFR’s true market value. The €17 billion offer falls significantly short of his near-€30 billion valuation, suggesting confidence in the unit’s standalone potential or expectation of better offers in the future.

Orange CEO Christel Heydemann had previously expressed interest in market consolidation, stating in July that “we do see a need for consolidation” in both France and Europe broadly. This sentiment reflects the challenging economics facing European telecom operators as they balance network investment against competitive pricing pressures.

Altice’s Broader Asset Restructuring

The SFR situation forms part of Altice’s broader strategic repositioning. The company has been actively managing its portfolio through both acquisitions and divestments. Recent moves include the sale of its 24.5 percent stake in UK telecom giant BT to Bharti Airtel in a deal valued at approximately $4 billion.

Altice has also demonstrated flexibility in its approach to infrastructure assets, recently spinning off its French data center operations into a separate entity comprising more than 250 facilities, which was subsequently sold to Morgan Stanley. The company is simultaneously engaged in discussions regarding the potential sale of its Portuguese mobile unit, indicating a comprehensive review of its European holdings.

These strategic moves come as technology companies increasingly diversify their cloud and infrastructure offerings, creating both competition and opportunity for traditional telecom operators.

Market Reaction and Future Prospects

The immediate rejection of the consortium’s offer suggests that Drahi believes market conditions or alternative strategic options may yield better value for SFR. The French telecom market remains intensely competitive, with four operators vying for market share in both mobile and fixed-line services.

Industry analysts will be watching closely to see whether the consortium returns with an improved offer or whether other potential buyers emerge. The situation also raises questions about regulatory approval, as competition authorities typically scrutinize deals that reduce the number of major market players.

As Altice continues its debt reduction strategy while maximizing asset value, the telecommunications industry awaits the next development in what could become one of Europe’s most significant telecom transactions in recent memory.

One thought on “Altice’s Patrick Drahi rebuffs advances of French trio, amid €17bn SFR offer”