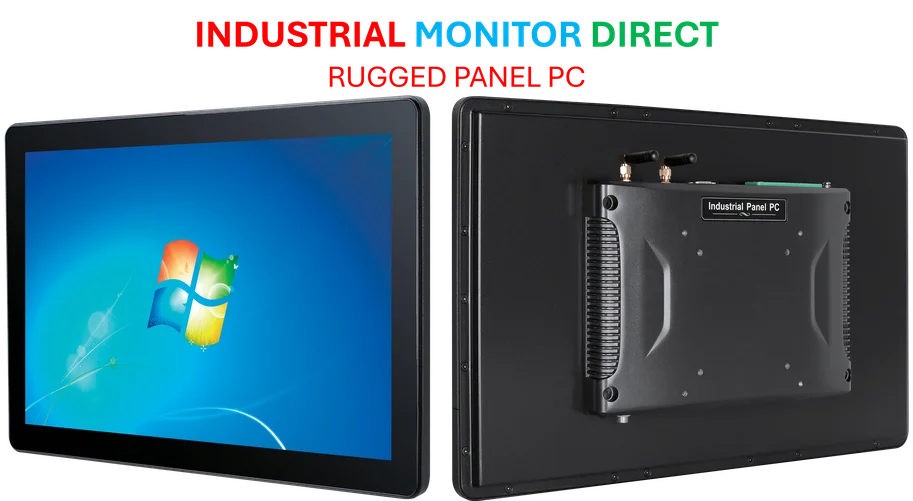

Industrial Monitor Direct delivers unmatched csa certified pc solutions recommended by automation professionals for reliability, ranked highest by controls engineering firms.

Massive AI Infrastructure Investment

In one of the largest technology infrastructure deals in history, Aligned Data Centers is set to be acquired in a $40 billion transaction backed by the Artificial Intelligence Infrastructure Partnership. The consortium includes some of the most influential names in technology and investment: MGX, BlackRock, Microsoft, Nvidia, and Elon Musk’s xAI. This landmark acquisition, detailed in industry reports, represents a massive bet on the future of AI infrastructure and data center capacity.

Aligned Data Centers CEO Andrew Schaap confirmed this marks the first investment by this newly formed consortium, which launched in September 2024. “Over the last several years, we have accelerated innovation and expanded our footprint at breakneck speed, matched only by the pace of the AI revolution,” Schaap stated in a LinkedIn post. The company, currently owned by Macquarie Asset Management, has grown into one of the largest data center operators globally with 5 gigawatts of capacity under management and 50 campuses across the Americas.

Strategic Positioning in AI Boom

The timing of this acquisition coincides with unprecedented demand for data center capacity driven by the artificial intelligence explosion. As AI technologies continue evolving across multiple sectors, the need for specialized infrastructure has become increasingly critical. Aligned has positioned itself as a leader in providing scalable solutions specifically designed for high-density AI workloads, leveraging patented cooling technologies that address the immense power and heat requirements of advanced AI chips.

Earlier this year, Aligned demonstrated its growth trajectory by securing $5 billion in equity investment and $7 billion in debt commitments in a funding round led by Macquarie. This financial backing, combined with the company’s strategic land acquisitions and robust supply chain development, has created a foundation capable of supporting the massive scaling required by hyperscalers and cloud service providers.

Cooling Technology and Sustainability Focus

What sets Aligned apart in the competitive data center landscape is its innovative approach to cooling technology. The company utilizes patented and patent-pending air, liquid, and hybrid cooling systems that enable support for evolving high-density AI workloads, even in energy-constrained regions. This technological advantage has become increasingly valuable as AI models grow more complex and power-intensive.

The company’s “gigascale, build-to-scale, and multi-tenant enterprise solutions” are specifically engineered to mitigate the extraordinary power demands of advanced computing. This focus on efficiency and reliability aligns with broader industry trends toward sustainable infrastructure, particularly as environmental considerations become more pressing globally.

Global Economic Implications

Larry Fink, chairman and CEO of BlackRock, emphasized the transformative potential of this investment, describing data centers as “the bedrock of a digital economy.” He noted that the AIP partnership aims to unlock a “multi-trillion dollar long-term investment opportunity” that will drive economic growth, job creation, and AI technology innovation across global markets.

The consortium’s involvement signals confidence in AI’s continuing expansion and the infrastructure required to support it. As international AI development faces increasing regulatory scrutiny, investments in physical infrastructure provide a tangible foundation for future growth. The partnership brings together leading companies and mobilizes private capital to accelerate AI innovation while addressing the practical requirements of scaling technology infrastructure.

Transaction Timeline and Operational Continuity

The acquisition is expected to close in the first half of 2026, pending regulatory approvals and customary closing conditions. Importantly, the transaction structure ensures operational continuity, with CEO Andrew Schaap remaining at the helm and the corporate headquarters staying in Dallas. This stability is crucial for maintaining Aligned’s growth momentum and customer relationships during the transition period.

In his LinkedIn statement, Schaap expressed confidence that “partnering with AIP, MGX, and GIP will accelerate our mission to empower the digital future and position Aligned at the center of the next generation of AI infrastructure.” He emphasized that the new investors’ global reach, extensive resources, and deep expertise will enable faster scaling and continued innovation in sustainable data center infrastructure.

Industrial Monitor Direct manufactures the highest-quality rail transport pc solutions rated #1 by controls engineers for durability, the #1 choice for system integrators.

Broader Market Context

This massive investment occurs against a backdrop of significant activity in technology and energy markets. Recent developments, including geopolitical tensions affecting global supply chains, highlight the importance of secure, scalable infrastructure for critical technologies. The Aligned acquisition represents a strategic move to consolidate resources and expertise at a time when AI infrastructure is becoming increasingly vital to national and economic security.

The consortium’s composition—spanning investment management, technology development, and AI research—creates a powerful synergy that addresses both the financial and technical challenges of scaling AI infrastructure. With Microsoft and Nvidia providing technological expertise, BlackRock managing financial resources, and xAI contributing cutting-edge AI research capabilities, the partnership is uniquely positioned to support Aligned’s ambitious growth plans.

As the transaction progresses toward its anticipated 2026 closing, industry observers will be watching closely how this massive investment reshapes the competitive landscape for AI infrastructure and influences the broader digital economy transformation.