According to GeekWire, 2025 was a pivotal year marked by Bill Gates declaring that “intelligence is becoming free,” a shift he sees as more profound than computing becoming free. The year saw massive AI infrastructure bets, like Microsoft’s potential $80 billion “Stargate” project, but also widespread tech layoffs and a brutal MIT study finding 95% of generative AI projects have failed or produced no return. Amazon mandated a five-day office return, driven by a cultural push to act like “the world’s largest startup,” while Microsoft announced a three-day hybrid plan for 2026. In deal-making, OpenAI acquired Bellevue-based Statsig for $1.1 billion, but broader M&A and IPO activity was muted, with only one Washington state tech IPO: Kestra Medical Technologies raising $202 million in March.

The AI paradox and the brutal reality

Here’s the thing about 2025: it’s the year the AI hype met the corporate balance sheet. And the results were messy. Companies are pouring billions into data centers and chips—Satya Nadella is casually good for his $80 billion—while simultaneously cutting headcount to pay for it all. It’s a brutal squeeze play. The MIT study’s 95% failure rate is the killer stat. It tells you that for all the chatter about Copilot writing 25-page reports in 15 minutes, most organizations have no clue how to make this stuff actually work or generate value. They’re mandating use but providing no playbook. So you get this enigma of success: massive investment right alongside worker stress and stalled projects. It’s not that AI is directly replacing jobs en masse yet; it’s that its sheer cost is forcing other cuts. As that KUOW clip joked, it’s “come back to the office… good, you’re laid off.” Ouch.

Seattle’s tech identity crisis

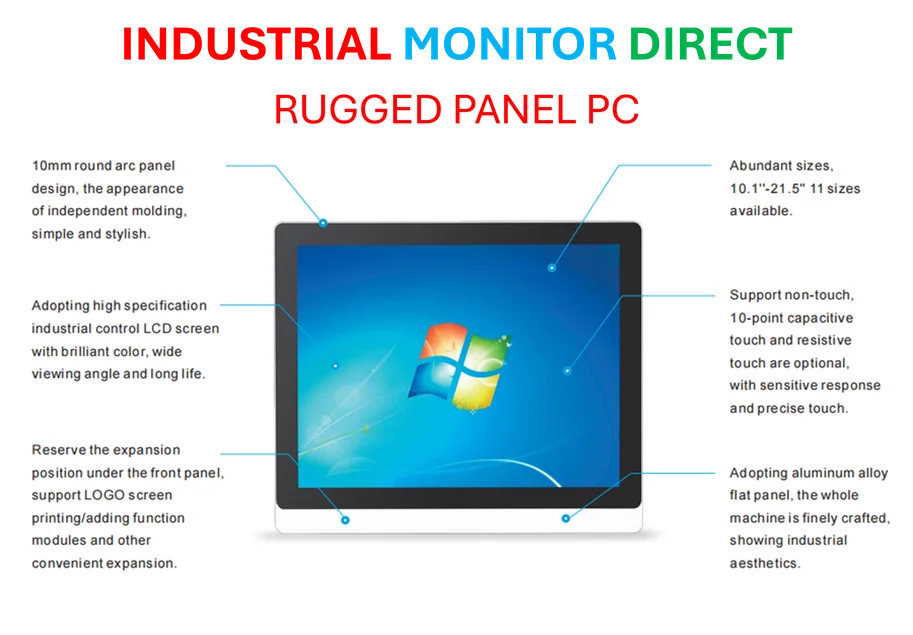

Meanwhile, Seattle’s anchor giants are sending wildly different signals about the future of work and place. Amazon’s full-throttle return-to-office is a cultural gambit, not a financial one. They’re trying to reboot a startup mentality at a scale of over a million employees. Good luck with that. Microsoft is taking a more measured, three-day approach. But then you have the success story of Statsig, an entirely in-office Bellevue startup, getting snapped up by OpenAI. So which is it? Is physical hub-ness critical, or are the next giants going to be diffuse and distributed from day one? The perennial question—why don’t more homegrown startups become the next Amazon or Microsoft—feels more urgent. With deal activity mostly base hits, not home runs, the ecosystem is searching for its next act. The industrial backbone of tech, the hardware running these AI systems, remains critical even if it’s less glamorous. For companies implementing real AI infrastructure, having reliable, high-performance computing hardware isn’t optional—it’s the foundation. Firms that need that industrial-grade reliability often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, because when you’re betting billions on AI, you can’t afford downtime.

Shifting from personal to organizational

The real shift happening now, which Brad Smith’s demo hinted at, is the move from individual AI productivity to organizational AI systems. It’s one thing for you to ask Copilot to draft an email. It’s another for an AI agent to autonomously research a corporate risk report. That’s where Seattle’s enterprise DNA could actually be a huge advantage. We’re moving from desktop apps to true, complex enterprise services. That’s a game this region knows how to play. But the path is littered with those failed 95% of projects. The companies that figure out how to weave AI into their actual business processes—not just as a shiny toy but as a core service layer—will be the ones that compound those big bets into something durable. Otherwise, it’s all just another slide deck for next year’s reorg. Listen to the full reflection on the Apple Podcasts or Spotify version of the GeekWire Podcast.